Search results for: “LNG”

-

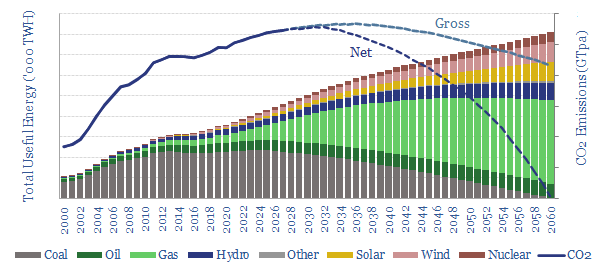

China: can the factory of the world decarbonize?

China now aspires to reach ‘net zero’ CO2 by 2060. But is this compatible with growing an industrial economy and attaining Western living standards? The best middle-ground sees China’s coal phased out and gas rising by a vast 10x to 300bcfd. The biggest challenges are geopolitics and sourcing enough LNG.

-

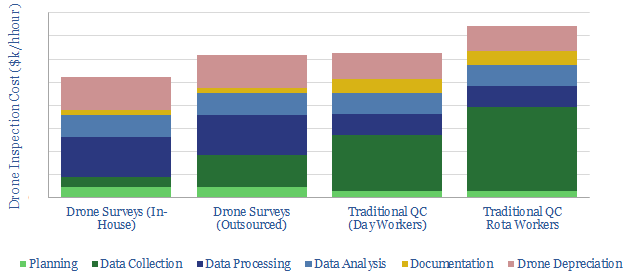

Inspection costs: drones versus traditional quality control?

This data-file estimates the costs of drone inspections, for the construction and resources industries, using bottom-up numbers from technical papers. Costs per hour can be 30% lower than for traditional quality control. A single drone, including software licenses likely costs c$30k.

-

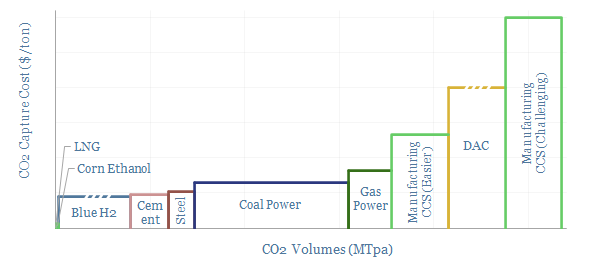

CO2 capture: a cost curve?

This data-file summarizes the costs of capturing CO2. The lowest-cost options are to access pure CO2 streams that are simply being vented at present. Next are blue hydrogen, steel and cement, which could each have GTpa scale. Power stations place next, at $60-100/ton. DAC is carbon negative but expensive.

-

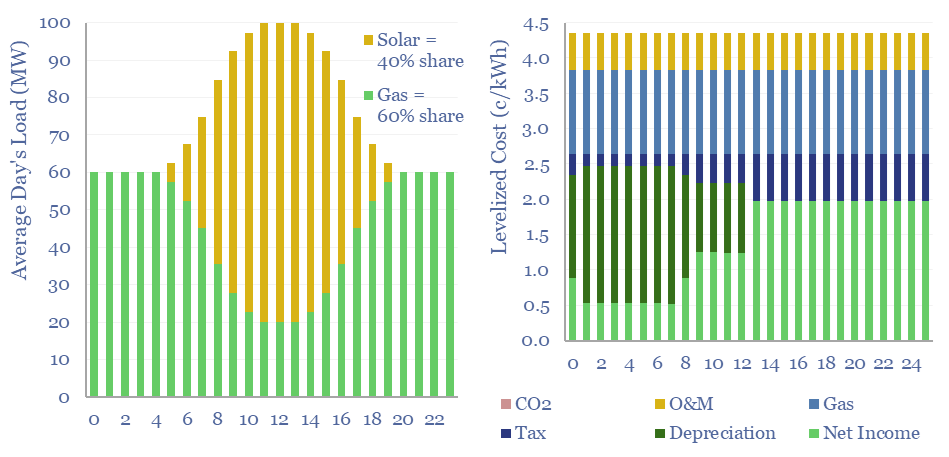

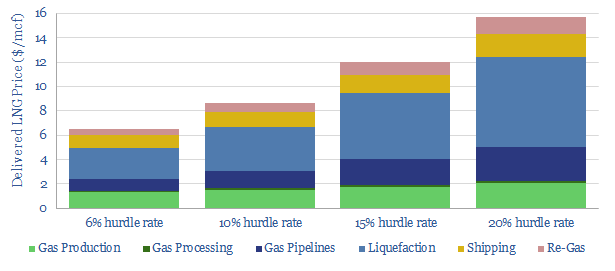

Renewables+gas LCOEs versus standalone gas turbines?

Levelized costs of electricity depend as much on the system being electrified as the energy sources used to electrify it. This data-file captures solar+gas LCOEs (in c/kWh), when meeting different load profiles, as a function of solar capex (in $/kW), gas prices (in $/mcf), and the relative utilization of solar vs gas.

