Search results for: “gas”

-

Carbon Funds to Decarbonize Natural Gas

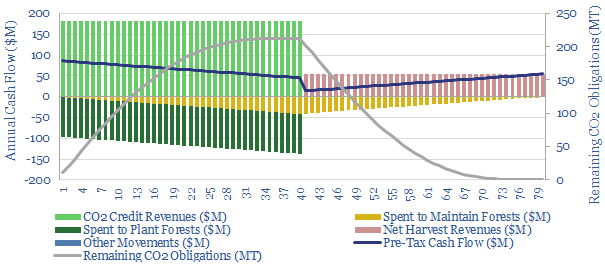

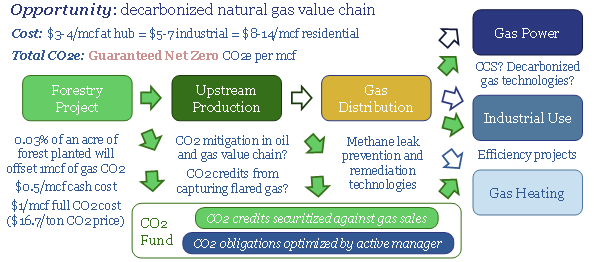

Natural gas can be decarbonized for a $1/mcf premium, which is used to seed new forests. Attractive cash flows and economics are modelled here. c50% of the carbon premia are dedicated to a carbon fund. It guarantees future CO2 obligations, optimizes emissions reductions, and finally disburses remaining funds.

-

How to structure a decarbonized gas value chain?

Gas value chains are the largest and lowest cost decarbonization opportunity on the planet, commercialising zero carbon energy for an incremental cost below $1/mcfe ($17/ton of CO2). This compares with end gas prices of $4-14/mcf and other CO2 mitigation options up to $800/ton. This 15-page note outlines how to structure a decarbonized gas value chain,…

-

Gas diffusion: how will record prices resolve?

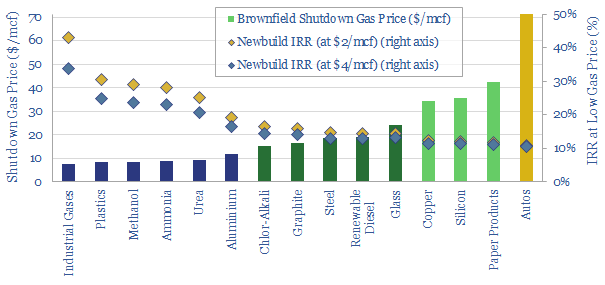

Dispersion in global gas prices has hit new highs in 2022. Hence this 17-page note evaluates two possible solutions. Building more LNG plants achieves 15-20% IRRs. But shuttering some of Europe’s gas-consuming industry then re-locating it in gas-rich countries can achieve 20-40% IRRs, lower net CO2 and lower risk? Both solutions should step up. What…

-

Global gas: five predictions through 2030?

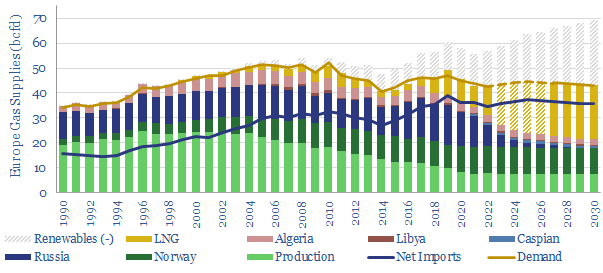

Modelling Europe’s gas balances currently feels like grasping at straws. Yet this 10-page note makes five predictions through 2030. We have revised our views on how fast new energies ramp, which gas gets displaced first, which energy sources are no longer ‘in the firing line’, and gas pricing.

-

Entropy CCS: natural gas CCS breakthrough?

Advantage is a Montney gas producer, which recently sourced a $300M investment from Brookfield to scale up its Entropy23 amine blend for natural-gas CCS. Entropy has captured 90-93% of the CO2 at the first pilot plant at Glacier, Alberta, with 2.4 GJ/ton reboiler duty, 40% below MEA. This 7-page report confirms a moat around the…

-

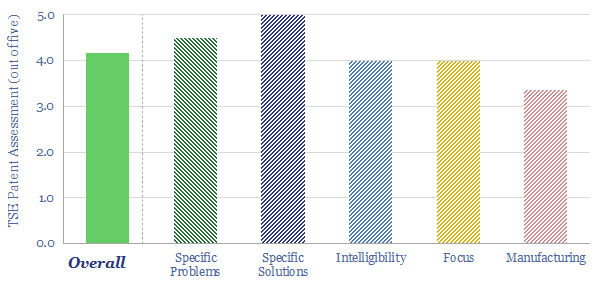

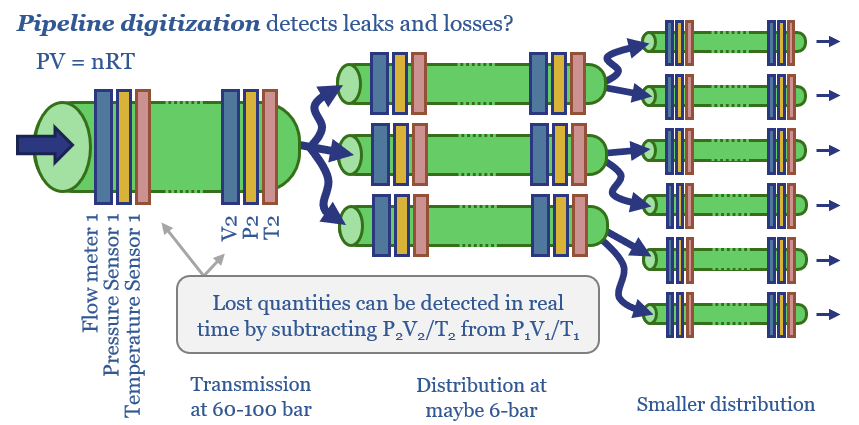

Seeing sense: digitize the downstream gas network?

