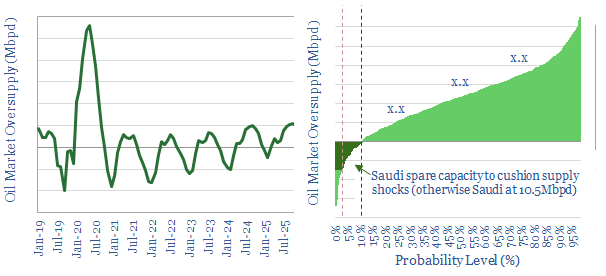

There is now a 75% chance of an oil rout in 2020, with prices falling to $20-40/bbl. Our updated Monte Carlo models, outlined in this 4-page report, reflect the demand destruction due to COVID19 and the breakdown of OPEC’s accord. The range of uncertainties is vast, c5x higher than at YE19. But our base case sees 2.3Mbpd of oversupply this year, denting oil to $30/bbl, and halving the US rig count. A 1Mbpd YoY shale curtailment by April 2021 brings the market back into balance by 2022. But there is also a c2-10% risk of steeper supply disruptions due to new policies and geopolitics.