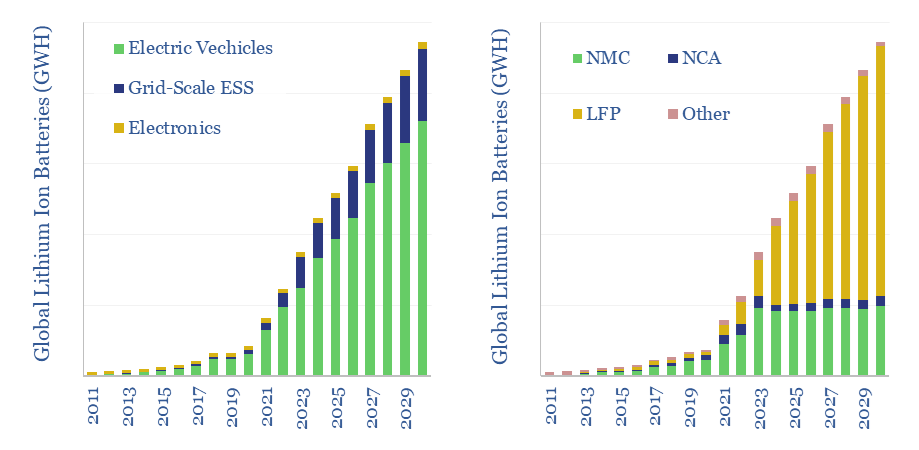

The lithium ion battery market reached 900GWH in 2023, representing 7x growth in lithium ion battery volumes in the past half-decade since 2018, and 20x growth in the past decade since 2013. Volumes treble again by 2030. This data-file breaks down global lithium ion battery volumes by chemistry and by end use. A remarkable shift to LFP is underway, and NMC sales may even have peaked.

The lithium ion battery market reached 900GWH in 2023, representing 7x growth in the past half-decade since 2018, and 20x growth in the past decade since 2013. This data-file breaks down global lithium ion battery volumes by chemistry and by end use, by aggregating past estimates from technical papers and forecasting agencies.

Over 70% of the lithium ion battery market is for electric vehicles, followed by grid-scale energy storage, and incorporation into electronic devices.

Our forecasts for lithium ion battery sales through 2030 hinge on our outlook for electric vehicles as reflected in our global vehicle sales database, and our outlook for co-deployment of batteries with renewables, as reflected in our global power grid capex model. In turn, these forecasts impact the demand for battery materials such as lithium, graphite, nickel, cobalt and fluorinated polymers.

Cathode chemistry has shifted markedly over time, which is reflected in the data-file. Prior to 2013, the lithium ion battery market was dominated by LMO/LCO. At peak in 2019, NMC batteries had over 60% market share, and NMC incumbents were declaring victory over LFP cells, whose share, in turn, was projected to fall to zero throughout the 2020s.

Reality has turned out quite different, due to amazing deflation in LFP batteries (see above), especially from Chinese suppliers such as CATL and BYD. China’s electric vehicles could comprise two-thirds of all global EV sales in 2024 and LFP dominates in China. If LFP continues gaining share to around 75% of lithium ion batteries by 2030, or higher, then demand for NMC cells may have peaked in 2023.

Innovator’s dilemma? It is truly remarkable to look back at technical papers published by LG Energy Solutions (larger NMC battery producer in the world) and similarly from McKinsey, back in 2019, arguing that NMC would dominate the industry in the future, and that LFP’s market share would gradually fall to zero (!), due to its inferior ionic mobility, hygroscopicity, charge-monitoring, voltage, density and [sic] longevity. These studies did not, however, clock LFPs’ lower costs.

Maybe there is a lesson here about the importance of unbiased first-principles analysis, supported by economic models, when assessing energy transition technologies. There is a danger of confirmation bias, within an ocean of possible data-points that may support pre-existing positions. But costs often turn out to be the single most important variable.

Our own first-principles analysis into the rise of LFP is re-capped below. The data-file tracks how NMC leaders from 2019m such as LGES and SK On have shifted their perspective, based on technical papers, news stories and the number of patent filings. In 2019, LG literally wrote that “NMC is the right choice… LFP should not be preferred” yet by 2024 it signed a contract to supply LFP cells to Renault’s Ampere EVs from a facility in Poland. It may take 3-5 years for LGES and SK On to catch up with CATL and BYD in LFP.

Lithium ion battery volumes in GWH per year, are broken down by end use, and by cathode chemistry, in this data-file, triangulating between technical papers, going back to 2011, and forecast out through 2030.