Over $100bn pa of industrial gases and $5-6bn pa of cryogenic air separation plants are produced each year. This data-file is a screen of leading industrial gas companies and cryogenic air separation companies, breaking down their market share (number of ASUs constructed) history, geography, sales and headcounts.

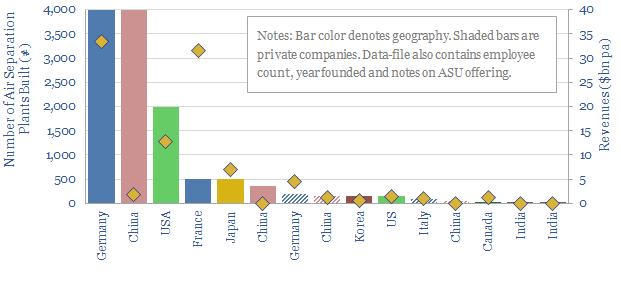

Industrial gases are relatively concentrated. Out of 20,000 units constructed historically, 50% of the market has historically been controlled by four large leaders: Air Liquide, Air Products, Hangyang and Linde.

A second tier of regional specialists are focused on specific countries such as Germany, Italy, Japan, Korea; several of which are listed. These companies are also broken out in the data-file.

As a result of this moderately concentrated industry structure, margins are fine, but not stellar. The average company is generating c20% EBITDA margins and c10% operating margins, with ROCE around 10% plus or minus a few percentage points.

Uptime and utilization are crucial to the economics of air separation units (model here). Hence this means that some of the largest and most experienced equipment manufacturers in the space can have a moat and generate higher margins and returns.

We see growing demand for cryogenic air separation in the energy transition, in order to produce pure oxygen for metals, wind and solar value chains, blue hydrogen and Allam Cycle oxycombustion.

Decarbonization ambitions of different industrial gas companies are also noted in the data-file. Some of this is achieved through plant efficiency. For example, Linde notes that its technologies helped customers avoid 2x more GHG emissions than Linde itself emitted. Other industrial gas companies are gearing up in CCS and hydrogen value chains.