Search results for: “direct air capture”

-

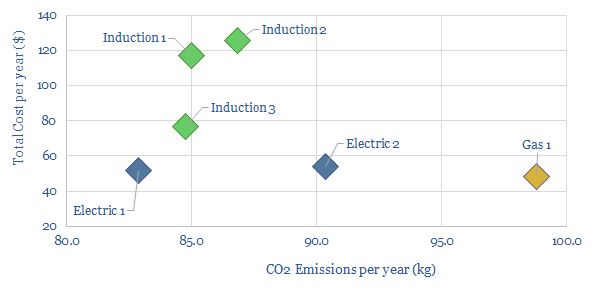

Cost and CO2 intensity of home cooking technologies?

The most important determinant of cooking’s CO2 intensity is consumer behaviour. At today’s energy costs and grid mix, gas-fired cooking yields the lowest costs. Sometimes electrification of cooking will decrease CO2 and sometimes not. Electric induction is most efficient, but 2-3x more expensive than gas and electric hobs.

-

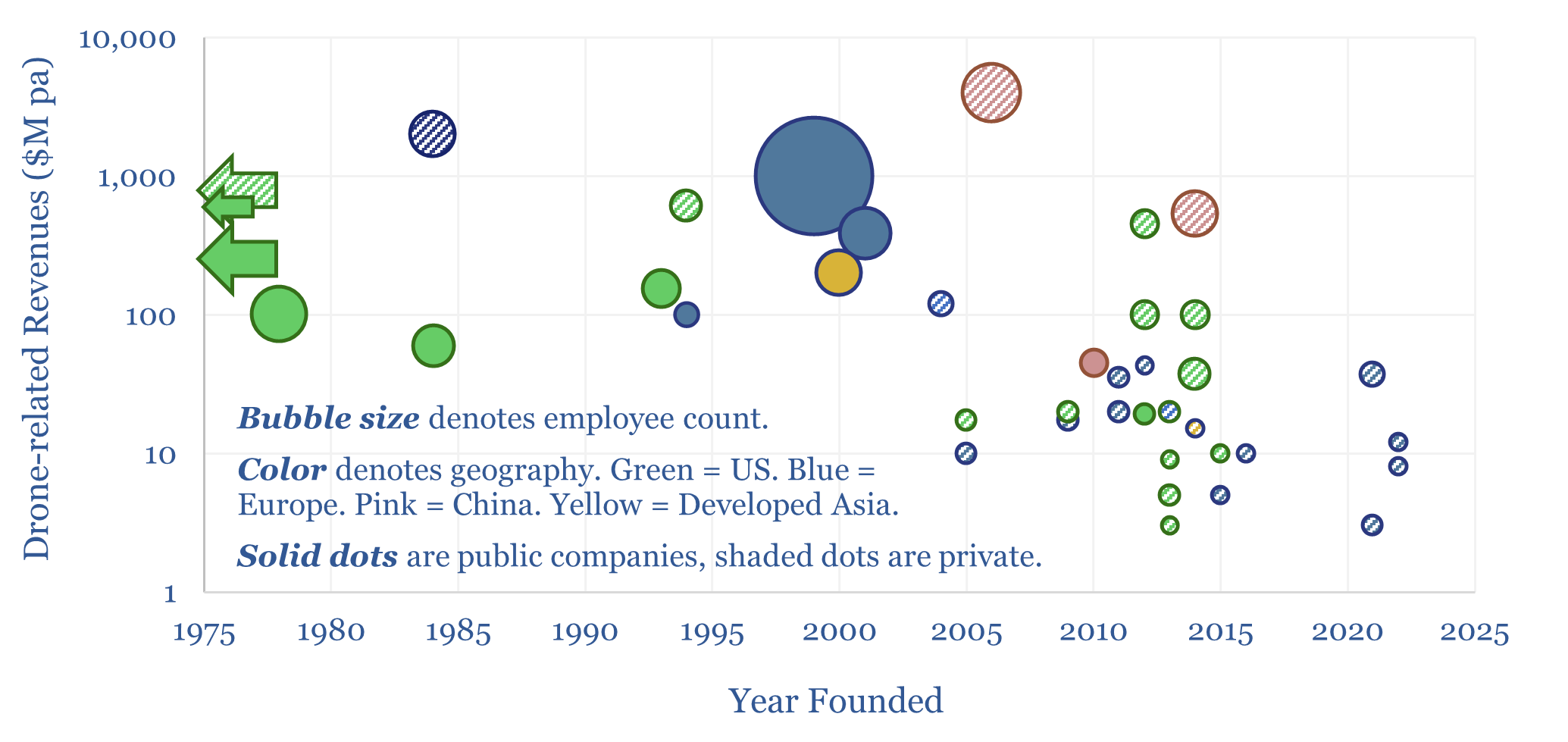

Drone companies: OEMs, inspection, defense and delivery?

This data-file is a screen of 40 leading drone companies, which either manufacturing drones for consumer, commercial and defense purposes; offer drone inspection services; or offer drone delivery services. It is a vibrant landscape, with over half of the companies founded after 2010, worth c$40bn pa, and creating c$120bn pa of economic benefits.

