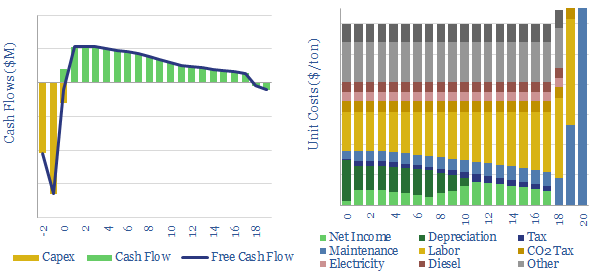

The economics of coal mining are captured in this data-file. $60/ton coal, equivalent to 1c/kWh-th, at the bottom of the global energy cost curve, can typically be unlocked by capex costs of $60/Tpa at a new coal mine, and other opex costs, tabulated in the data-file.

This data-file aims to approximate the economics of a new coal mine, using simple rules of thumb and data from past projects, capex (in $/Tpa) and opex (in $/ton).

$60/ton coal is ridiculously cheap, providing thermal energy at around 1c/kWh while also generating a 10% IRR on the new investment. 1 MWH pa of new energy can be produced for an up-front investment of around $10.

A high CO2 intensity of 0.4-0.5kg/kWh-th is also quantified in the data-file, including combustion emissions, methane leaks, diesel fuel and electricity usage at the mine. Although it depends on the coal grade.

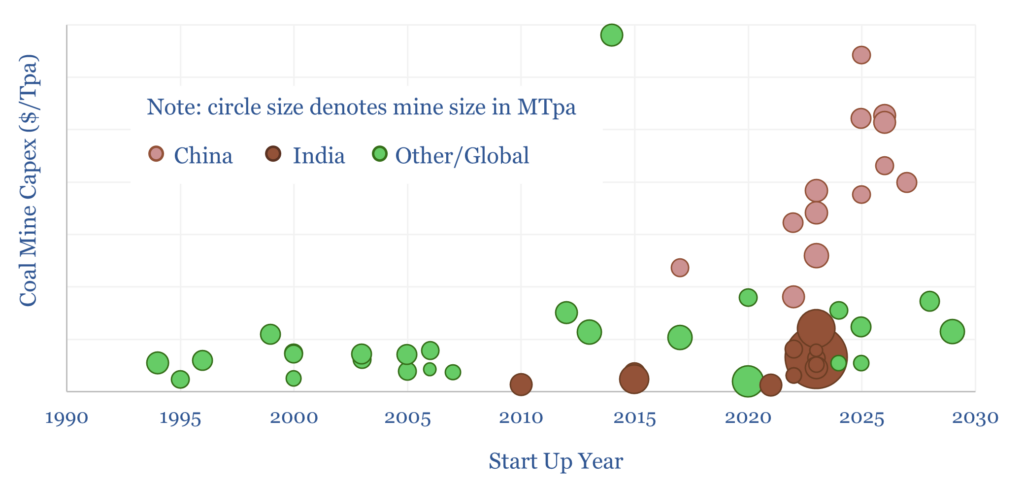

Something is fascinating about the capex costs of recent Chinese coal mines, which we have sampled in the data-file, rising to $200-300/Tpa. In this range, the marginal cost of Chinese coal is $100-150/ton, around 2-3c/kWh-th, and the cost of (38% efficient) coal power is 6-8 c/kWh-e. This would be a game-changer for global energy, as LNG that is delivered for $9/mcf can also provide (45-55% efficient) power at 6-8c/kWh-e. Substituting each 100MTpa of the 2.5GTpa coal consumed for Chinese coal power would draw in 30MTpa of LNG and avoid 150MTpa of CO2, as explored in our note here.

We will continue tracking data-points into Chinese coal vs LNG, in our coal mine model, coal trackers, coal-power models and gas-power models.

Please download the data-file to stress test the economics of coal mining and sensitivity to coal prices in $/ton.