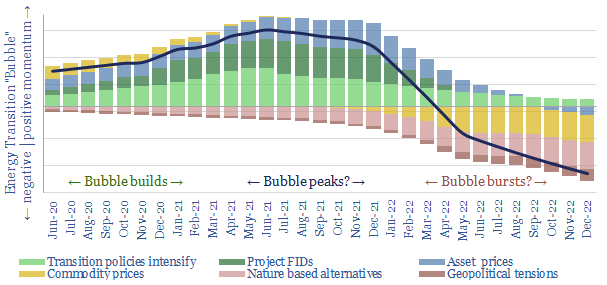

This 25-page note outlines our top ten themes for 2021. We fear Energy Transition will continue building into an investment bubble. But also appearing on the horizon this year are three triggers to burst the bubble. We continue to prefer non-obvious opportunities in the transition and companies with leading technologies.

(1) Climate policies are at an increasing risk of blowing ‘investment bubbles’ (pages 2-4)

(2) Renewables’ grid volatility is also reaching new levels, creating a new opportunity to absorb excess power supplies (pages 5-7)

(3) Nature-based solutions are continuing to find favor, and may start displacing higher-cost transition technologies from the cost curve (pages 8-9).

(4) Conventional energy demand recovers post-COVID, and will lead to eventual under-supply in conventional oil and gas markets (pages 10-13).

(5) Shale productivity is likely to disappoint during the recovery, albeit temporarily (pages 14-15).

(6) Project FIDs will need to accelerate, but we think new energies projects will still outpace conventional energy projects (pages 16-17)

(7) Relativism ramps. The market will become increasingly discerning between low-CO2 and high-CO2 companies within different industrial sub-segments (pages 18-20).

(8) Geopolitical flashpoints are going to flare up around climate policies (pages 21-22).

(9) Non-obvious opportunities in the Energy Transition are most exciting, hence we re-cap most salient examples from our work to-date (page 23).

(10) Technology leaders remain best-placed, hence we outline examples (pages 24-25).