Renewable-heavy grids: dividing the pie?

…natural gas is going to emerge as the most pragmatic and cost-effective backstop for the volatility in renewable-heavy grids. Hence gas is going to ‘surprise’ by entrenching at a 30-50%…

…natural gas is going to emerge as the most pragmatic and cost-effective backstop for the volatility in renewable-heavy grids. Hence gas is going to ‘surprise’ by entrenching at a 30-50%…

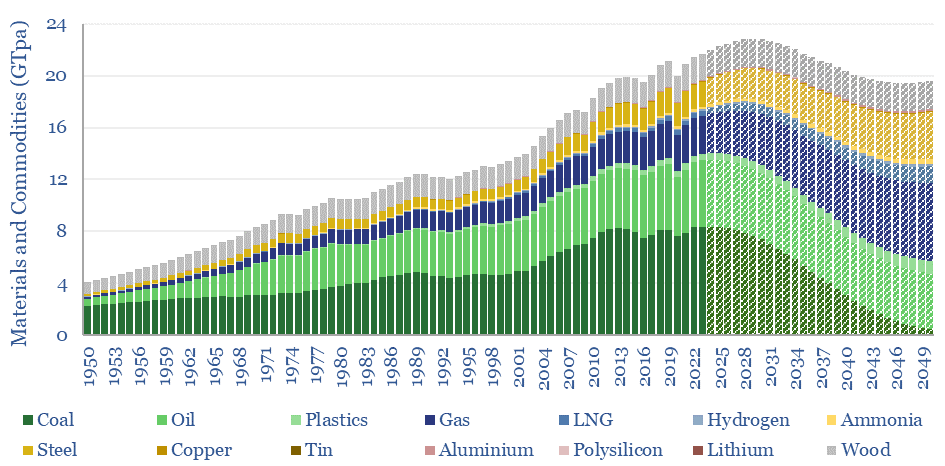

…is historically unprecedented. And our plateau in tonnage terms is a doubling in value terms, a kingmaker for gas, plastics and materials. 30 major commodities are reviewed. $599.00 – Purchase Checkout Added…

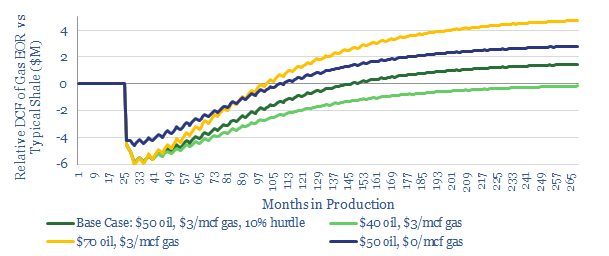

This model assesses the economics of a shale-EOR huff’n’puff project. NPVs and IRRs can be stress-tested as a function of oil prices, gas prices, production-profiles, EUR uplifts and capex costs….

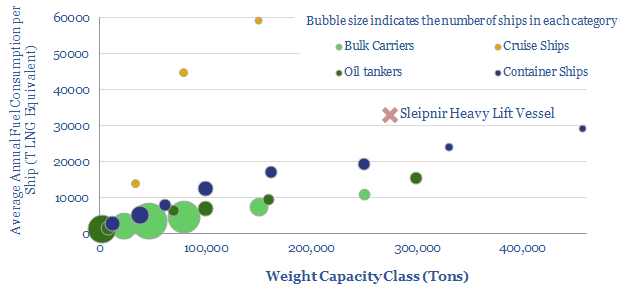

…Leviathan gas field, and progressing on to Johan Sverdrup Phase II. Sleipnir is a record-setting LNG vessel, burning gas as its primary fuel (although it can also burn diesel). With…

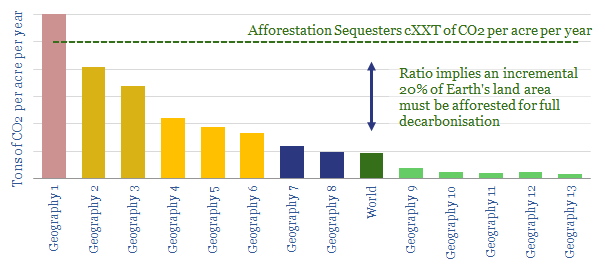

…increasing albedo, and warming the planet mildly. Trees can also release compounds called isoprenes, which reacts with nitrogen oxides in the air to form ozone (a greenhouse gas), while lengthening…

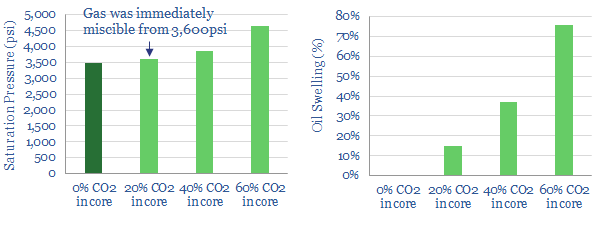

…CO2, methane and field gas. Under simulated reservoir conditions, around 3,600psi, bubbles of CO2 immediately began dissolving into the oil, helping to mobilise it. (2) CO2 swelled the oil by…

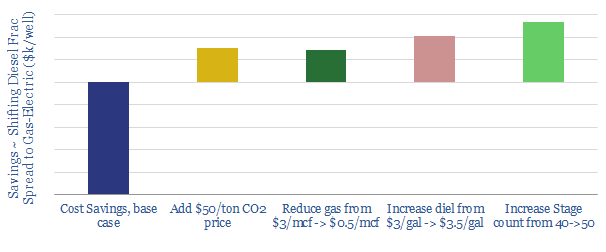

In 2019, the virtues of switching diesel-powered frac fleets to gas-powered electric have been extolled by companies such as EOG, Shell, Baker Hughes, Halliburton, Evolution and US Well Services. The…

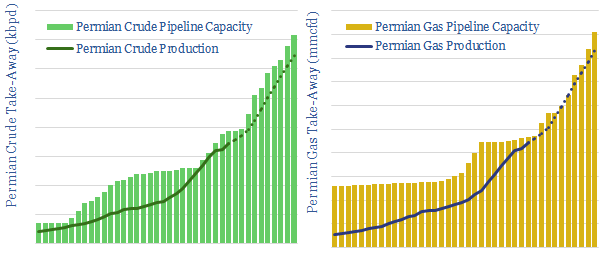

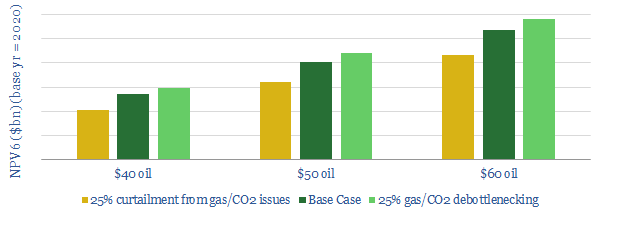

This data-file tracks c50 oil and gas pipelines in the Permian basin — their route, their capacity and their construction progress — in order to assess the severity of pipeline…

…capacity, development timing and recent news. We also compare the FPSOs’ gas-handling capacity with regional pipeline capacity. There will only be room to monetize one-third of the pre-salt’s produced gas…

The super-giant Mero field in pre-salt Brazil is not like its predecessors. While prolific, it has a 2x higher gas cut, of which c45% is corrosive and environmentally unpalatable CO2….