Search results for: “shale”

-

U.S. Shale: Winner Takes All?

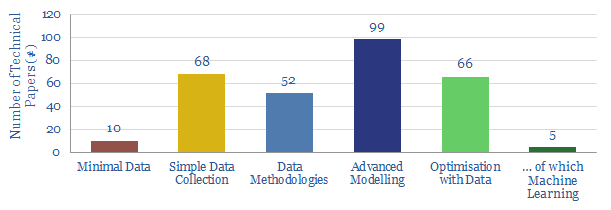

Shale is a ‘tech’ industry. And the technology is improving at a remarkable pace. But Permian technology is improving faster than anywhere else. These are our conclusions after reviewing 300 technical papers from 2018. We address whether the Permian will therefore dominate future supply growth.

-

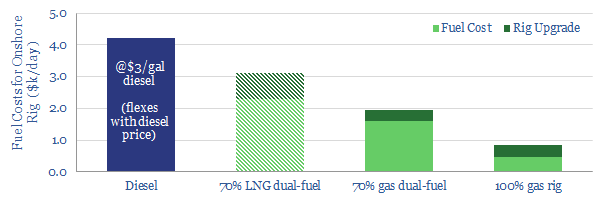

Should a shale rig switch to gas-fuel?

Should a shale rig switch to gas-fuel? We estimate that a dual-fuel shale rig, running on in-basin natural gas would save $2,300/day (or c$30k/well), compared to a typical diesel rig. This is after a >20% IRR on the rig’s upgrade costs. The economics make sense. However, converting the entire Permian rig count to run on…

-

US Shale: the second coming?

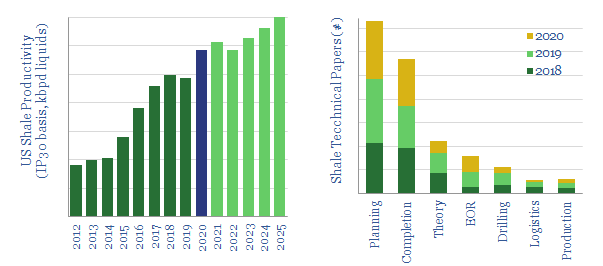

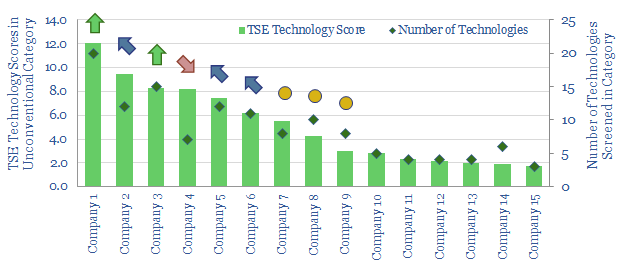

US shale productivity can still rise at a 5% CAGR to 2025, based on evaluating 300 technical papers from 2020. The latest improvements are discussed in this 12-page note. Thus unconventionals could quench deeply under-supplied oil markets by 2025. Leading technologies are also becoming concentrated in the hands of fewer operators.

-

US shale: the quick and the dead?

It is no longer possible to compete in the US shale industry without leading digital technologies. This 10-page note outlines best practices, process by process, based on 500 patents and 650 technical papers. Chevron, Conoco and ExxonMobil lead our screens. Falling from the leader-board is EOG, whose long-revered technical edge may have been eclipsed.

-

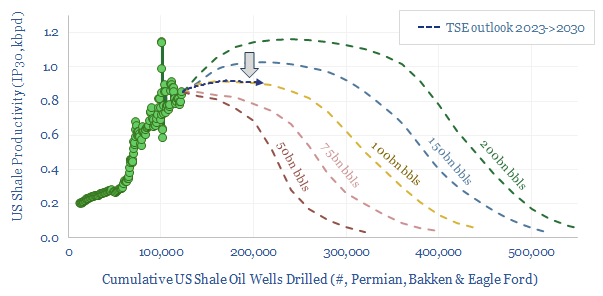

Shale oil: fractured forecasts?

