Search results for: “small scale LNG”

-

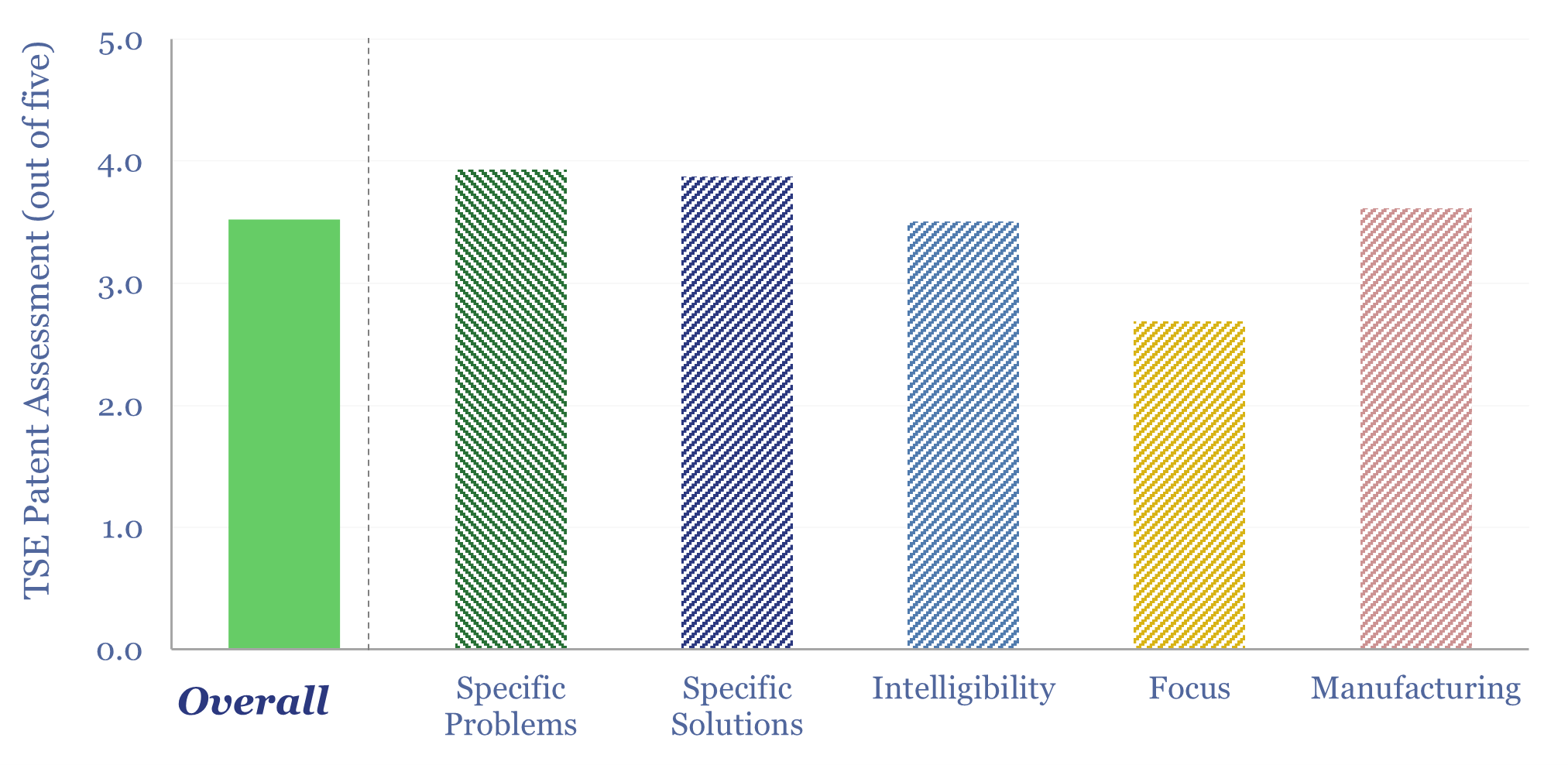

Kraken Technologies: smart grid breakthrough?

Kraken Technologies is an operating system, harnessing big data across the power value chain, from asset optimization, to grid balancing, to utility customer services. We reviewed ten patents, which all harness big data, of which 65% optimize aspects of the grid, and 40% are using AI. This supports the deployment of distributed energy, renewables and…

-

Microwave Chemical: electrical heating?

Microwave Chemical is a small-cap company, developing microwave-based heating solutions, across over a dozen use cases, from acrylic recyling, to producing food/cosmetic compounds, to carbon fiber (particularly interesting!). We reviewed a dozen of the company’s patents in this data-file, which is a Microwave Chemical technology review and finds a moat in efficient microwave heating.

