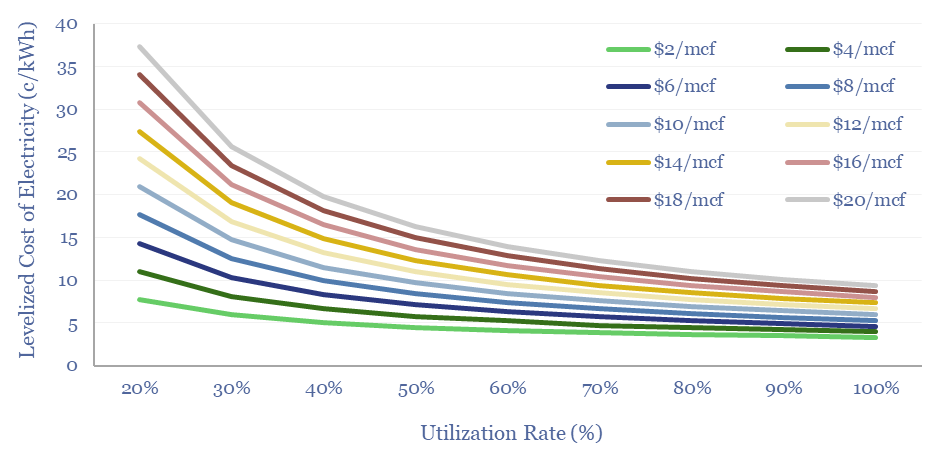

Levelized costs of combined cycle gas turbines are built up in this data-file. Our base case costs of gas-fired power generation are 8c/kWh, at a combined cycle turbine converting 55% of the thermal energy of natural gas into electrical energy, at 50% utilization, for a total CO2 intensity of 0.35 kg/kWh.

A gas turbine operates via the Brayton Cycle, compressing inlet air, super-heating it to 1,200-1,600ºC by combusting a gaseous fuel, then expanding the super-heated gas mixture across a turbine. The turbine can be used to provide mechanical drive (including the inlet compressor) and generate electricity. There is c4% CO2 in the exhaust gas.

In a simple-cycle configuration, exhaust gases exit from the gas turbine at 400-600ºC, hence efficiency is limited to 35-45%, for example to maximize flexibility. However, in a combined-cycle gas turbine, the hot exhaust gases are used to generate high-pressure steam and run a separate steam-cycle, reaching 55-65% efficiency.

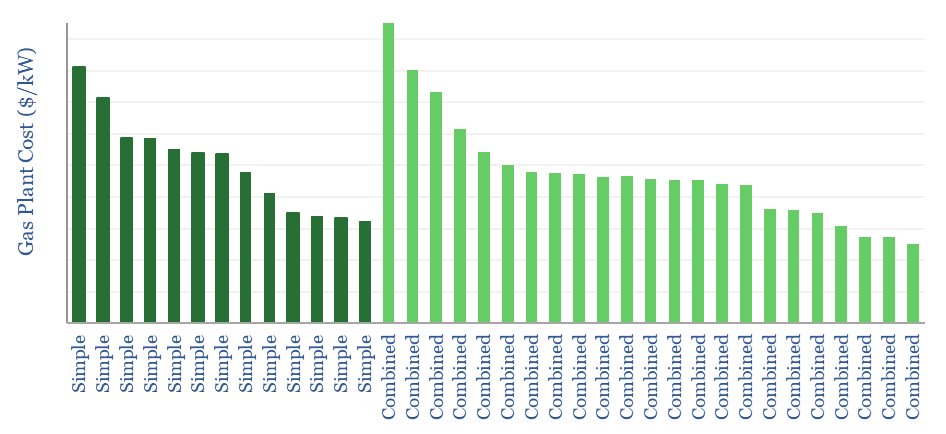

This data-file models the economics of constructing a new gas-to-power project, using simple or combined cycle gas turbines, based on technical papers and past projects around the industry. Other operating parameters are tabulated here.

