It is often said that Oil Majors should become Energy Majors by transitioning to renewables. But what is the best balance based on portfolio theory? Our 7-page note answers this question, by constructing a mean-variance optimisation model. We find a c0-20% weighting to renewables maximises risk-adjusted returns. The best balance is 5-13%. But beyond a c35% allocation, both returns and risk-adjusted returns decline rapidly.

Pages 2-3 outline our methodology for assessing the optimal risk-adjusted returns of a Major energy company’s portfolio, including the risk, return and correlations of traditional investment options: upstream, downstream and chemicals.

Page 4 quantifies the lower returns that are likely to be achieved on renewable investment options, such as wind, solar and CCS, based on our recent modeling.

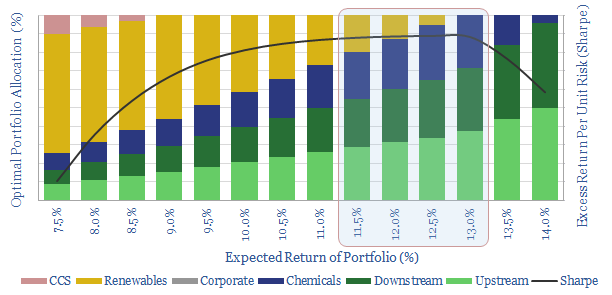

Pages 5-6 present an “efficient frontier” of portfolio allocations, balanced between traditional investment options and renewables, with different risk and return profiles.

Pages 6-7 draw conclusions about the optimal portfolios, showing how to maximise returns, minimise risk and maximise risk-adjusted returns (Sharpe ratio).

The work suggests oil companies should primarily remain oil companies, working hard to improve the efficiency and lower the CO2-intensities of their base businesses.