-

Origin Materials: bio-plastics breakthrough?

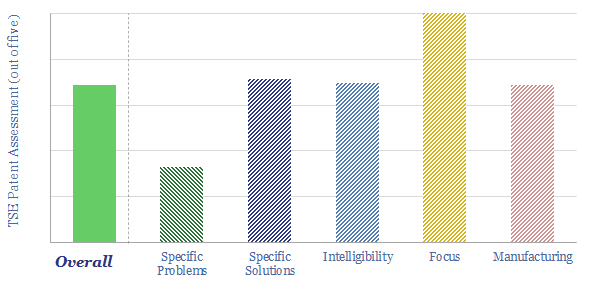

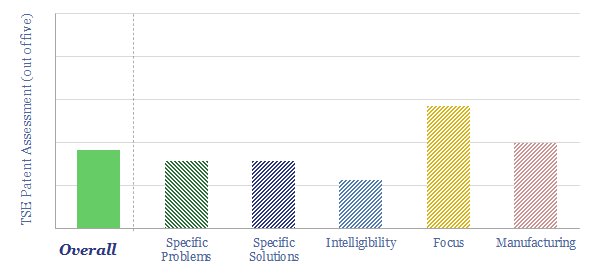

Origin Materials went public via SPAC in February-2021, as it was acquired by Artius Acquisition Inc at a valuation of $1.8bn. Its ambition is to use wood residues to create carbon-negative plastics, cost-competitively with petroleum products. This data-file outlines our conclusions from reviewing patents.

-

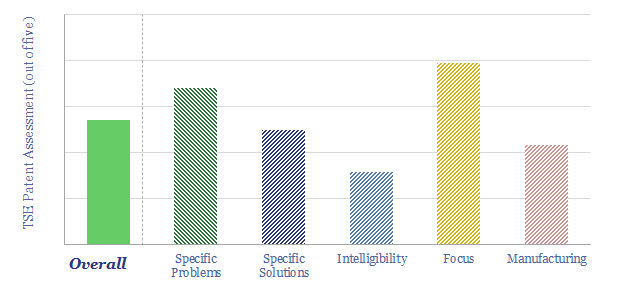

LanzaTech: biofuels breakthrough?

LanzaTech aspires to “take waste carbon emissions and convert them” into sustainable fuels (and bio-plastics) with a >70% CO2 reduction. We have assessed its patents but concluded we cannot yet de-risk the CO2-to-fuels pathway in our energy transition models.

-

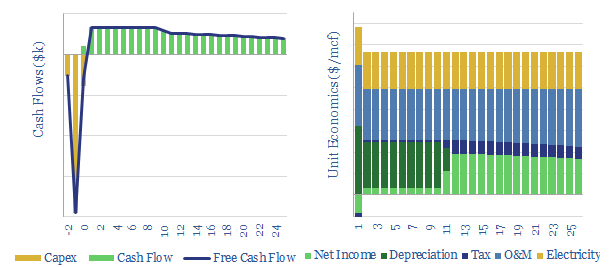

Landfill gas: the economics?

