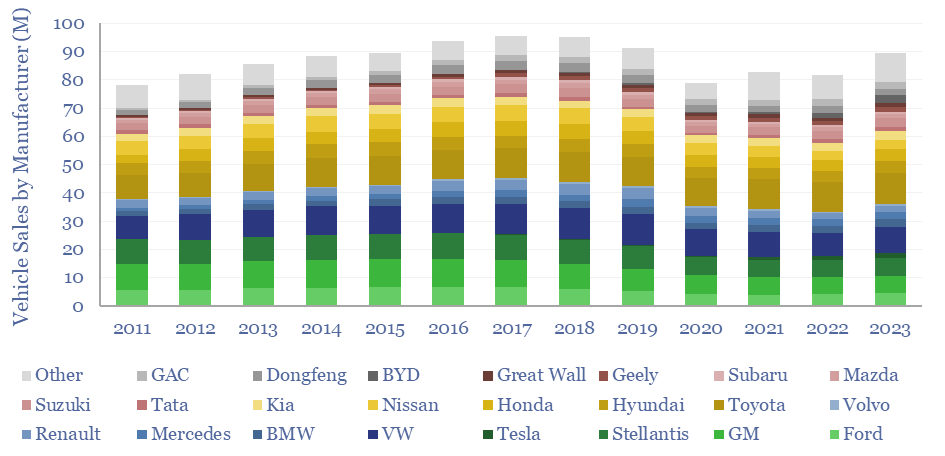

Global vehicle sales by manufacturer are broken down in this screen. 20 companies produce 85% of the world’s vehicles, led by Toyota, VW, Stellantis, GM and Ford. The data-file contains key numbers and notes on each company, including each company’s sales of BEVs, PHEVs, general EV strategy, and how it has been evolving in 2024.

Global vehicle sales by manufacturer are tabulated in this data-file. The entire global OEM industry produces 90M vehicles per year (see our vehicle sales database), at an average revenue of $30k per vehicle, for $2.5trn of total revenues (i.e., 2.5% of global GDP), across $2trn of market cap (2% of global total), while directly employing around 5M people.

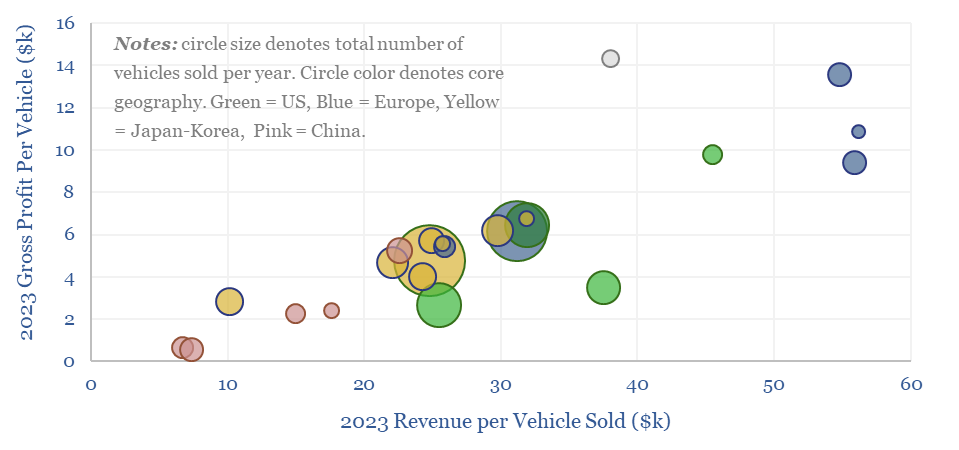

OEMs’ revenues average $30k per global vehicle sold and their gross profit averages $5k per vehicle sold. For luxury vehicles (e.g., BMW, Mercedes, Volvo, Land Rover), revenue per vehicle is closer to $55k and gross profit per vehicle can exceed $10k per vehicle. Details are in the file for each OEM (chart below).

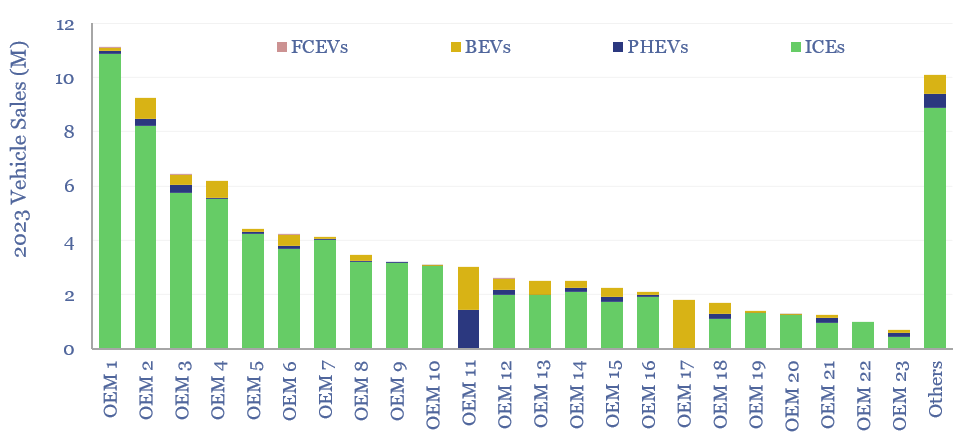

Electric vehicle sales by manufacturer are also disaggregated for 9M BEVs and 4M PHEVs sold in 2023. BYD and Tesla together sold 40% of the world’s EVs, while the top 10 list accounts for 75% of EVs and also includes VW, Stellantis (due to the Fiat 500e and Peugeot e-208) and GM (due to the Chevy Bolt range).

2024 has seen weaker momentum for electric vehicles. GM pulled back on a target to produce 1M EVs per year by 2025 saying instead it would be “guided by the consumer”. Ford pivoted a new manufacturing plant in Canada away from EVs and back towards gasoline-powered pick-ups after its EV division made a loss of $100k per vehicle. In May-2024, Nissan delayed an expansion of EVs in North America. Mecedes-Benz said it needed a flexible approach to reflect “peaks and troughs” in EV momentum. In May-2024, even Tesla dropped a goal of producing 20M vehicles per year by 2030. In September-2024, Volvo abandoned a target to sell only electric cars by 2030.

Our take is that electric motors are superior to ICE engines in power, performance and vehicle emissions; but EV batteries are still inferior to hydrocarbons in energy density and vehicle cost implications.

Therefore context matters. And different OEMs need clear strategies that ramify into specific niches (e.g., clean urban mobility ≠ pick-up trucks for Middle America ≠ premium vehicles ≠ low-cost all-purpose cars).

As an example, BMW is focused on luxury vehicles (not low-cost, mass-market EVs!!), and is thus adding bi-directional charging to its vehicles, and continuing with electrification ambitions; while many of Japan’s OEMs, such as Toyota, Honda, Suzuki, Mazda, Subaru partly due to challenged Japanese electricity markets, have limited their electrification strategies to hybrids, and are selling almost no BEVs.

However, uncertainties over the pace of EV adoption, the extent of policy support, and the ultimately winning EV technologies create a long-term challenge for the OEMs. At worst, there are risks of betting on the wrong horse, prioritizing dimensions that consumers will ultimately not accept, and getting distracted from what consumers actually will want; precisely at the time when China is gearing up in low-cost vehicle production helped by low-cost LFP batteries.