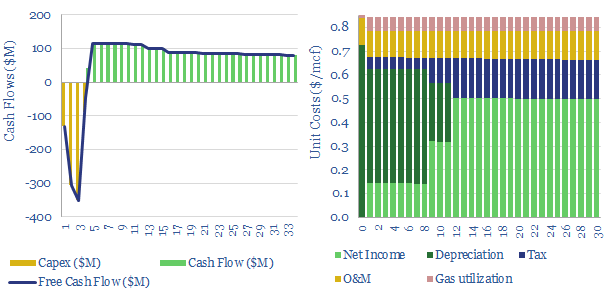

This data-file captures the economics for a typical LNG regas facility. We estimate that a fixed plant with 75-80% utilization requires a spread near to $0.8/mcf on its gas imports, in order to earn a 10% IRR.

However, infrastructure-like investments, such as regas facilities typically get financed off lower return expectations, and $0.6/mcf is sufficient for a 6% IRR.

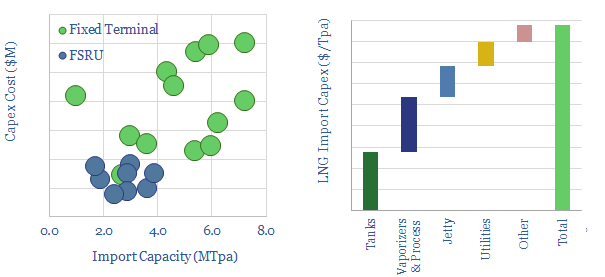

The main input is cost, which we have appraised based on past projects, company disclosures and technical papers (chart below).

Most interesting for the 2020s is the asymmetric upside that could result from extreme gas market tightness. In times of weak pricing, downside is capped, as you can idle the facility. But recent history shows that during times of gas shortages, gas prices effectively have uncapped upside, and this can easily add 3-10% to full-cycle IRRs.