10MTpa of hydrogen is produced in the US, of which 40% is sold by industrial gas companies, 20-25% is generated on site at refineries, 20% at ammonia plants and 15-20% in chemicals/methanol. This datafile breaks down US hydrogen production by facility. Owners of existing steam methane reforming units may readily be able to capture CO2 and benefit from CO2 disposal credits under the US Inflation Reduction Act?

Methodology. As far as we are aware, there is no publicly available database of US hydrogen production by facility. However, we have cleaned up facility by facility data from EPA FLIGHT, which show CO2 emissions by facility, and then used some rules of thumb to estimate hydrogen production. For example, our methane reforming model estimates 9 tons of CO2 are emitted per ton of hydrogen. Our ammonia models estimate 0.2 tons of hydrogen per ton of ammonia, and 2.5 tons of CO2 per ton of ammonia. We then spent a day scrubbing the data and comparing our numbers with publicly available information from different companies. Our conclusions follow.

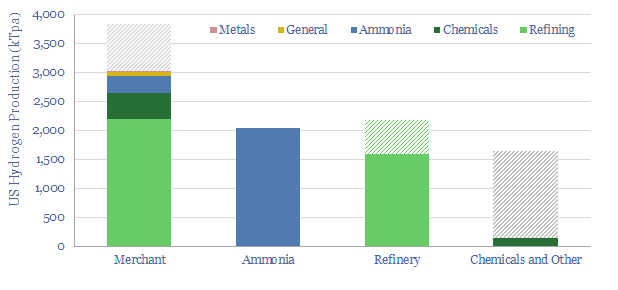

The US produces 10MTpa of hydrogen each year, of which c40% is merchant hydrogen sold by industrial gas companies, 20-25% is generated on site at refineries, c20% is at ammonia plants and c15-20% is at methanol/chemicals facilities (chart below). The solid bars are fully disaggregated, facility by facility, in the database. We also added increments to reflect facilities that do not report to FLIGHT, catalytic reforming units at refineries, and other chemical generation of hydrogen, especially methanol plants.

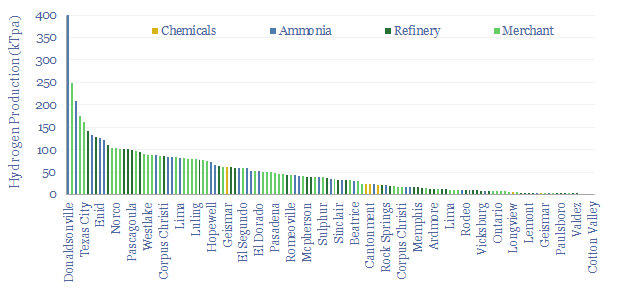

Two states on the US Gulf Coast, Texas and Louisiana, dominate the mix, with around 45% of total US hydrogen production, and c65% of total merchant hydrogen production.

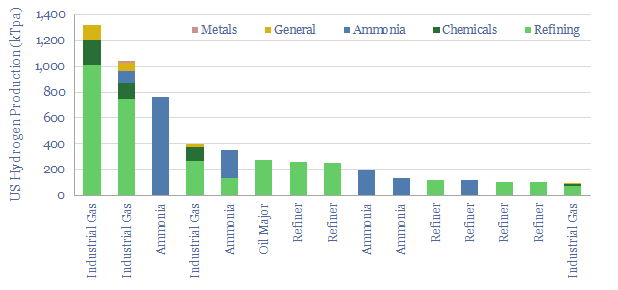

Similarly, three industrial gas giants, Air Products, Linde and Air Liquide dominate the industry, producing well over 90% of the US’s merchant hydrogen, and c30-40% of all US hydrogen.

Also among the US’s major hydrogen producers are ammonia companies and oil refiners. Refineries currently consume 70-80% of all merchant hydrogen sales from industrial gas companies in the US. Some large and famous refiners purchase effectively all of their refinery hydrogen from third parties. For example, ExxonMobil has a long-standing partnership with Air Products (highlighted by Air Products here).

But other refiners operate their own SMRs and produce their own hydrogen on site. One Oil Major and two refiners stand out, with over 300kTpa of annual hydrogen production (all of the different companies are covered in the database and in our broader US refinery database).

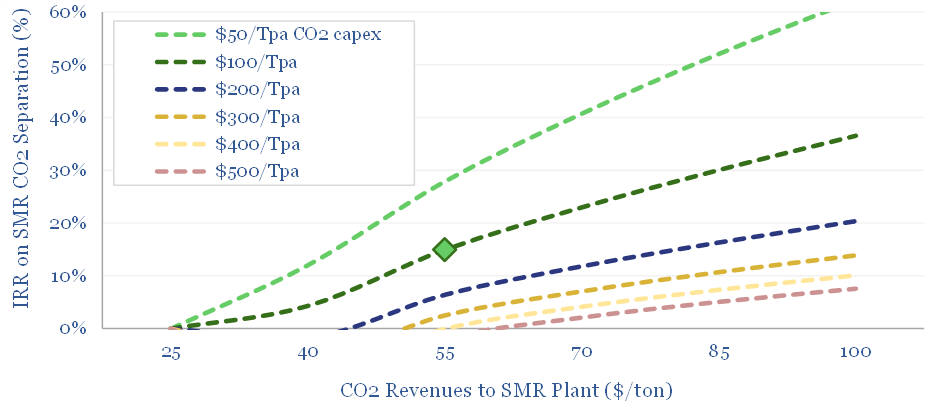

Where this gets interesting is that the US Inflation Reduction Act (45Q) offers $85/ton cash incentives to companies that can capture and sequester CO2. In our view, capturing CO2 from existing Steam Methane Reformers is technically ready, relatively simple (compared to other CCS opportunities with high energy penalties and amine degradation issues), and can earn 20% IRRs when we model the costs and a share of 45Q revenues (chart below). The company that owns the reformer is the one that will be able to benefit from the 45Q credits. So we wonder which industrial gas companies, refiners and chemicals plants from the data build-up overleaf will grasp this opportunity.

Please download the database for our estimated breakdowns of US hydrogen production, facility by facility and operator by operator.