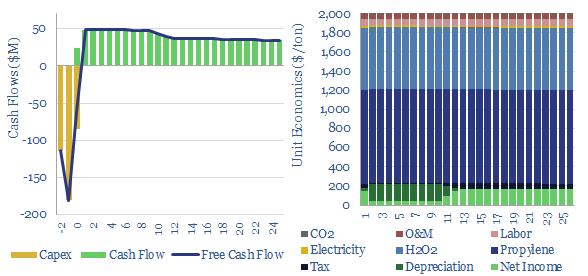

Propylene oxide production costs average $2,000/ton ($2/kg) in order to derive a 10% IRR at a newbuild chemicals plant with $1,500/Tpa in capex. 80% of the costs are propylene and hydrogen peroxide inputs. 60-70% of this $25bn pa market is processed into polyurethanes. CO2 intensity is 2 tons of CO2 per ton of PO today, but there are pathways to absorb CO2 by reaction with PO and possibly even create carbon negative polymers.

Global production of propylene oxide is estimated at 12MTpa in 2022, implying a $25bn pa market at an average propylene oxide cost of $2/kg.

Propylene oxide production costs are modeled in this data-file, and most likely run at $2/kg ($2,000/ton to derive a 10% IRR at a plant costing $1,500/Tpa.

Specifically we have modeled the HPPO process, forming propylene oxide via the exothermic condensation reaction between propylene and hydrogen peroxide, in methanol solvent, catalysed by titanium silicalite (TS-1). Although as noted in the data-file there are alternative production routes, such as the chlorohydrin process and the styrene monomer process PO process. HPPO seems like the front-runner solution for new plants.

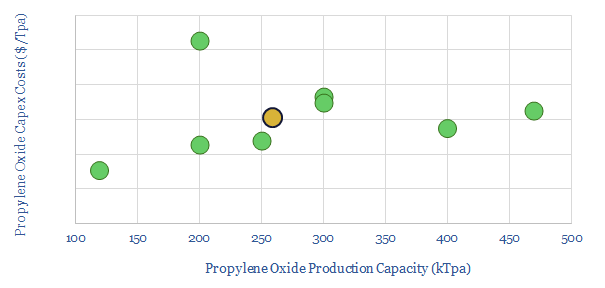

Capex costs of propylene oxide plants are estimated based on recent project announcements (chart below). Our base case estimate is $1,500/Tpa of propylene oxide capacity.

Propylene and hydrogen peroxide inputs comprise 80% of the final costs of propylene oxide.

Two thirds of the propylene oxide market today is alkoxylated to form polyols for use as building blocks for polyurethanes.

Vertical integration across petrochemicals? US propylene oxide producers include LyondellBasell (600kTpa at Bayport TX, 550kTpa at Channelview TX), Dow (725kTpa at Freeport TX, 330kTpa at Plaquemine LA) and Huntsman (240kTpa at Port Neches TX).

CO2 intensity of propylene oxide is estimated at 2 tons of CO2 per ton of propylene oxide, which in turn, is largely inherited from the commodity inputs as well. You can stress test this in the data-file.

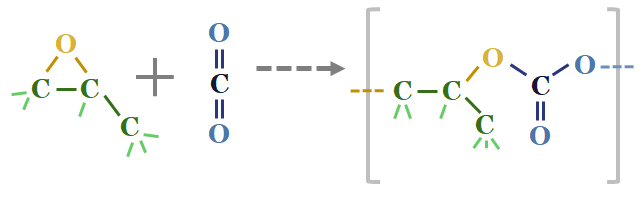

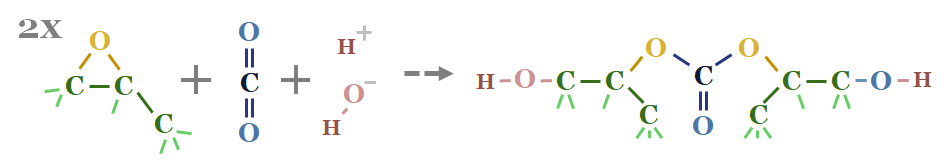

What is interesting about propylene oxide is the COC epoxide unit is strained, hence it can react with CO2 to form compounds such as propylene polycarbonate (first chart below) or polycarbonate polyols (second chart below). Note that polyurethanes polymerize with diisocyanates to form polyurethanes.

In other words, these propylene oxide reaction products can absorb CO2 and prevent its emission into the atmosphere (effectively a type of CCS).

However the maths in the data-file show that propylene carbonate (first chart above) is 57% propylene oxide by mass (gross emissions of 2 tons of CO2 per ton of propylene oxide in our base case) and 43% CO2 (1 ton of CO2 avoided per ton of CO2) and hence while this building block absorbs CO2, it cannot entirely be said to be carbon negative today.

However, the best route to decarbonize propylene oxide is via decarbonizing the hydrogen peroxide inputs using lower-carbon hydrogen. This is also increasingly incentivized by the US IRA. Companies pursuing this CO2-absorbing polyurethanes include Novomer (acquired by Aramco) and Empower Materials.

Please download the data-file to stress test propylene oxide production costs, as a function of propylene prices, hydrogen peroxide prices, capex, opex, electricity, labor costs, O&M costs, CO2 prices and tax rates. Detailed notes are also laid out in the notes tab.