Search results for: “shale”

-

US shale: our outlook in the energy transition?

This presentation covers our outlook for the US shale industry in the 2020s, and was presented at a recent investor conference. It covers the importance of shale oil supplies in balancing future oil markets, our outlook for 5% annual productivity growth, and the opportunity for carbon-neutrality to attract capital.

-

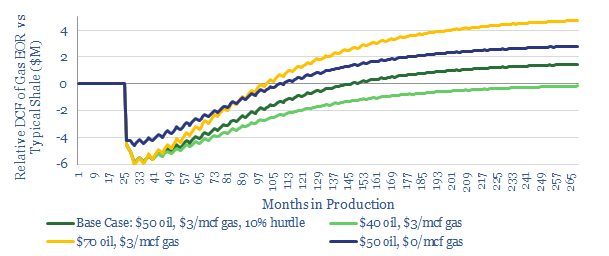

Shale EOR: the economics

This model assesses shale-EOR economics, as a function of oil prices, gas prices, production-profiles and capex costs. 15-20% IRRs are attainable in our base case. Economics are getting increasingly exciting, as the technology is de-risked and more gas is stranded in key shale basins.

-

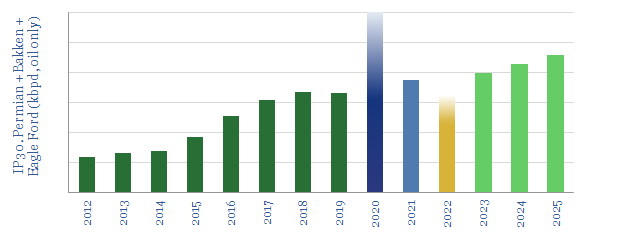

Shale EOR: Container Class

Is Shale-EOR the next wave of unconventional upside? The topic jumped into the ‘Top 10’ most researched shale themes last year. Stranded in-basin gas will improve the economics. Production per well can rise by 1.5-2x. The theme could add 2.5Mbpd to YE25 output.

-

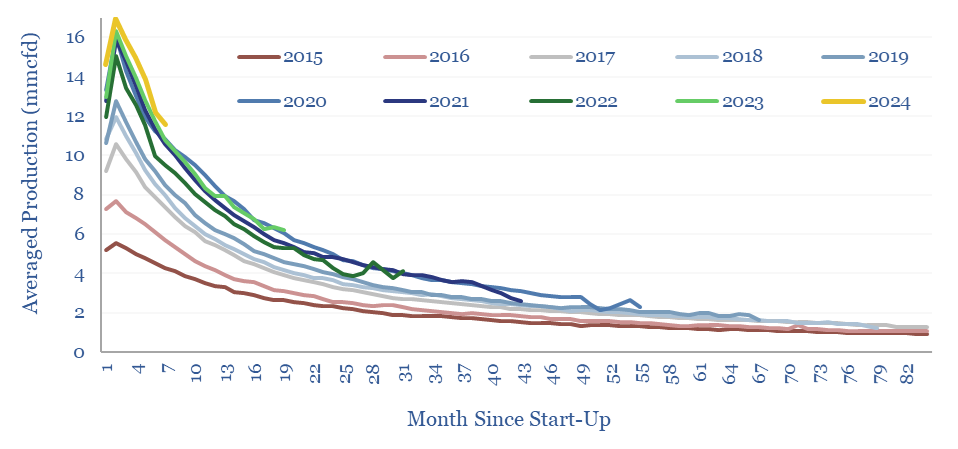

Marcellus shale: well by well production database?

This large data-file tracks activity, well-by-well, across c11,000 wells in the Pennsylvania Marcellus, month-by-month, from 2015-2021. First tier operators stand out, especially as the basin has consolidated. They achieve higher IP rates and have been able to do more with less.

-

The cutting edge of shale technology?