-

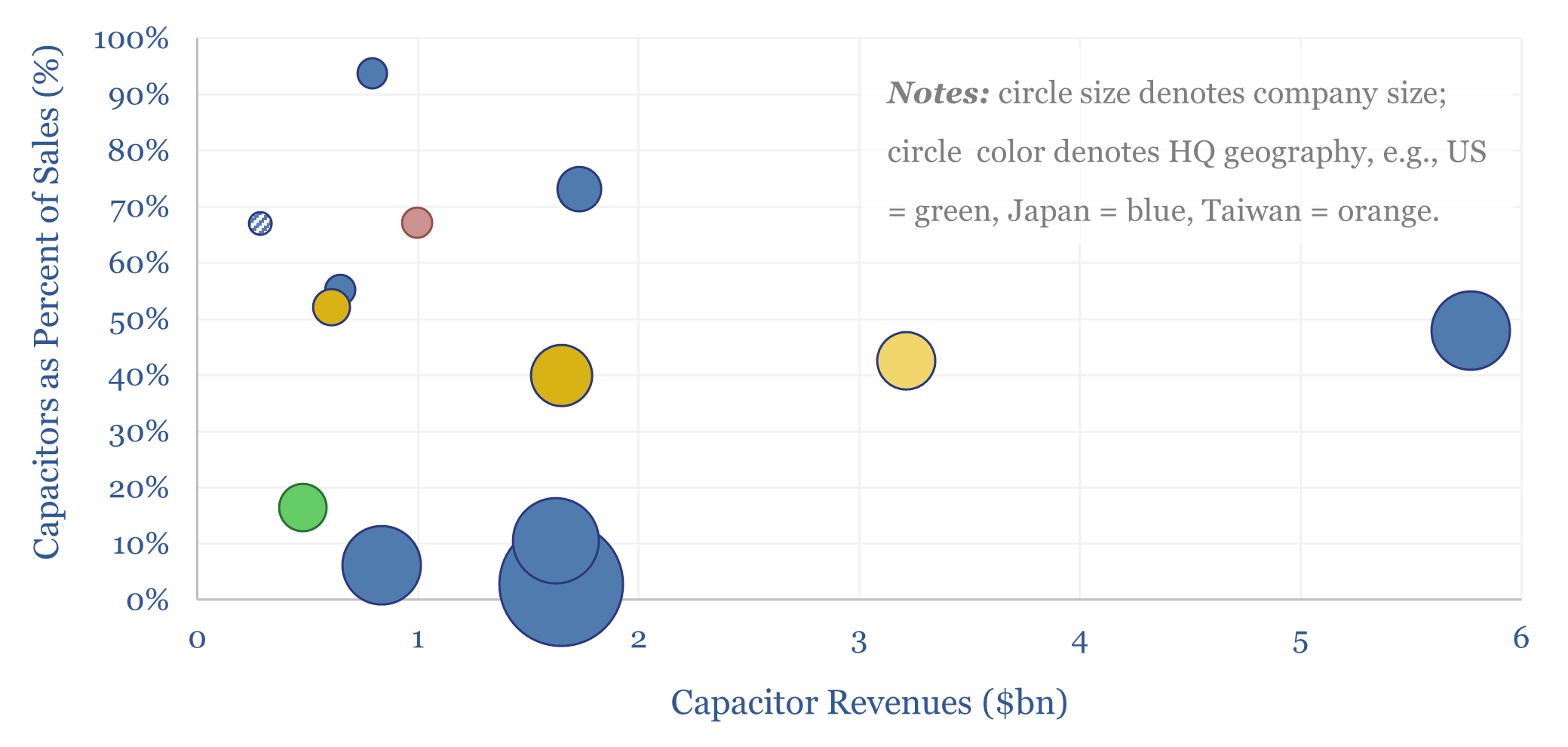

Capacitor market: leading companies?

This data-file profiles a dozen leading companies in capacitors, which control two-thirds of the $30bn pa global market. Many companies also produce other passive electronic components, sensors and MOSFETs. Hence will the rise of AI, especially transient-heavy data-centers, pull on demand?

