Search results for: “gas turbine”

-

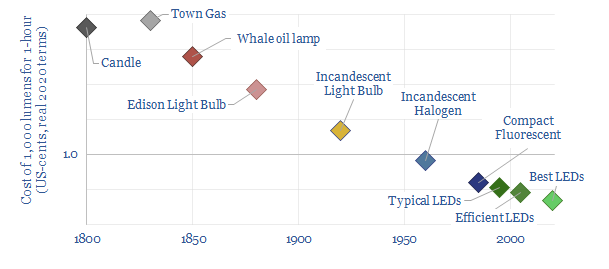

Lighting: historical costs and energy efficiency?

This data-file assesses lighting solutions throughout history, from candles, to whale oil, to incandescent bulbs, to modern LEDs. Overall, the best LEDs now achieve over 80% useful energy efficiency. Lighting costs have improved by 100x over the past century, while efficiency has improved 13x.

-

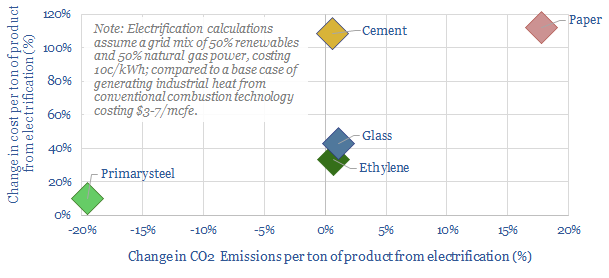

Industrial heat: the myth of electrify everything?

“Electrify everything then decarbonize electricity”. This mantra is dangerously incorrect for industrial heating. It raises output costs by 10-110% without lowering CO2. Our 19-page note presents case studies in the steel, cement, glass, petrochemical and paper industries, which exceed 15% of global CO2.

-

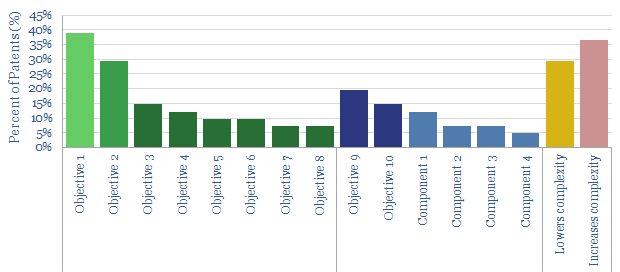

LNG liquefaction: what challenges and opportunities?

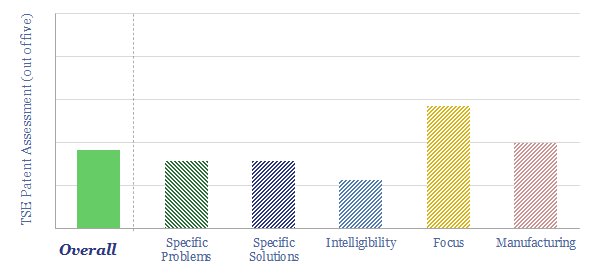

This data-file reviews 40 recent LNG patents, to draw conclusions and identify leading companies. Lowering capex costs matters, but should not be done at the expense of higher opex or emissions. The next generation of modular plants offer a step-change improvement. And new process technologies are also coming through.

-

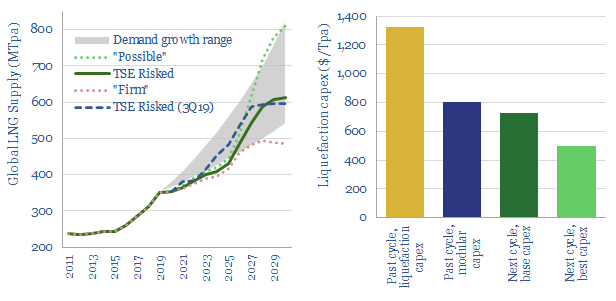

LNG in the energy transition: rewriting history?

A vast new up-cycle for LNG is in the offing, to meet energy transition goals, by displacing coal. 2024-25 LNG markets could by 100MTpa under-supplied, taking prices above $9/mcf. But emerging technologies are re-shaping the industry, so well-run greenfields may resist the cost over-runs that marred the last cycle.

-

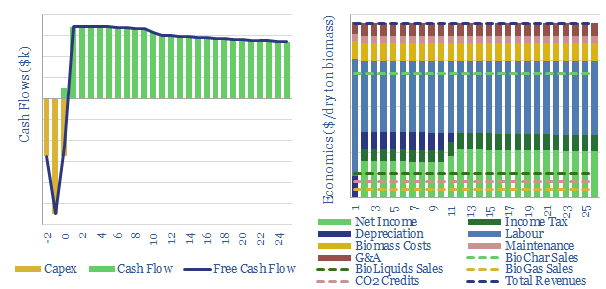

Biomass to biochar: the economics?