This 17-page note makes the largest changes to our shale forecasts in five years, on both quantitative and qualitative signs that productivity growth is slowing. Productivity peaks after 2025, precisely as energy markets hit steep undersupply. We still see +1Mbpd/year of liquids potential through 2030, but it is back loaded, and requires persistently higher oil…

-

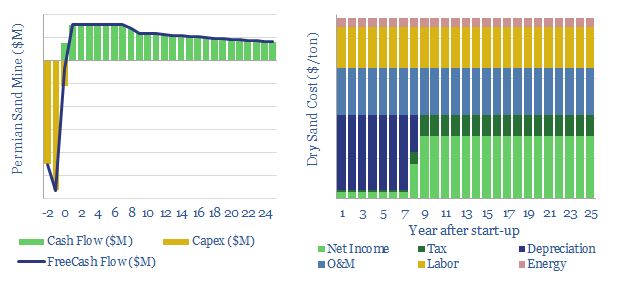

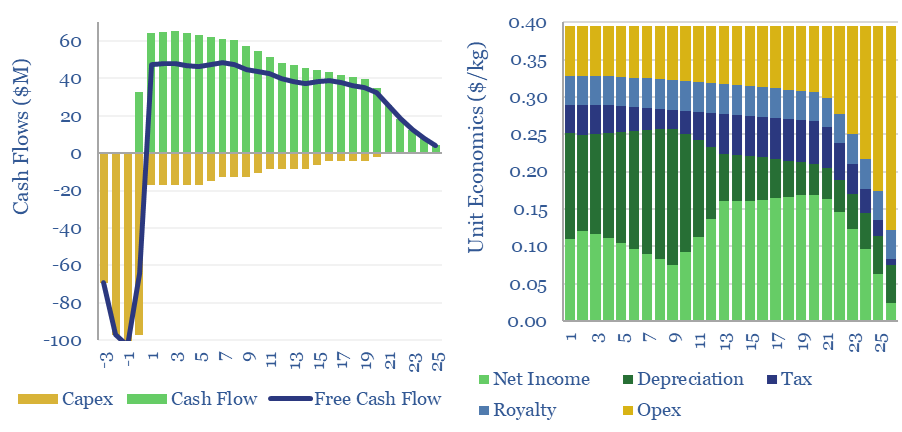

US shale sand mines: simple economics?

This model is a very simple breakdown of economics for in-basin sand production, around the US shale industry. The model can also be used to quantify the potential savings from shifting from dry sand to wet sand, estimated at c25% of total costs.

-

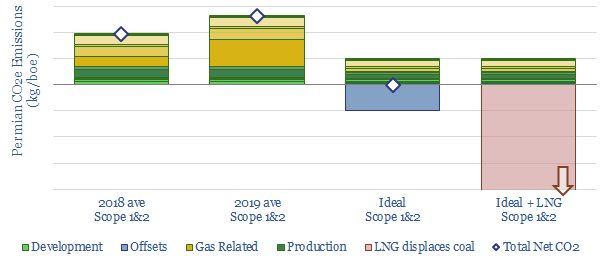

Shale growth: what if the Permian went CO2-neutral?

Shale growth is slowing due to fears over the energy transition, as Permian upstream CO2 emissions reached a new high this year. We have disaggregated the CO2 across 14 causes. It could be eliminated by improved technologies and operations: making Permian production carbon neutral, uplifting NPVs by c$4-7/boe, re-attracting a vast wave of capital and…

-

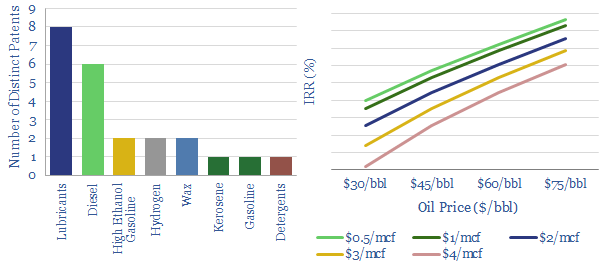

US Shale Gas to Liquids?

Shell filed 42 distinct new patents around GTL in 2018. This data-file reviews them, showing how the broad array of GTL products confers defensiveness and downstream portfolio benefits. Hence, we have modeled the economics of “replicating” Pearl GTL in Texas. Our base case is a 11% IRR taking in 1.6bcfd of stranded gas from the…

-

Gold hydrogen: the economics?

Natural hydrogen could be recovered from the Earth’s subsurface, with costs ranging from $0.3-10/kg, and CO2 intensities of 0.2-5.0 kg/kg. This data-file models the economic costs of gold hydrogen, and its sub-variants such as white hydrogen and orange hydrogen.

