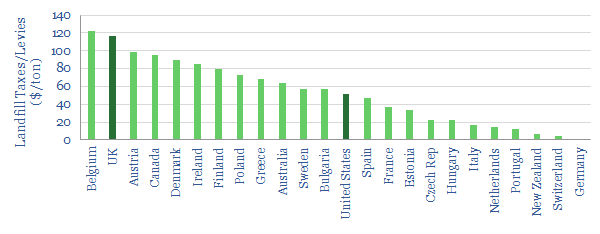

This data-file tabulates the most likely costs of placing waste-material (e.g., plastic) into landfill, country by country, and over time. Landfill taxes have risen at an 8% CAGR on average, clearly reduce landfilling rates, and promote recycling, plastic pyrolysis and biogas. This work spells out our top five conclusions on landfill taxes by country and over time.

(1) There is no such thing as “a landfill tax“. We need to start with this caveat. What we mean is that the taxes imposed on landfilling waste material are complex. If we take the UK as an example: there is a ‘standard rate’, a ‘lower rate’; a range of industries that qualify for exemptions (ranging from mining-related industries to ‘pet cemeteries’); VAT is charged on top of the landfill tax (which may not apply if your business is VAT-exempt); and then different municipalities may add their own additional fees. And this is just one country. So please allow us this caveat. Nevertheless, what we are trying to do in this work is just chart relatively comparable times-series data into landfill fees, by country, and over time.

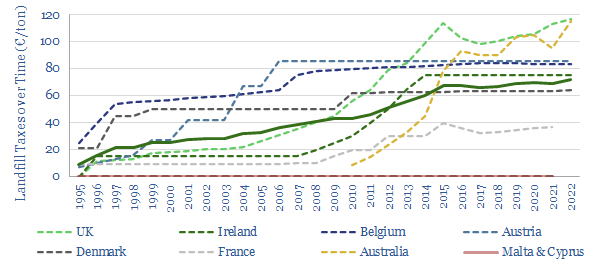

(2) Taxes have risen at an 8% CAGR on average, across the different geographies plotted below. The average landfill fee in 2022 is around €70/ton, which is up from €50/ton a decade ago, and €30/ton, two decades ago. Taxes are said to be one of the inevitabilities of life. Taxes on landfill have effectively only ever risen. Even the small ‘decreases’ that seem to be visible on the chart below are functions of FX-fluctuations, while landfill rates did not actually fall in local currency terms.

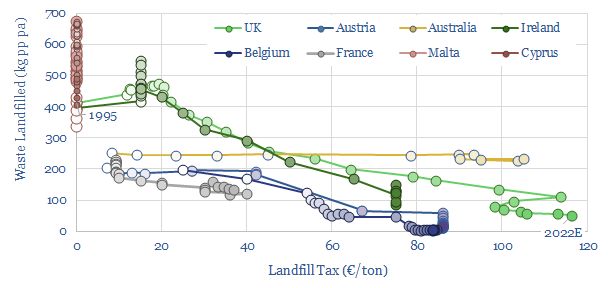

(3) Landfill taxes have been effective in reducing landfilling. The best example of this comes from countries such as the UK and Ireland. Neither country had a landfill tax in 1995. Since then, the UK has imposed one of the largest landfill taxes of any country in Europe. As a result it has lowered waste landfilling by 80%, more than any other country in the screen. Ireland lowered landfill waste by around 70%.

(4) Did landfill rates fall faster because of landfill taxes? An interesting comparison point is to look at the rate of landfill rate reductions in countries that did not institute landfill taxes. Malta and Cyprus are two examples of countries in Europe that do not have dedicated landfill taxes. Landfilling rates have ebbed and flowed over time in both countries. But on average, these two countries have the exact same landfilling rates in 2020 as they did in 1995. Likewise, France, whose general landfill tax is somewhat lower than other countries, appears to have achieved a lower rate of landfill reduction, at around 30%.

(5) What implications for CO2 taxes? In the past, we have blown hot and cold over CO2 taxes. We have argued that a consistent, level playing field could help the US achieve cost effective decarbonization. On the other hand, we have worried that badly designed CO2 taxes could cause industrial leakage and must be combined with a border adjustment tax. We have also worried that CO2 taxes could just end up being taxes that raise living costs, without necessarily achieving decarbonization which, unless taxes are reduced somewhere else in the system to compensate, equates to a high CO2 abatement cost. So overall, we think the case study from landfill taxes is a very helpful analogy. All things considered, well-designed CO2 taxes can very likely help to incentivize hundreds of energy efficiency initiatives.