Biochar is a carbon negative material, according to our accounting, locking as much as 0.5kg of CO2 into soils per kg of dry biomass inputs. It can also be highly economical, with a base case IRR of 25%. Our full model allows you to stress-test input assumptions.

-

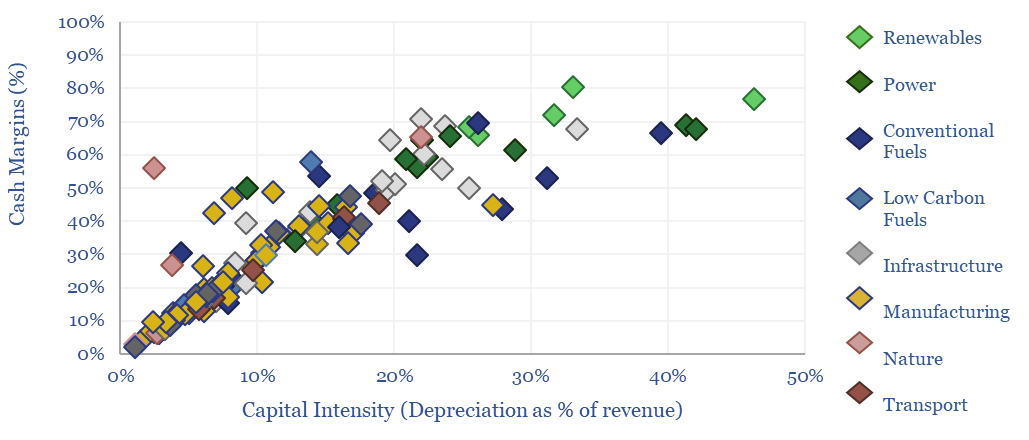

Energy economics: an overview?

This data-file provides an overview of energy economics, across 175 different economic models constructed by Thunder Said Energy, in order to put numbers in context. This helps to compare marginal costs, capex costs, energy intensity, interest rate sensitivity, and other key parameters that matter in the energy transition.

-

LanzaTech: biofuels breakthrough?

LanzaTech aspires to “take waste carbon emissions and convert them” into sustainable fuels (and bio-plastics) with a >70% CO2 reduction. We have assessed its patents but concluded we cannot yet de-risk the CO2-to-fuels pathway in our energy transition models.

-

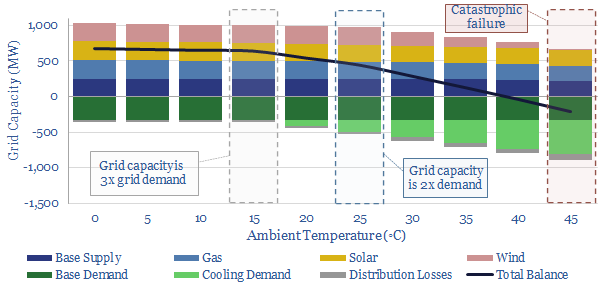

Power grids: hell is a hot, still summer’s day?

Ramping renewables to 50% of power grids is a growing aspiration in the energy transition. But in some markets, it may result in devastating blackouts during summer heatwaves, as power demand doubles exactly when wind, solar, gas, transmission losses and disruptions all deteriorate. This 15-page note assesses the implications.

-

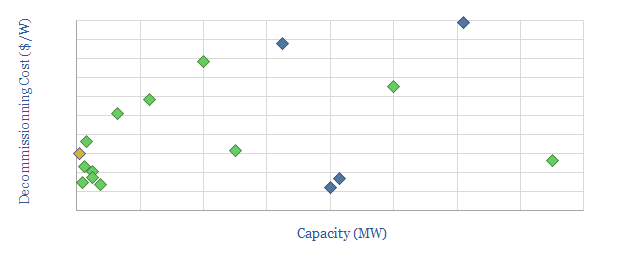

Solar power: decommissioning costs?

This data-file aims to break down the costs of decommissioning solar projects. Gross costs are estimated within a range of $0.03-0.20/W, which is around 3-20% of the initial installation costs. What might help is the ability to re-use old panels, which could possibly even allow a small profit at end-of-life.

-

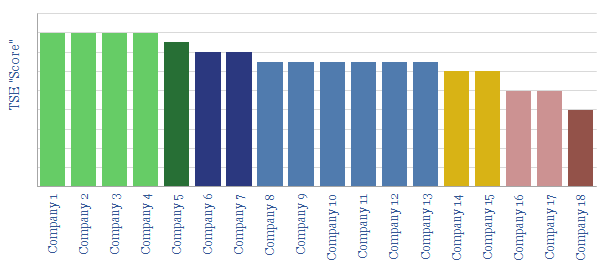

Heat pumps: a screen of providers and reviews?

This data-file tabulates our subjective opinions on c20 different heat pump companies, based on their consumer reviews, pricing, reliability, efficiency, company size, models, integration, and visual/acoustic properties. We conclude heat pumps are opaque and must be selected carefully.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)