-

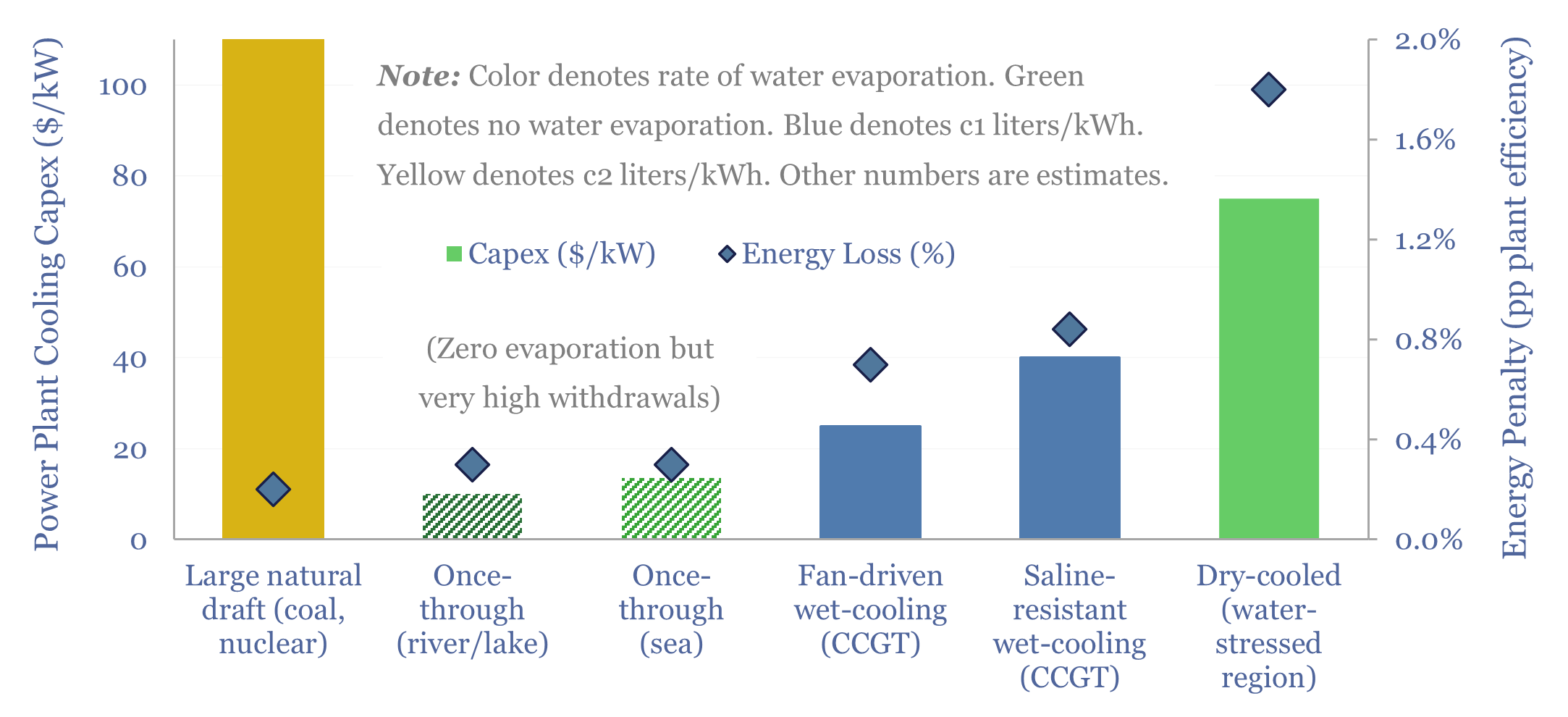

Power plant cooling: adapting for water scarcity?

Water is needed to condense steam, downstream of the steam turbines, in nuclear, coal and CCGT power plants. But thermal power demands and fresh water scarcity are both structurally rising. Hence this 16-page report explores how the energy industry might adapt, trends in power plant cooling, and who benefits.

Content by Category

- Batteries (85)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (88)

- Data Models (808)

- Decarbonization (158)

- Demand (106)

- Digital (52)

- Downstream (44)

- Economic Model (196)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (270)

- LNG (48)

- Materials (79)

- Metals (70)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (22)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (119)

- Renewables (149)

- Screen (110)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (342)