This data-file is an overview of mining equipment companies, as mined materials increasingly seem like a bottleneck in the energy transition. For each company, we have noted its location, size, age, number of employees, number of patents, latest revenues, operating margins, exposure to the mining equipment industry, and a few short summary sentences. Where possible, we have also broken down the company’s revenues by end-market or by commodity.

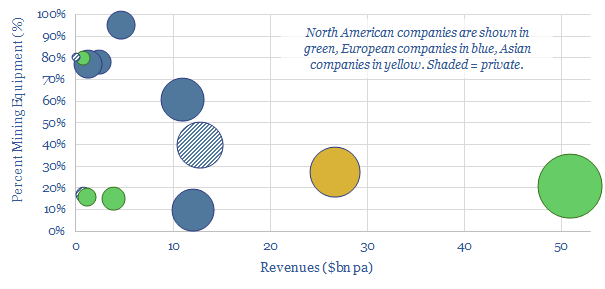

Seven companies stand out as they are larger, institutional quality companies with differentiated product offerings and >20% exposure to the metals and mining. This includes well-known titans of the mining industry, such as Caterpillar, Komatsu, Metso-Outotec, Epiroc and Sandvik.

Operating margins average 15% across this landscape of mining equipment companies, which is a good baseline for appraising the sector.

After-market sales contribute to strong margins. Some companies in our screen are generating 65% of their total revenue from after-market, as mining equipment requires an ongoing supply of replacement parts and servicing.

Much of the sector is dividend-generating, with targets to pay out 40-50% of earnings over the cycle.

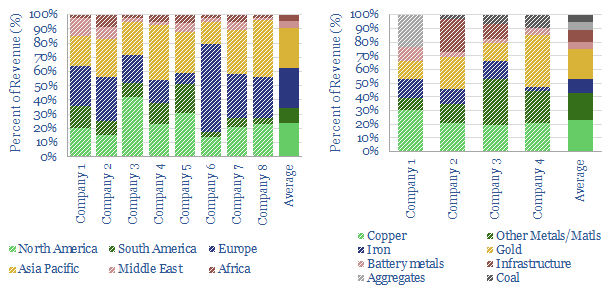

A breakdown of revenues is given where possible. As a rule of thumb, the mining equipment industry generates 35% of its revenue in the Americas, 25-30% in Europe and 25-30% in Asia. Another 25-30% is usually associated with the copper industry, 25-30% with the gold-silver industry, and the remainder is diversified (charts below).

Direct focus on the energy efficiency is a core theme. One specialist company notes its HPGR units can cut energy consumption by 40% in crushing-grinding circuits, especially by lowering re-processing. Another specialist company noted that its autonomous drilling units can achieve 29% lower CO2 and 40% lower cost per meter of progress.

Electrification and hydrogen. Many of the companies in our screen are highlighting an increasingly electric product offering. One specialist company notes the benefits of electrifying underground mining equipment, which saves 30% of the mine’s ventilation costs and energy use. However, one of the largest mining equipment manufacturers in the world has noted challenges with hydrogen fuel cells, which is that they may not operate brilliantly in the extremely dusty and high-vibration mining applications.

Supporting the energy transition is also acknowledged by many companies. One firm notes its ‘handprint’ is 10x larger than its ‘footprint’. I.e., the products that it helps to produce will abate 10x more emissions than the company emits directly. Another of the largest mine equipment manufacturers in the world notes that its product suite will naturally extend to electrification of frac fleets and the CCS industry.

Please download our overview of mining equipment companies, for full details, looking company by company.