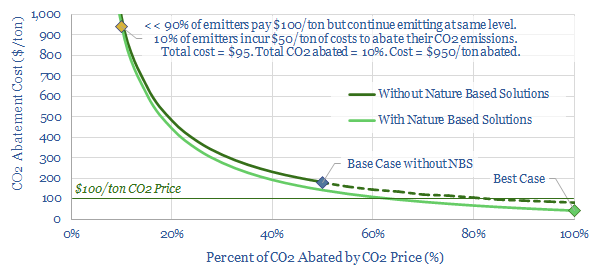

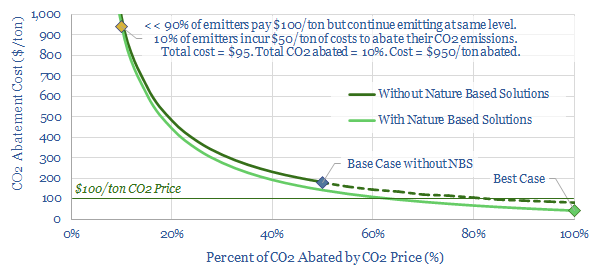

CO2 prices and CO2 abatement costs are very different numbers. CO2 prices are incurred by emitters. But abatement costs depend on how much CO2 is reduced. These abatement costs can actually be astronomical if CO2 does not fall by very much. Hence we argue CO2 prices are only effective if nature-based offsets are incorporated.

Economy-wide CO2 prices have been suggested as an effective policy tool to drive decarbonization. For example, our research has shown that a CO2 price could create a level playing to allow a broad range of energy technologies to decarbonize the entire US economy. (note below).

But something is missing from this analysis: what is the relationship between CO2 prices and CO2 abatement costs? The chart below aims to answer this question.

Short-run abatement costs from a CO2 price are astronomically high. To see this, consider the yellow dot in the chart above. Let us assume that a $100/ton CO2 price is imposed on all emitters in an economy. As a result, 10% of those emitters spend c$50/ton to eliminate their CO2 (total cost = $5 per ton of total ex-ante emissions). However, the remaining 90% of emitters continue emitting as before, and simply bear the costs of the $100/ton CO2 price, or pass it on to their customers (total cost = $90 per ton of total ex-ante emissions). Now, to calculate the CO2 abatement cost, we must add these costs together ($90 + $5 = $95/ton of ex-ante emissions) and then we must divide this total by the percent of CO2 that has been abated (10%). The result is a $950/ton abatement cost.

Can this be right? It might seem like a paradox, that the CO2 abatement cost associated with a $100/ton CO2 price could be $950/ton. The reason is that CO2 prices and CO2 abatement costs are very different things. As shown on the chart above, the CO2 abatement cost depends on how much CO2 is actually abated. If a CO2 price is imposed, and no one actually abates their CO2, then you have simply imposed a consumption tax.

Is this risk realistic? Different studies show that the price-elasticity of energy demand is relatively low. One good meta-study finds an average price-elasticity of 13% (here). In other words, a 100% increase in energy prices would likely only reduce energy demand by 13%. Using our data-file below, we estimate that a $100/ton CO2 price, if imposed overnight, would increase retail energy prices by around 35%, which in turn would most likely reduce energy demand (and with it CO2) by around 5%. So if anything, our suggestion of a $950/ton CO2 abatement cost from a $100/ton CO2 price is 2x too low.

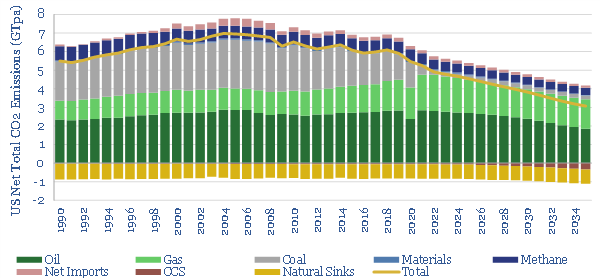

The objective of a CO2 price, however, is to incentivize deep changes across an economy, in order to reduce emissions. We studied one such scenario for the US last year (link here). This work found that by 2035, a CO2 price gradually rising to above $100/ton could eliminate around half of all US CO2 emissions (chart below). Here, the CO2 abatement cost comes out at c$180/ton. 50% of emitters continue emitting, and pay $100/ton of CO2 prices ($50). The other 50% of emitters incur an average of $80/ton of CO2 abatement costs to eliminate their CO2 ($40). The total cost is $90. This translates into a CO2 cost of $180/ton, because c50% of emissions are abated on this model.

One problem of this model is that many of the technologies that need to be incentivized have a much higher incentive price than $100/ton. As an illustration, some of the direct subsidies currently offered to different transition technologies are shown below, translated into $/ton terms. A $100/ton CO2 price clearly does not incentivize a technology costing $200-700/ton. So complex additional subsidies would also be needed.

A much more effective iteration of the model allows nature-based solutions into the solution set. Specifically, companies that sponsor reliable nature-based offset projects can use the CO2 abatement from these projects as a credit against CO2 price payments. First, allowing these nature-based offsets is the only way that many industries can realistically get to ‘zero’ CO2. Second, the costs are much lower, and our roadmap to net zero finds that the entire global economy could be decarbonized for an average cost of $40/ton, if 25% of the heavy-lifting is done via nature-based methods (note here).

What is interesting about this scenario, returning to the chart below, is that the average CO2 abatement cost in our ‘best case’ comes in at $40/ton. This is to say, 0% of emitters continue emitting and paying the $100/ton CO2 price (why would you, if you could source nature-based carbon offsets for a much lower price, of $3-50/ton). 100% of erstwhile emitters pay an average abatement cost of $40/ton. And this offsets 100% of emissions, hence the total CO2 abatement cost also comes in at $40/ton.

Note the abatement cost is lower than the CO2 price, in this scenario. This also seems counter-intuitive at first glance. It is a function of two variables: the abatement cost is lower than the CO2 price, and a very high portion of CO2 is being abated. As another example, imagine the government declares a $1,000 fine for anyone caught wearing a yellow T-shirt tomorrow. As a result, no-one wears a yellow T-shirt. The total cost of this policy is therefore zero.

Achieving a low cost transition matters, as our recent work finds that inflation could de-rail high-cost transition pathways (note below). We conclude that CO2 prices can be very powerful. But to be cost-effective, they must genuinely drive decarbonization, rather than simply taxing continued emissions. This is best achieved by integrating nature-based carbon offsets into CO2 pricing frameworks, in our view.