-

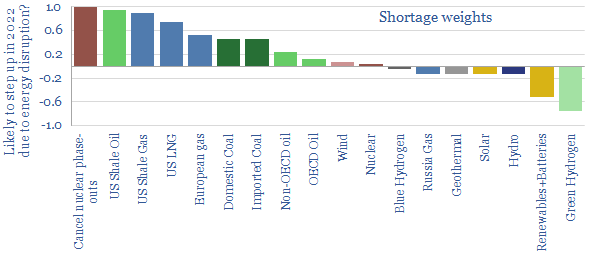

End game: options to cure energy shortages?

This note considers five options to cure emerging gas and power shortages. Unfortunately, the options are mostly absurd. They point to inflation, industrial leakage and slipping global climate goals. But also opportunities in LNG, nuclear and efficiency technologies.

-

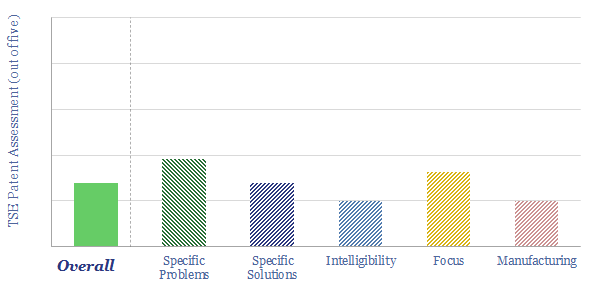

Aspen Aerogels: insulation breakthrough?

Aerogels have thermal conductivities that are 50-80% below conventional insulators. Target markets include preventing thermal runaway in electric vehicle batteries and cryogenic industrial processes (e.g., LNG). This data-file notes some challenges, using our usual patent review framework.

-

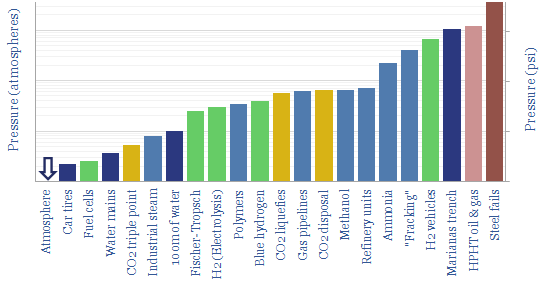

Pressure ratings: industrial and energy processes?

The purpose of this data-file is to chart the typical pressures of industrial processes and energy processes, as a useful reference. We are all used to 1 atmosphere of pressure, which is 1.0125 bar, 0.10125 MPa and 14.7 psi. But what pressures do industrial processes use?

-

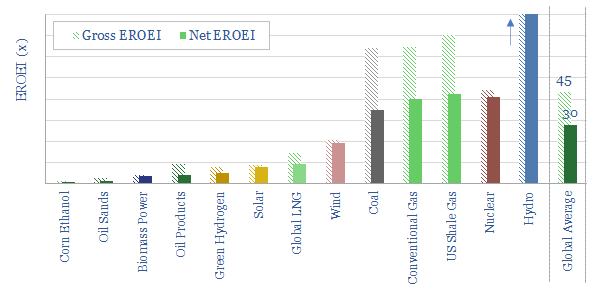

Energy return on energy invested?

Global average EROEI is around 30x. Sources with EROEI above average are hydro, nuclear, natural gas and coal. Sources with middling EROEIs of 10-20x are solar, wind and LNG. Sources with weaker EROEIs are oil products, green hydrogen and some biofuels.

-

Russia conflict: pain and suffering?

This 13-page note presents 10 hypotheses on Russia’s horrific conflict. Energy supplies will very likely get disrupted, as Putin no longer needs to break the will of Ukraine, but also the West. Results include energy rationing and economic pain. Climate goals get shelved during the war-time scramble. Pragmatism, nuclear and LNG emerge from the ashes.

-

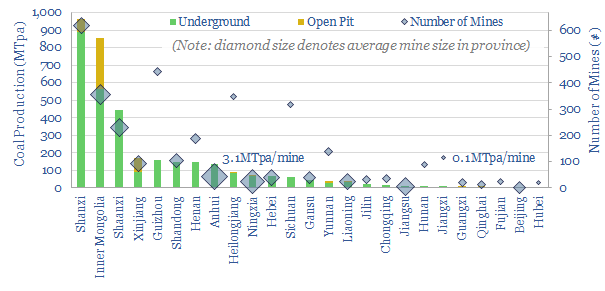

All the coal in China: our top ten charts?

Chinese coal provides 15% of the world’s energy, equivalent to 4 Saudi Arabia’s worth of oil. Global energy markets may become 10% under-supplied if this output plateaus per our ‘net zero’ scenario. Alternatively, might China ramp its coal, especially as Europe bids harder for renewables and LNG post-Russia? This note presents our ‘top ten’ charts.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)