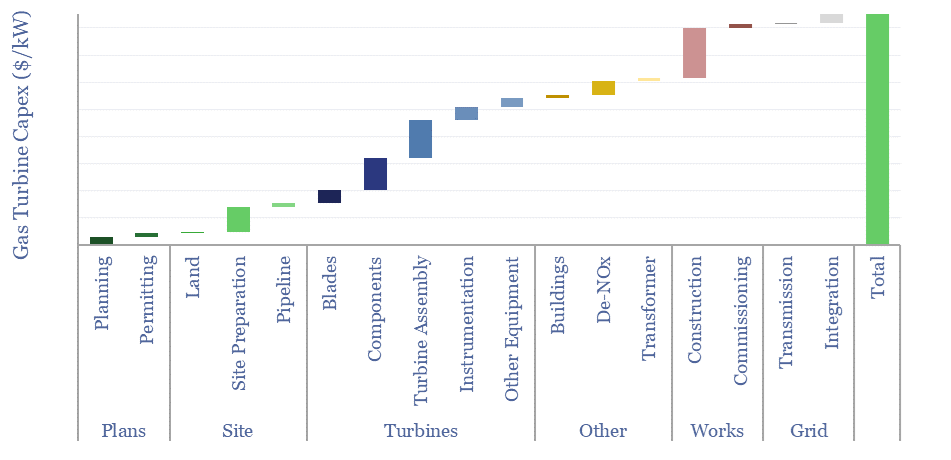

The capex cost of a large new gas turbine can be approximated around $1,000/kW. The chart below is a breakdown of gas turbine capex, by component. c40% is the core turbine, 20% is construction, 15% is other equipment, 10-15% is site work, 10-15% is other planning, permitting, hook-up and commissioning. Numbers will vary case by case.

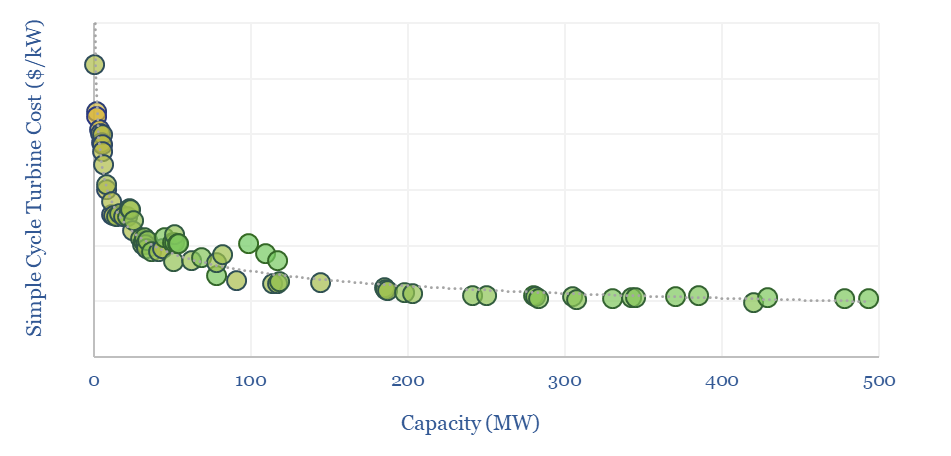

Gas turbine capex is also subject to economies of scale, with capex costs (in $/kW) falling by a factor of 50% every time capacity (in MW) doubles.

Gas power project capex also depends on context. There is a 3x variation in prices between the lower and upper deciles of 35 projects we have surveyed. Some recent projects in 2024 seem more expensive.

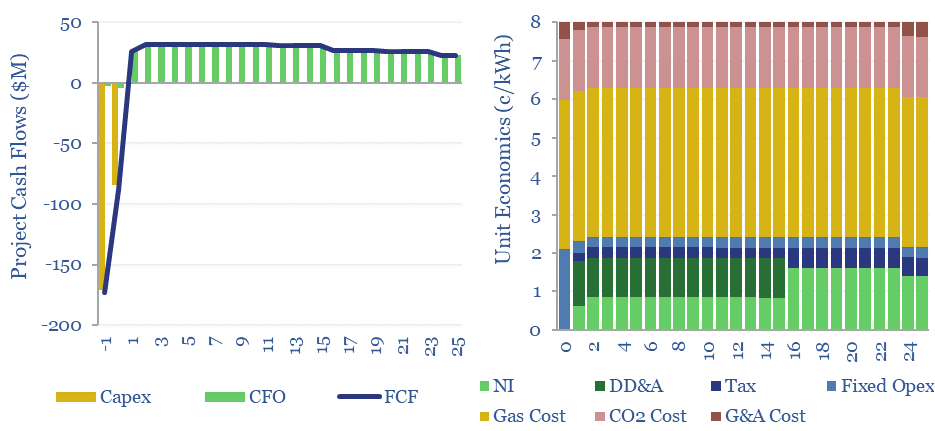

Our base case cost is that a large new combined cycle gas turbine can achieve a levelized cost of electricity of 8c/kWh with a CO2 intensity factor of 0.35 kg/kWh (title chart). Although this does include a CO2 price, which is not always present in all geographies.

A dozen input variables can be flexed in the model, to stress test economic sensitivity to: gas prices, power prices, carbon price, gas distribution costs, conversion efficiency, capex costs, opex costs, utilization rates and tax rates (chart below).

Gas-fired power generation explained 23% of global electricity generation in 2023, second only to coal at 35% of global electricity generation. Simply switching coal-fired power to gas-fired power avoids c60% of the CO2. CO2 abatement costs are generally low. While a surprising finding in our recent research is that natural gas can economically backstop renewables such as wind and solar, due to high operating flexibility.

Please download the data-file to stress-test the costs of gas-fired power generation. We have also published summaries of our conclusions into natural gas in the energy transition and LNG in the energy transition. We also have a separate data-file capturing the economics of gas peaker plants, which better reflects electricity pricing volatility.