We have modelled the economics of CO2-EOR in shale, after interest in this topic spiked 2.3x YoY in the 2019 technical literature. Our deep-dive research into the topic is linked here.

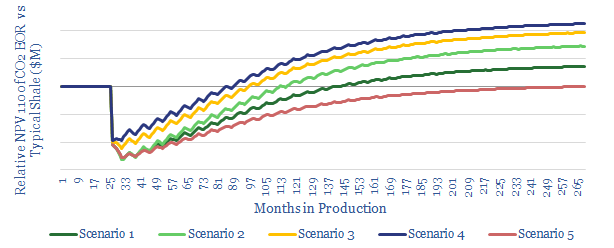

The economics appear positive, with a 15% IRR under our base case assumptions, and very plausible upside to 25-30%.

There is potential to sequester 3.5bn tons of CO2 in shale formations in the US, plus another 40bn tons internationally, for a CO2 disposal fee of c$40/ton, which we have quantified based on the technical literature.

The model also allows you to stress-test your own assumptions such as: oil prices, gas prices, CO2 prices, CO2 tax-credits, compressor costs and productivity uplift. The impacts on IRR, NPV and FCF are visible.