Wind economics are not good or bad in absolute terms. They depend on capacity factors, which average 26% globally, but can range from 10% to 60%. In the best locations, levelized costs are <4c/kWh. Hence this 16-page note explores global wind capacity factors and updates our wind energy outlook.

Is wind inflationary or deflationary? The answer depends on context, varying with the location, capex costs, capital costs, the shape of the surrounding grid, and most of all, wind turbine capacity factors, as shown on pages 2-3.

Hence in this report, we want to delve into real-world capacity factors, in order to gauge which locations will find it natural to ramp up wind, versus other regions that have lower capacity, or where wind may even be saturating. Our methodology for calculating capacity factors, both at the national level, and the asset level are discussed on pages 4-5.

Wind capacity factors by country are ranked — scoring leaders and laggards — and discussed on page 6.

The variability of capacity factors within individual countries is quantified and discussed on page 7.

Are wind economics improving or deteriorating? There is evidence that future wind installations, especially in geographies that have already deployed large amounts of wind, will see progressively lower capacity factors on average. It is reminiscent of the classic “resource depletion” issue in hydrocarbons and mining, as discussed on pages 8-10.

Many commentators group wind and solar together, as though they are allies in “combatting CO2”. This narrative is wrong. Wind and solar are inherent competitors. Grids have limited tolerance for volatile loads (see pages 10-12).

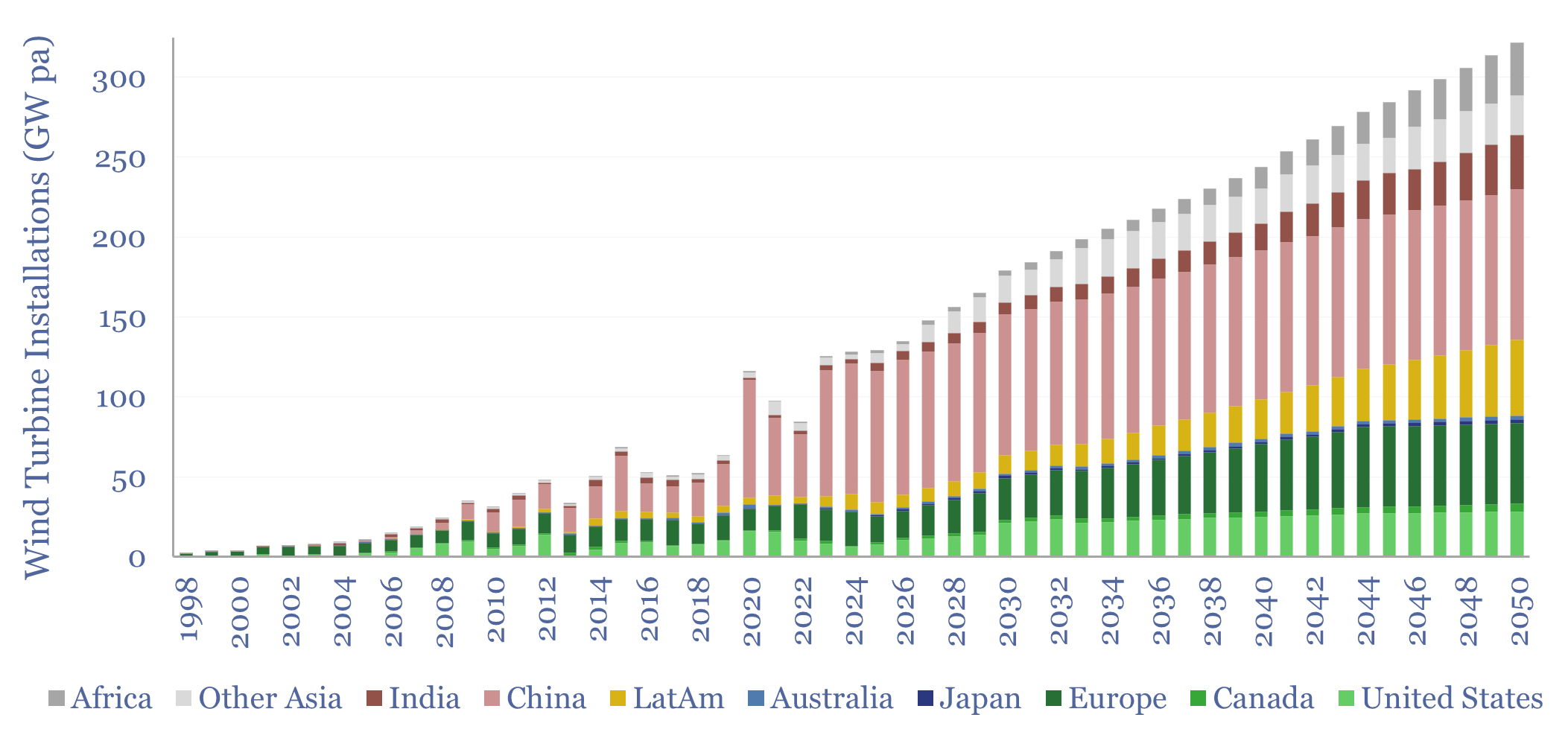

Our outlook for wind capacity installations, by region and by year, which reflects capacity factors, broader regional energy balances, emerging powerhouses (LatAm?) and windy laggards, is all updated on pages 13-15.

The distribution of future growth plays to the strengths of Chinese turbine manufacturers, while the angle that interests us in the developed world is at the intersection of wind and defence-tech, as discussed on pages 15-16.