Search results for: “hydrogen peroxide”

-

Power Trains? Electric, diesel or hydrogen

This data-file compares diesel trains, electric trains and hydrogen trains, according to their energy consumption, carbon emissions and fuel costs. The energy economics are best for electrifying rail-lines. Hydrogen costs must deflate 25-75% to be cost-competitive.

-

Hydrogen vehicles and fuelling stations: where’s the IP?

We cleaned 18,600 patents into hydrogen vehicles and vehicle fuelling stations. Technology leaders include large auto-makers, industrial gas companies, Energy Majors and hydrogen specialists. Overall, the patents indicate the array of challenges that must be solved to scale up hydrogen fuel in transport.

-

Hydrogen reformers: technology leaders

This data-file assesses who has the leading technology for producing industrial hydrogen, but especially blue hydrogen from auto-thermal reformers, after reviewing public disclosures and 750 patents. Companies include Air Liquide, Air Products, Casale, Haldor Topsoe, Johnson Matthey, KBR, Linde, Thyssenkrupp.

-

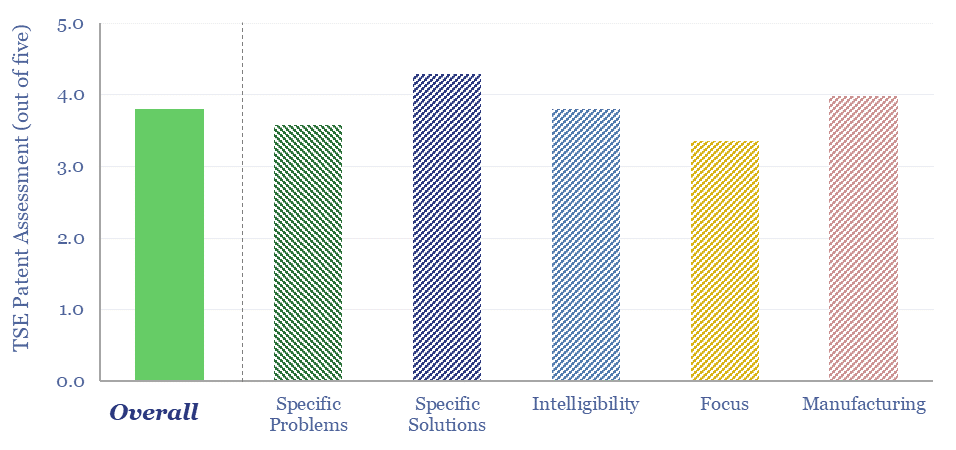

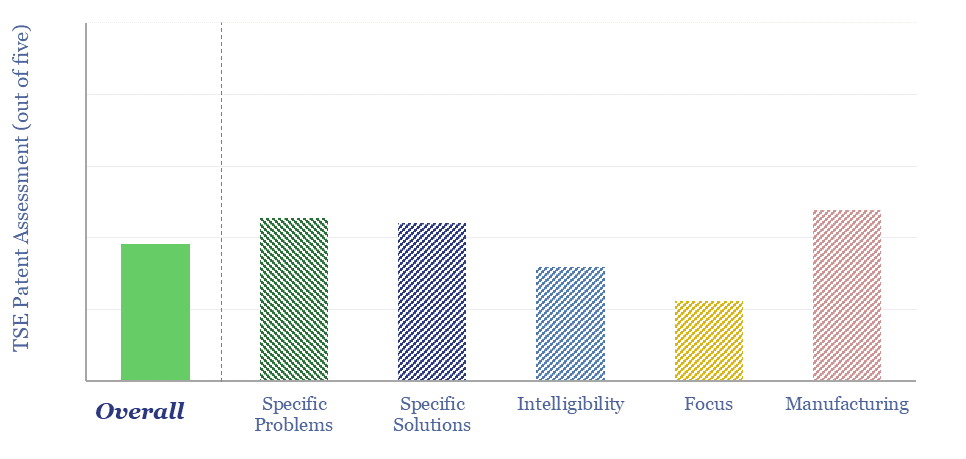

Monolith: turquoise hydrogen breakthrough?

Monolith claims it is the “only producer of cost effective commercially viable clean hydrogen today” as it has developed a proprietary technology for methane pyrolysis. But overall this was not one of our most successful patent screens. Some specific question marks are noted in the data-file.

