HVDC costs? This model captures the economics of transporting electricity (especially from renewable sources, such as wind and solar), over vast distances, using high voltage direct current power cables (HVDCs).

HVDCs are increasingly important, as we see power transmission capex rising 4x in our roadmap to net zero. HVDC costs and round-trip efficiencies can also surpass batteries for integrating more renewables into grids.

Our numbers are based on technical papers, a dozen past projects and a granular bottom-up breakdown of costs (both capex and opex). Our notes from technical papers follow in the final tab as context.

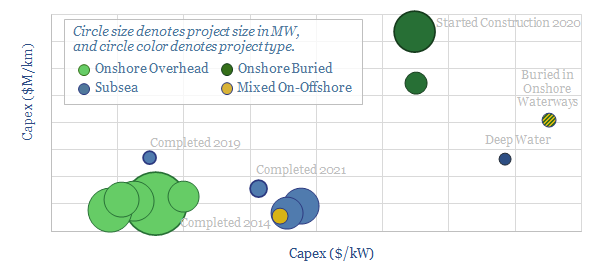

We have also reviewed the capex costs of over a dozen past projects and proposed projects, moving an average of 3GW over an average of 1,500km, at 500kV and 2.4 kA per line. Project type and geography are the biggest determinants of capex. Underlying project details are covered in detail in the data-file.

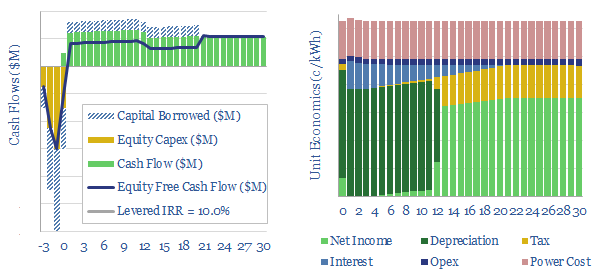

Our base case estimate is that a 3-10c/kWh transportation spread is required to earn a 10% levered IRR on 1,000-mile cable. Numbers are better for larger and higher utilization lines.

Please download the data-file to stress test HVDC costs, power prices, capex, opex, line losses, leverage levels and fiscal impacts.

The second download compares the cost of transporting large quantities of power down a DC cable, versus converting it into hydrogen and piping the hydrogen.

The opportunity in HVDCs is covered in more detail across our broader research, including an overview of power transmission, an adjacent opportunity in STATCOMs, a screen of leading HVDC companies, a patent review for Prysmian, project parameters for Chinese HVDCs, and an overview of future aluminium and copper demand.