Search results for: “climate model”

-

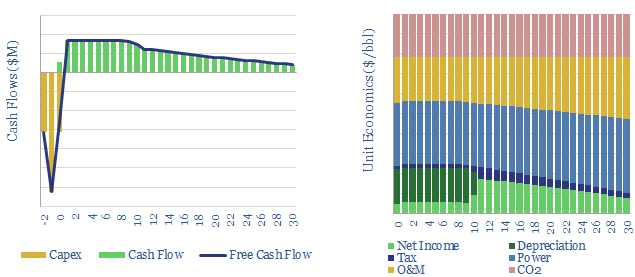

Power-to-liquids: the economics?

Liquid transport fuels with almost no CO2 emissions could be created from renewable energy, by electrolysing water and CO2, then combining the hydrogen and CO, e.g., via Fischer Tropsch. This simple models stress tests the economics. Our base case estimates are for costs between $400-600/bbl ($10-14/gallon).

-

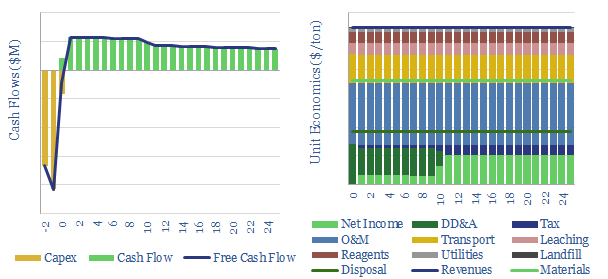

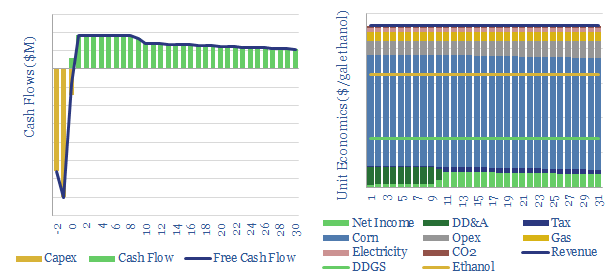

Ethanol from corn: the economics?

This data-file captures the economics of producing ethanol from corn. Our base case requires a price of $1.6/gallon of ethanol for a 10% IRR on a new greenfield plant, equivalent to $2.4/gallon gasoline. 40% of the US corn crop is diverted into biofuels, but the rationale is marginal.

-

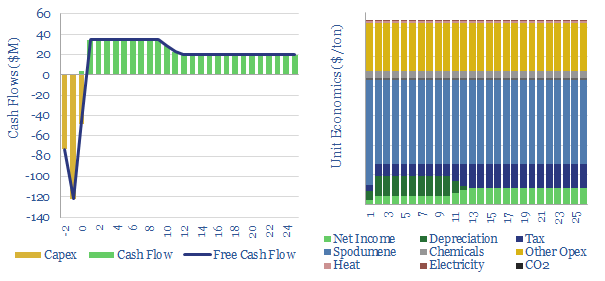

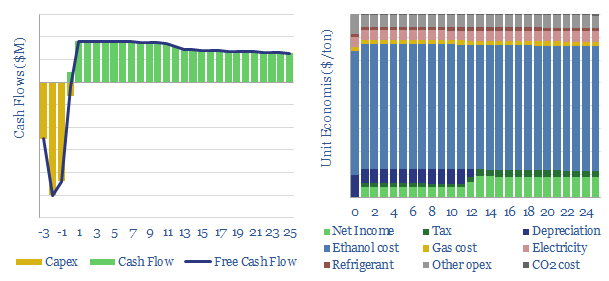

Ethanol-to-ethylene: the economics?

This data-file captures the economics of producing bio-ethylene by dehydration of ethanol. We estimate an ethylene price of $1,600/Tpa is required for a 10% IRR, which is almost 2x higher than a conventional ethane cracker. In a best case scenario, costs could fall below $1,000/ton.

-

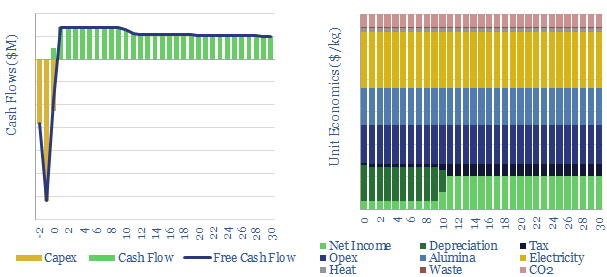

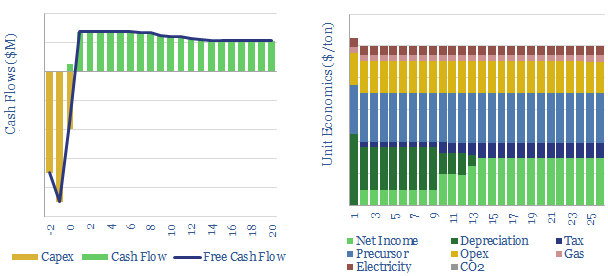

Carbon fiber: energy economics?

Carbon fiber production costs are estimated at $25/kg in this data-file, in order to generate a 10% IRR at a new world-scale carbon fiber plant. Energy economics are broken down across the value chain. The production process will likely emit 30 tons of CO2 per ton of carbon fiber if powered by a mixture of…

-

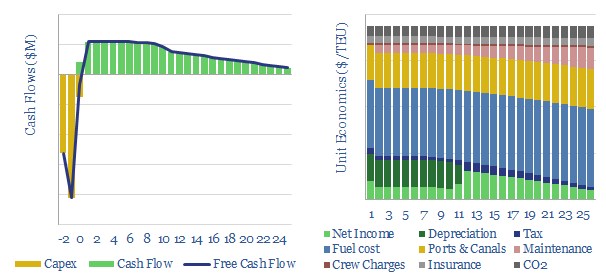

Container freight: shipping economics?

This data-file models the total costs of shipping a container c10,000 nautical miles from China to the West, in a 20,000 TEU vessel. Emerging fuels can lower the CO2 intensity of shipping from their baseline of 0.15kg/TEU-mile, by 60-90%, but freight costs inflate by 30%-3x.

-

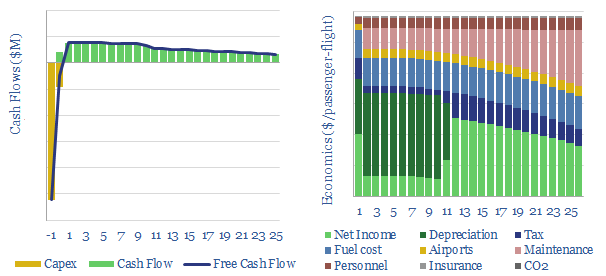

Commercial aviation: air travel economics?

This data-file estimates the economics of a passenger jet, over the course of its life: i.e., what ticket price must be charged to earn a 10% IRR after covering the capex costs of the plane, fuel costs, crew, maintenance and airport and air traffic charges. Decarbonization is challenging.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)