Europe’s energy ambitions are now intractable: It is just not feasible to satisfy former climate goals, new geopolitical realities, and also power future AI data centers. Hence this 18-page report evaluates Europe’s energy options; predicts how policies are going to change; and re-forecasts Europe’s gas and power balances, both to 2030 and to 2050.

Europe’s entire mindset has been shifting since 2022, and all the more so since turbulent world events at the start of 2025. From conversations with European decision-makers, a new era does seem to be underway. “Thus saith the LORD, Set thine house in order: for thou shalt die, and not live”. This fragment from the Book of Isiah is borrowed in the penultimate stanza of T. S. Eliot’s The Waste Land. Which is not actually a bleak poem. After death, there is re-birth. After descending into madness, on the arid shores of Waste Land, there is a return to productivity and growth. And so too in Europe?

Europe’s deteriorating energy self-sufficiency, industrial leakage and kamikaze energy policies are now turning a corner, as discussed on pages 2-4.

What energy does Europe need? Our answer is reliable, geopolitically secure load growth, to ensure that Europe can keep pace with the rise of AI, and power world-class services and precision manufacturing. It does not have to be the cheapest electricity in the world. But an unprecedented amount of new load growth is needed, per pages 5-7. So what are Europe’s energy options?

The economics of 35 different load growth options in Europe are modeled and summarized on page 8, plotting their capex, fueling costs, CO2 and other costs.

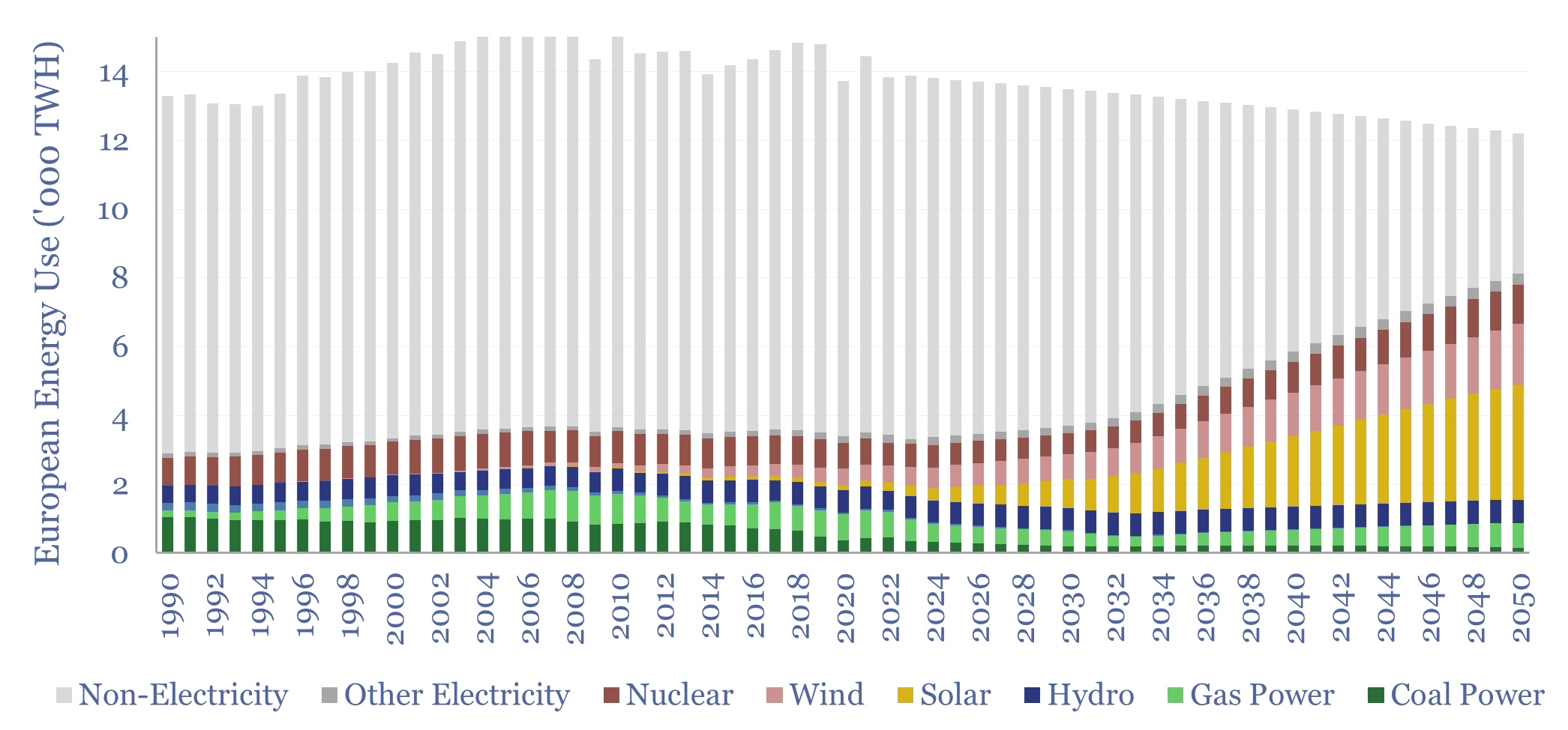

Economically attractive energy policies in Europe would vastly ramp solar (page 9), ramp wind more selectively (only in locations with >35% load factors, page 10), double nuclear generation by 2050 (page 11), abandon futile carbon constraints (page 12), incentivize domestic gas production over imports (page 13-14) and delay the phase-back of coal (pages 14-16). These are huge changes.

Accordingly, we have updated our European gas and power models and global electricity models, as discussed on pages 17-18.

Changing European policies, which are less ideological over decarbonization, and more focused on competitive domestic resources could result in Europe’s total LNG imports softening by 2030, less need to build new gas turbines before 2030, and real opportunities in European capital goods.