Search results for: “gas”

-

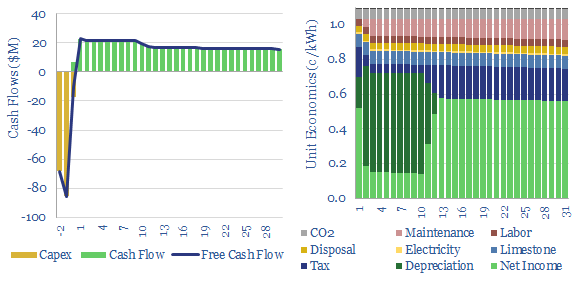

Flue gas desulfurization: costs of SO2 scrubbers?

This data-file captures the costs of flue gas desulfurization, specifically the costs of SO2 scrubbers, used to remove SO2 from the exhaust of coal- or distillate- fueled boilers and burners. We think a typical scrubber will remove 95% of the SO2 from the flue gas, but requires a >1c/kWh surcharge on electricity sales in order…

-

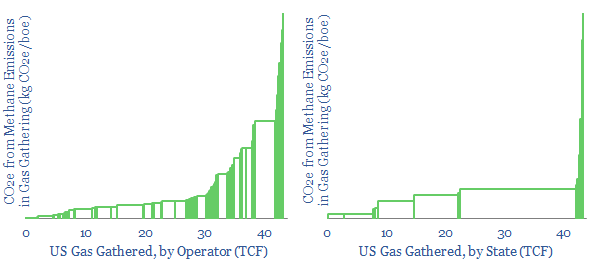

Gas Gathering: how much CO2 and Methane?

Gas gathering and gas processing are 50% less CO2 intensive than oil refining. Nevertheless, these processes emitted 18kg of CO2e per boe in 2018. Methane matters most, explaining 1-7kg/boe of gas industry CO2-equivalents. This data-file assesses 850 US gas gathering and processing facilities, to screen for leaders and laggards, by geography and by operator.

-

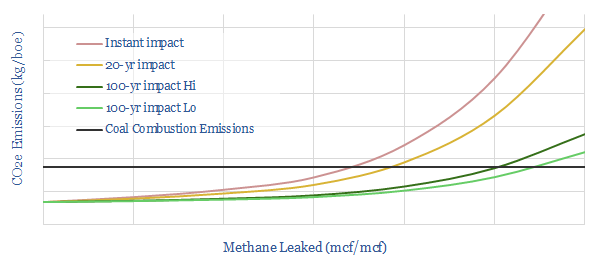

Methane emissions detract from natural gas?

With methane emissions fully controlled, burning gas is c60% lower-CO2 than burning coal. However, taking natural gas to cause 120x more warming than CO2 over a short timeframe, the crossover (where coal emissions and gas emissions are equivalent) is 4% methane intensity. The gas industry must work to mitigate methane.

-

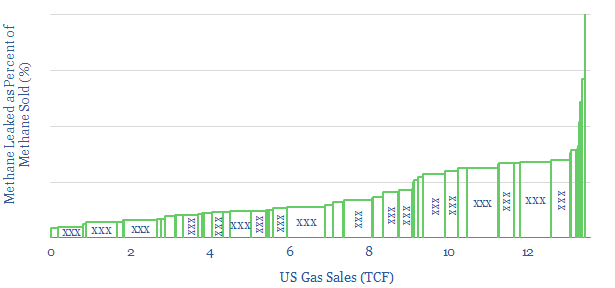

Methane Leaks from Downstream Gas Distribution

Methane leakages average 0.2% when distributing natural gas to end-customers, across the US’s 160 retail gas networks. Leakages are most correlated with the share of sales to smaller customers. 80 distinct gas companies are ranked in this data-file. State-owned utilities appear to have 2x higher leakage rates versus public companies.

-

Gas pipelines, CO2 pipelines, hydrogen pipelines?

This model captures the energy economics of a pipeline carrying natural gas, CO2 or hydrogen. It computes the required throughput tariff (in $/mcf or $/kg) to earn a 10% IRR. Hydrogen tariffs must be 2x new gas pipelines and 10x pre-existing gas pipelines. CO2 disposal is more economic at scale.

-

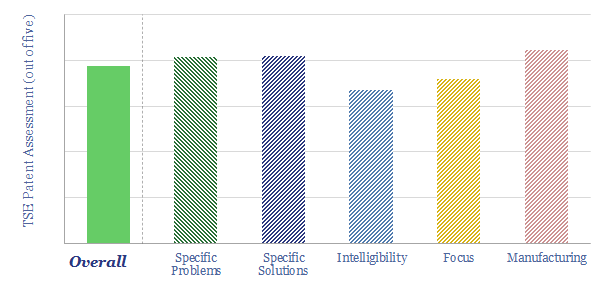

NET Power: gas-fired power with inherent CO2 capture?