Greater digitization of gas networks looks increasingly important, as gas, biogas, hydrogen and CCS all aim to shore up their futures. This 15-page note started as a deep-dive into the true leakage rates in downstream gas; and ended up finding opportunities in sensors and pipeline monitoring.

-

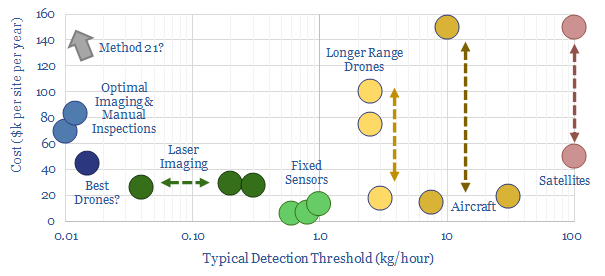

Global gas: catch methane if you can?

Scaling up natural gas is the largest decarbonisation opportunity on the planet. But this requires minimising methane leaks. Exciting new technologies are emerging. This note ranks producers, positions for new policies and advocates developing more LNG. To seize the opportunity, we also identify early-stage companies in methane measurement and mature public companies in the oilfield…

-

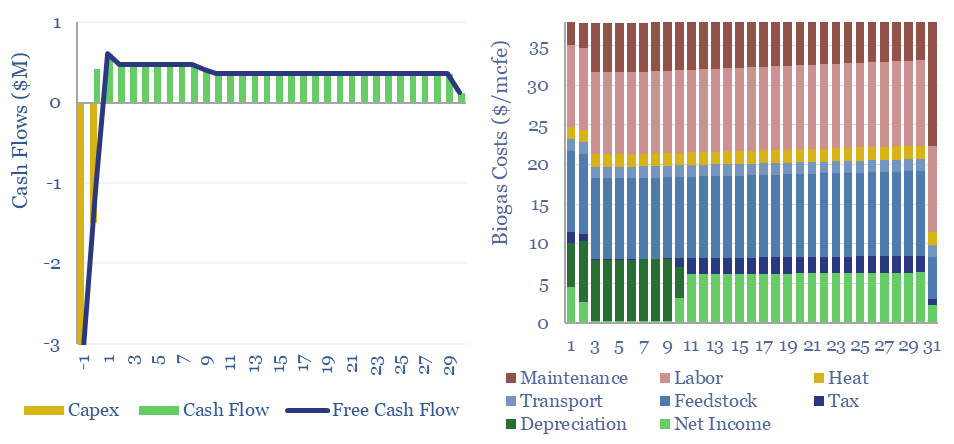

Biogas: the economics?

Biogas costs are broken down in this economic model, generating a 10% IRR off $180M/kboed capex, via a mixture of $16/mcfe gas sales, $60/ton waste disposal fees and $50/ton CO2 prices. High gas prices and landfill taxes can make biogas economical in select geographies. Although diseconomies of scale reward smaller projects?

-

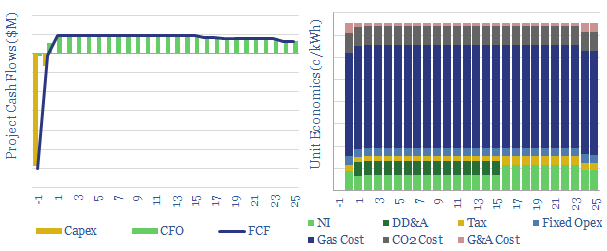

Turbo-charge gas turbines: the economics?

This data-file models the economics of turbo-charging gas turbines, which increases the mass flow of combustion air, to improve their power ratings by c10-20%. IRRs are solid. Turbo-charged gas turbines could thus gain greater share as grids become saturated with renewables

-

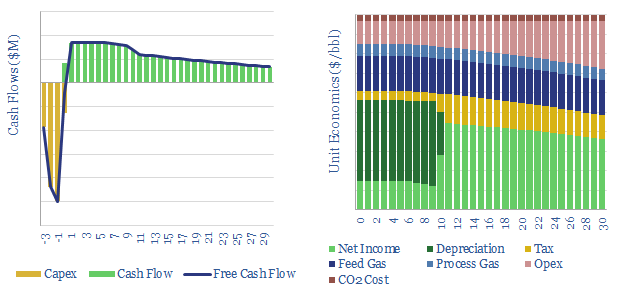

Gas-to-liquids: the economics?

This data-file captures the economics of gas-to-liquids via Fischer-Tropsch. Our base case requires $100/bbl realizations for a 10% IRR on a US project. You can stress-test the economics as a function of gas prices, capex costs, thermal efficiencies, et al, in the data-file.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (355)