This data-file is a screen of fluorinated polymers company screen, to explore opportunities in this value chain. It captures ten large Western companies, with exposure to producing fluorspar, refining fluorspar into hydrofluoric acid (HF) and/or further processing into fluorinated polymers, which matter increasingly in the energy transition.

In each case, we have compiled the company’s name, if/where it is listed, when it was founded, number of employees, revenues, its estimated exposure along the fluorinated polymer value chain, including fluorspar and hydrofluoric acid production, plus some recent and relevant notes.

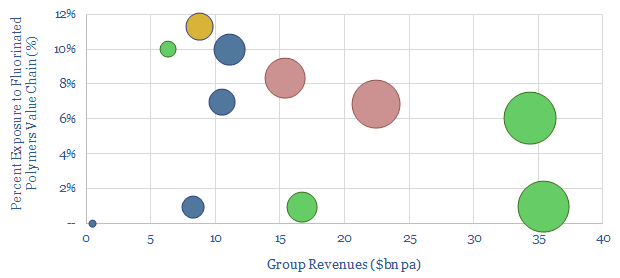

Concentration. On the plus side, the space is fairly concentrated among high-quality OECD companies. On the less positive side, there is a large number of non-OECD companies, especially in China. Another less positive angle is that no company seems more than c10% exposed to this value chain. Many of the companies are diversified chemicals companies.

Another interesting observation is that many companies are currently pointing to strong margins in their fluorinated materials business, which suggests tightness in the market.

In one of the back-up tabs, we have aggregated some of the common brand names. For example, ‘Teflon’ and ‘Zonyl’ are marketed by Chemours. Hylar and Solef are marketed by Solvay. Kynar is by Arkema and FluonETFE is by AGC.

In another back-up tab to this fluorinated polymers company screen, we have aggregated data from DuPont, suggesting that over 16% of solar panels deployed in the field have now suffered cracking in their back-sheets. This is an argument for using high-grade fluorinated polymers.