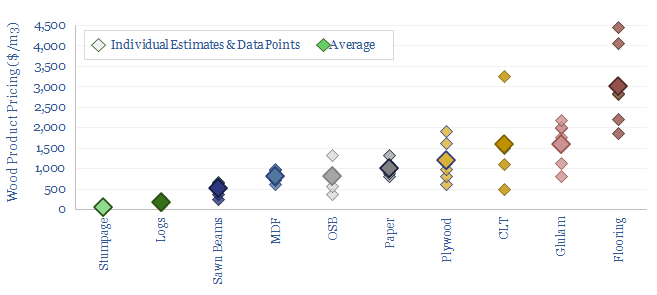

This data-file aggregates the pricing of different wood products, as storing carbon in long-lived materials matters amidst the energy transition. It can also add economic value. While upgrading raw timber into high value materials can uplift realized pricing in reforestation projects by 20-60x, which improves the permanence of nature-based CO2 removal credits.

Stumpage prices reflect the prices of timber at the immediate point of harvesting in a forest. We think stumpage prices are typically around $40/m3, ranging from $20-80/m3, depending on the timber type and location.

Whole logs that have been de-limbed, transported out of the forest, partially dried, and possibly de-barked are around 3-4x more valuable reaching $100-200/m3.

Sawn beams are 3x more valuable again, with pricing recently exceeding $500/m3, after the additional steps of drying, grading, cutting into specific shapes, and other possible treating steps.

Paper comes next, and we think pricing around $875/m3 is often sufficient for a 10% IRR at a new paper mill, while recent paper pricing has run around the $1,000/m3 mark.

Board materials are another 2-4x more valuable gain. Plywood, which is formed by unravelling entire logs into long, continuous sheets, might price above $1,000/m3, while lower grade board materials below $1,000/m3 will be formed by binding and re-constituting wood-chip (Oriented strand board, OSB) or sawdust (medium-density fibreboard, MDF).

Engineered timber products included glulam and cross laminated timber. These can have more variable pricing, but in both cases, we think recent pricing has run above $1,500/m3. We think CLT is an interesting alternative to steel in construction.

Hardwood flooring can be among the most valuable timber products. Again, pricing is variable, but it can be 2x more expensive than engineered timber products.

We also see growing value in mass timber, related chemicals, wood in wind, and interesting companies with specialized wood products, equipment or engineered wood technologies.