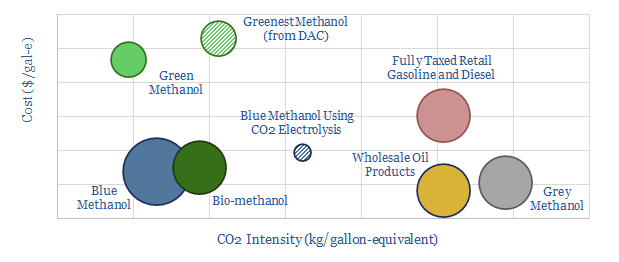

Methanol is becoming more exciting than hydrogen as a clean fuel to help decarbonize transport. Specifically, blue methanol and bio-methanol are 65-75% less CO2-intensive than oil products, while they can already earn 10% IRRs at c$3/gallon-equivalent prices. Unlike hydrogen, it is simple to transport and integrate methanol with pre-existing vehicles. Hence this 21-page note outlines the opportunity.

The objectives and challenges of hydrogen are summarized on pages 2-3. We show that clean methanol can satisfy the objectives without incurring the challenges.

An overview of the methanol market is given on pages 4-5, to frame the opportunity, particularly in transportation fuels and cleaner chemicals.

Conventional methanol production is described on 6-8. We focus upon the chemistry, the costs, the economics and the CO2 intensity.

Bio-methanol is modelled on pages 9-10. We also focus upon the costs, economics and CO2 intensity, including an opportunity for carbon-negative fuels.

Blue methanol is outlined on pages 11-15. Converting CO2 and hydrogen into methanol is fully commercial, based on recent case studies, which we also use to model the economics and CO2 credentials.

Green methanol is more expensive for little incremental CO2 reduction, and indeed some routes to green methanol production are actually higher-CO2 (pages 16-18).

Companies in the methanol value chain are profiled on pages 19-20. We focus upon leading incumbents, technology providers and private companies commercializing clean methanol.

Our conclusion is that methanol could excite decision-makers in 2021, the way that hydrogen excited in 2020. This thesis is spelled out on page 21.