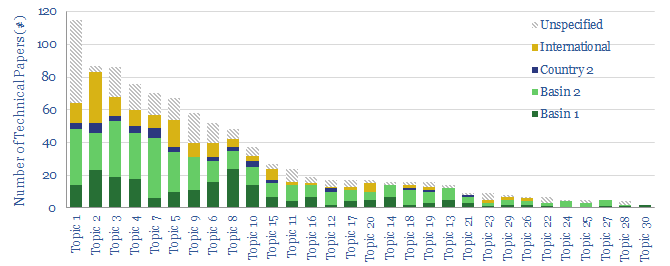

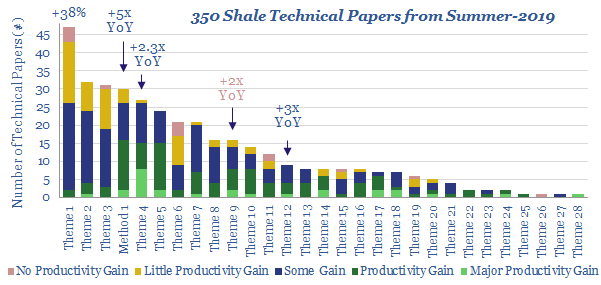

This data-file reviews 950 technical papers from the shale industry in 2018-2020, to identify the cutting edge of shale technology. The trends show an incredible uptick in completion design, frac fluids, EOR and machine learning. Each paper is summarized and categorized. The file also shows which companies and services have a technology edge.

-

Shale productivity: snakes and ladders?

Unprecedented high-grading is now occurring in the US shale industry, amidst challenging industry conditions. This means production surprising to the upside in 2020-21 and disappointing during the recovery. Our 7-page note explores the causes and consequences of the whipsaw effect.

-

DAS. At the cutting edge in shale?

This data-file summarises 25 of the most recent technical papers around the industry, using fiber-optic cables for Distributed Acoustic Sensing (DAS). The technology is now hitting critical mass to spur shale productivity upwards.

-

US Shale: No Country for Old Completion Designs

2019 has evoked resource fears in shale, after some E&Ps posted disappointing results, and implied productivity data fell 20% YoY, according to the EIA’s data. We find the data-issues are benign. They reflect changes to completion design, as a bottlenecked industry increased its use of cube development and flowback control. Underlying productivity continues improving at…

-

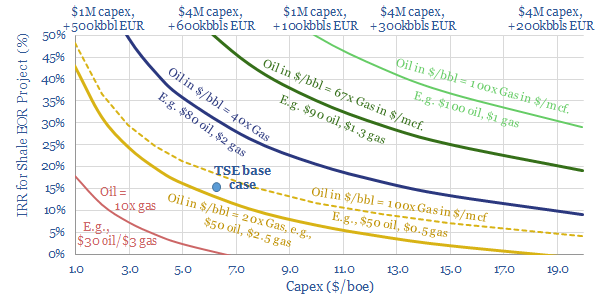

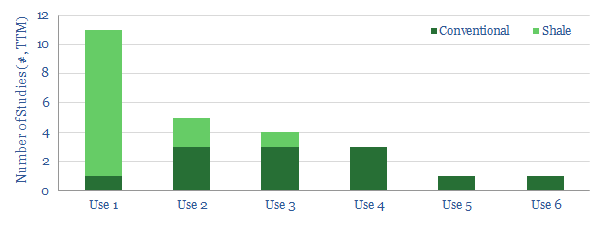

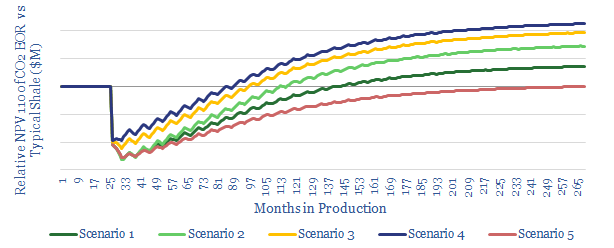

CO2-EOR in Shale: the economics

We model the economics for CO2-EOR in shales, after interest in this topic spiked 2.3x YoY in the 2019 technical literature. We see 15% IRRs in our base case, creating $1.6M of incremental value per well, uplifting type curves by 1.75x. Greater upside is readily possible. Most exciting is the prospect for Permian EOR to…

-

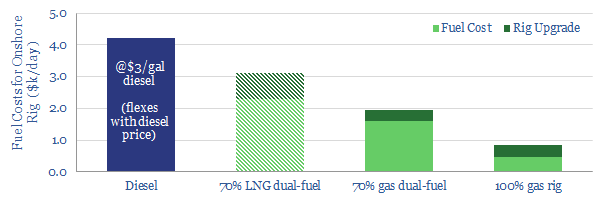

Should a shale rig switch to gas-fuel?

Should a shale rig switch to gas-fuel? We estimate that a dual-fuel shale rig, running on in-basin natural gas would save $2,300/day (or c$30k/well), compared to a typical diesel rig. This is after a >20% IRR on the rig’s upgrade costs. The economics make sense. However, converting the entire Permian rig count to run on…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)