We estimate that a typical landfill facility may be able to capture and abate 70% of its methane leaks for a CO2-equivalent cost of $5/ton. Other landfill gas pathways get more complex and expensive. Raw and unprocessed landfill gas can be economical to commercialize at a cost of $2-4/mcfe.

-

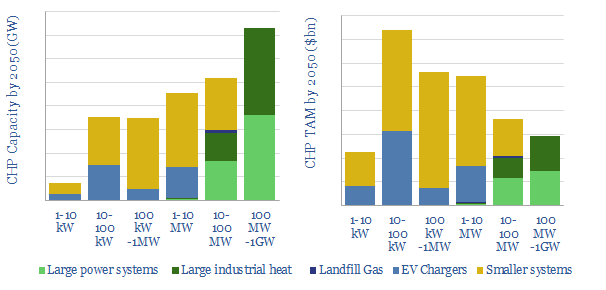

Gas turbines: what market size in energy transition?

CHP systems are 20-30% lower-carbon than gas turbines, as they capture waste heat. They are also increasingly economical to backstop renewables. Amidst uncertain policies, the market size for US CHPs could vary by a factor of 100x. We nevertheless find 30 companies well-placed in a $9trn global market.

-

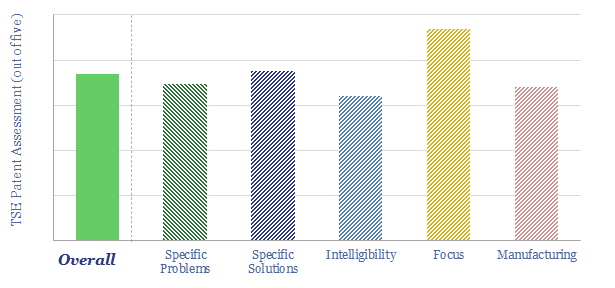

Carbon Clean: CCS breakthrough?

Carbon Clean is a CCS company. It has already captured over 1MT, across 38 facilities. But in addition, it is developing a next-generation design, which could ultimately lower cost to $30-40/ton. Our review finds a very decent, albeit concentrated patent library, following our usual framework.

-

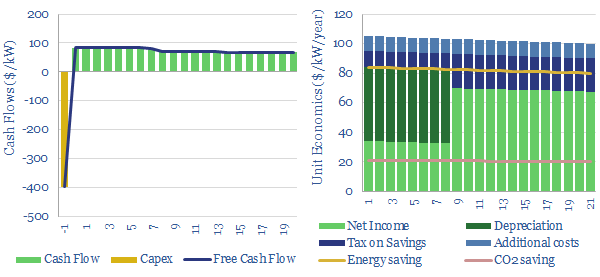

Variable frequency drives: the economics?

Variable frequency drives optimize the operating speeds of electric motors. Average energy saving are 34% and average costs are $250/kW. Hence our modelling calculates >15% IRRs installing a VFD at a typical industrial motor. This data-file captures the economics.

-

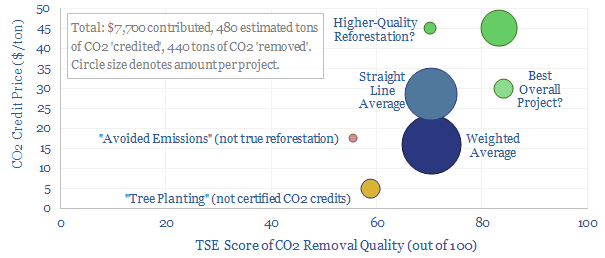

Nature based solutions: CO2 removals in 2022?

Is the nascent market for nature-based carbon offsets working? We appraised five projects in 2022, and contributed $7,700 to capture 440 tons of CO2, which is 20x our own CO2 footprint. This 11-page note presents our top five conclusions. Today’s market lacks depth and efficiency. High-quality credits are most bottlenecked. Prices rise further in 2023.…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (355)