Our NET Power technology review shows over ten years of progress, refining the design of efficient power generation cycles using CO2 as the working fluid. The patents show a moat around several aspects of the technology. And six challenges at varying stages of de-risking.

-

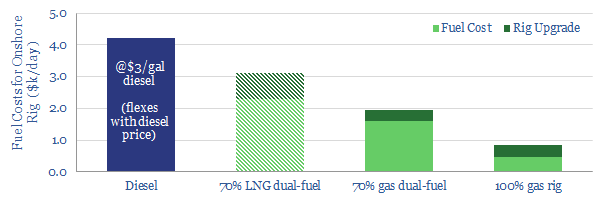

Should a shale rig switch to gas-fuel?

Should a shale rig switch to gas-fuel? We estimate that a dual-fuel shale rig, running on in-basin natural gas would save $2,300/day (or c$30k/well), compared to a typical diesel rig. This is after a >20% IRR on the rig’s upgrade costs. The economics make sense. However, converting the entire Permian rig count to run on…

-

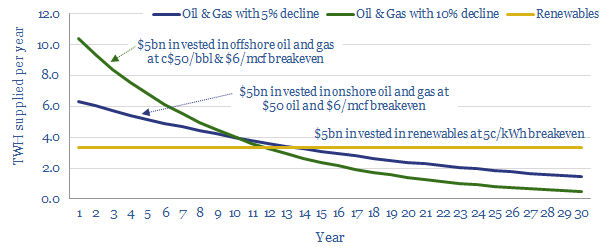

Production profiles: renewables vs oil and gas?

Further deflation of c50-70% is required before the world can truly “re-allocate” capital from fossil fuels to renewables, without causing near-term shortages. This is because fossil fuels’ production profiles are 2-3x more front-end loaded; despite comparable costs, breakevens and resource sizes. It is still necessary to attract adequate capital for both supply sources.

-

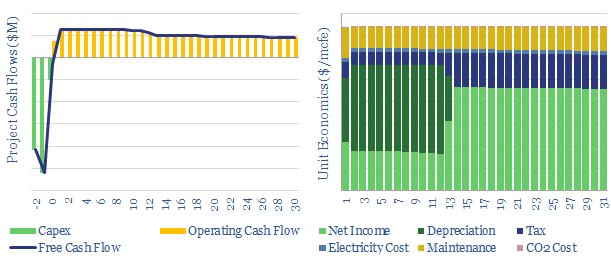

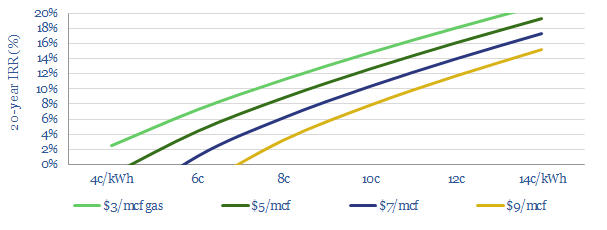

Oxycombustion: economics of zero-carbon gas?

Oxy-combustion is a next-generation power technology, burning fossil fuels in an inert atmosphere of CO2 and oxygen. It is easy to sequester CO2 from its exhaust gases, helping heat and power to decarbonise. We argue that IRRs can be competitive with conventional gas-fired power plants.

-

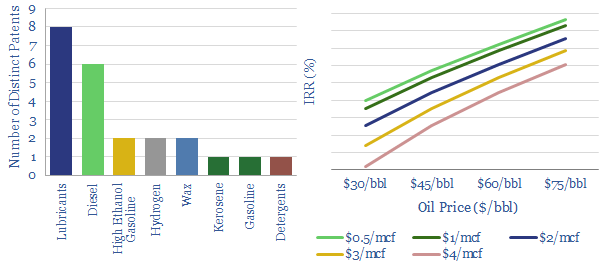

US Shale Gas to Liquids?

Shell filed 42 distinct new patents around GTL in 2018. This data-file reviews them, showing how the broad array of GTL products confers defensiveness and downstream portfolio benefits. Hence, we have modeled the economics of “replicating” Pearl GTL in Texas. Our base case is a 11% IRR taking in 1.6bcfd of stranded gas from the…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (355)