-

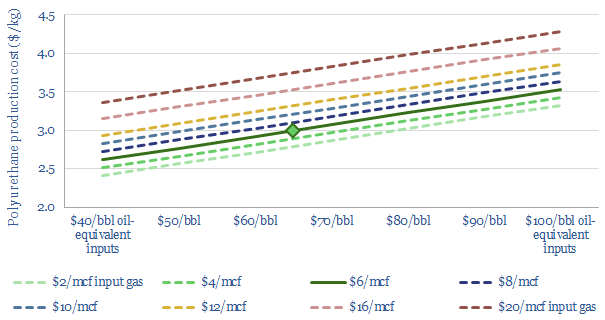

Polyurethane: production costs?

Polyurethane production costs are estimated at $2.5-3.0/kg in our base case model, which looks line-by-line across the inputs and outputs, of a complex, twenty stage production process, which ultimately yields spandex-lycra fibers. Costs depend on oil, gas and hydrogen input prices.

-

BrightLoop: clean hydrogen breakthrough?

Is Babcock and Wilcox’s BrightLoop technology a game-changer for producing low-carbon hydrogen from solid fuels, while also releasing a pure stream of CO2 for CCS? Conclusions and deep-dive details are covered in this data-file, allowing us to guess at BrightLoop’s energy efficiency and a moat around Babcock’s reactor designs?

-

Cemvita Factory: microbial breakthroughs?

Cemvita is a private biotech company, based in Houston, founded in 2017. It has isolated and/or engineered more than 150 microbial strains, aiming to valorize waste, convert CO2 to useful feedstocks, mine scarce metals (e.g., direct lithium extraction) and “brew” a variant of gold hydrogen from depleted hydrocarbon reservoirs. This data-file is our Cemvita Factory…

-

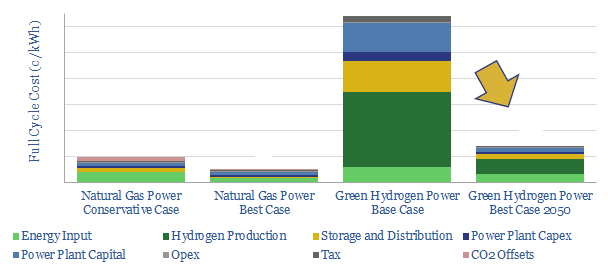

Green Hydrogen Economy: Holy Roman Empire?

We model the green hydrogen value chain: harnessing renewable energy, electrolysing water, storing the hydrogen, then generating usable power in a fuel cell. Today’s costs are very high, at 64c/kWh. Even by 2050, our best case scenario is 14c/kWh, which elevates household electricity bills by $440-990/year compared with decarbonizing natural gas.

-

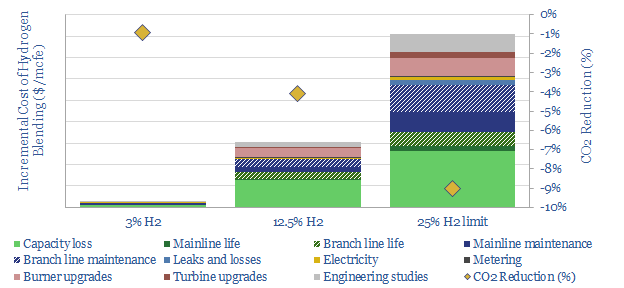

Hydrogen blending: costs and complexities?

This data-file estimate the costs of blending hydrogen into pre-existing natural gas pipeline networks. Costs are relatively low per mcf of gas, but very high per ton of CO2 abated. Costs also rise exponentially, as more hydrogen is blended into the mix.

-

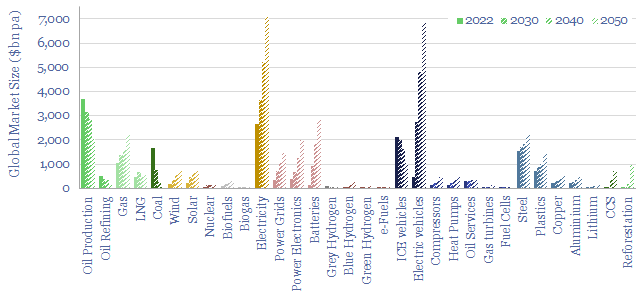

Energy transition market sizing: hydrocarbon, new energies, capital goods and materials?

This data-file contains energy transition market sizing analysis, for hydrocarbons, new energies, capital goods and materials in $bn pa, integrating over 1,000 items of energy transition research and our latest roadmap to net zero. In aggregate, energy, materials and transition-related markets double from $25 trn pa to $50 trn pa.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)