-

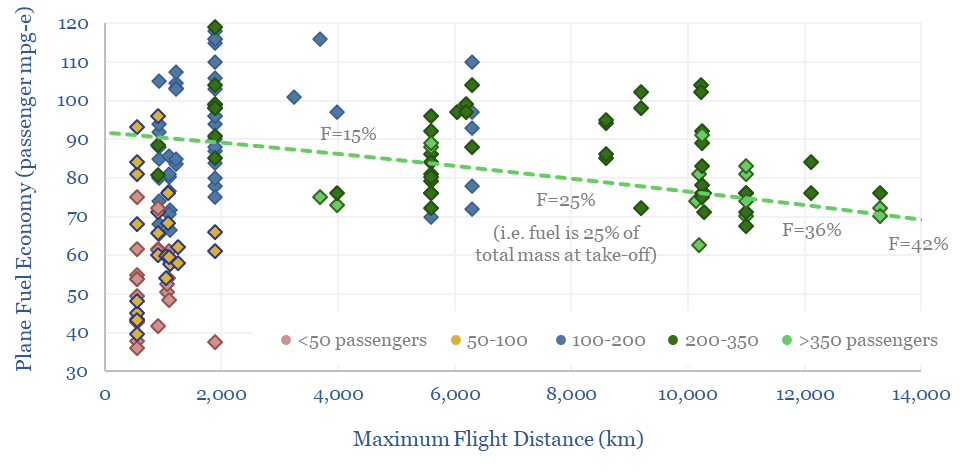

Commercial aviation: fuel economy of planes?

This data-file calculates the fuel economy of planes from first principles, using physics to calculate lift and drag, and comparing with actual data from aircraft manufacturers. The typical fuel economy of a plane is 80 passenger-mpg to carry 400 passengers, 8,000km at 900kmph, using jet fuel with 12,000 Wh/kg energy density. What sensitivities and decarbonization…

-

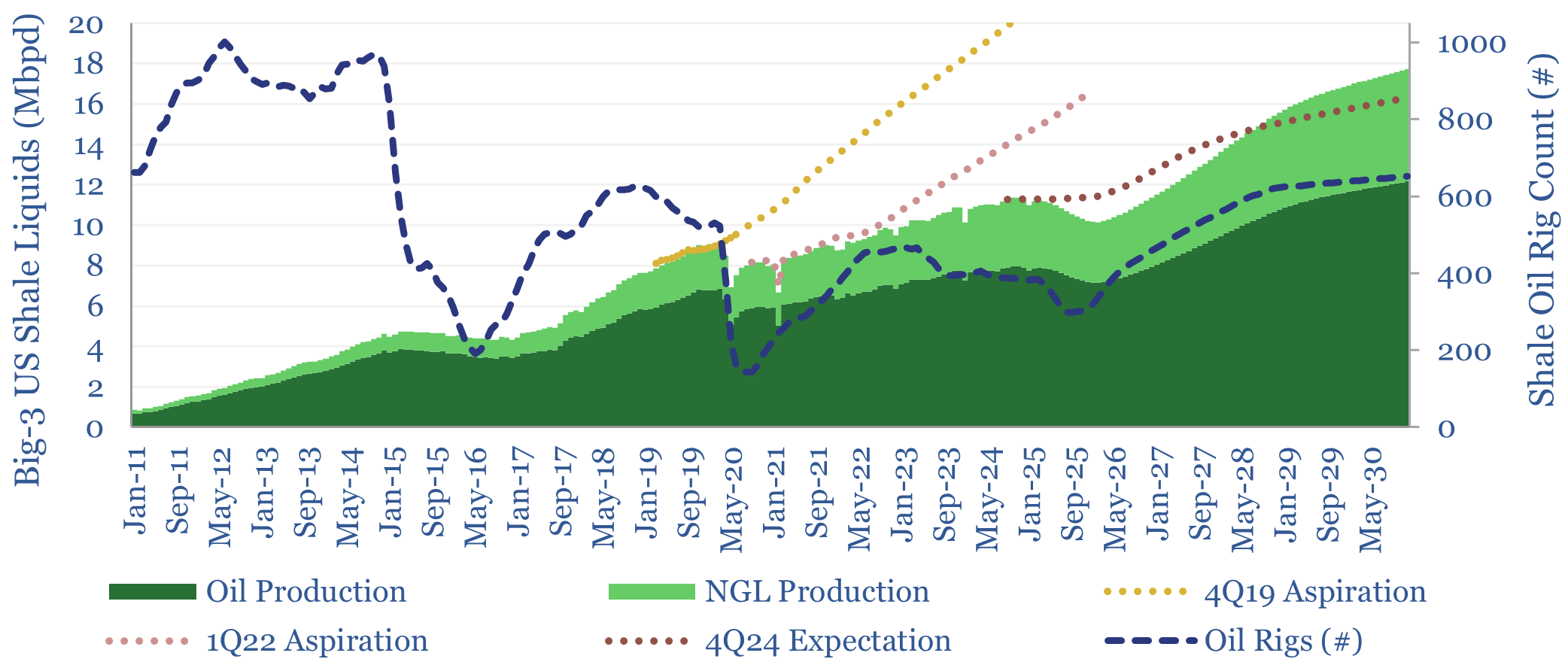

US shale: outlook and forecasts?

This model sets out our US shale production forecasts by basin. It covers the Permian, Bakken, Eagle Ford, Marcellus/Utica and Haynesville, as a function of the rig count, drilling productivity, completion rates, well productivity and type curves. The data-file was last updated in May-2025, revising liquids growth negative in 2025-26, which in turn tightens US…

-

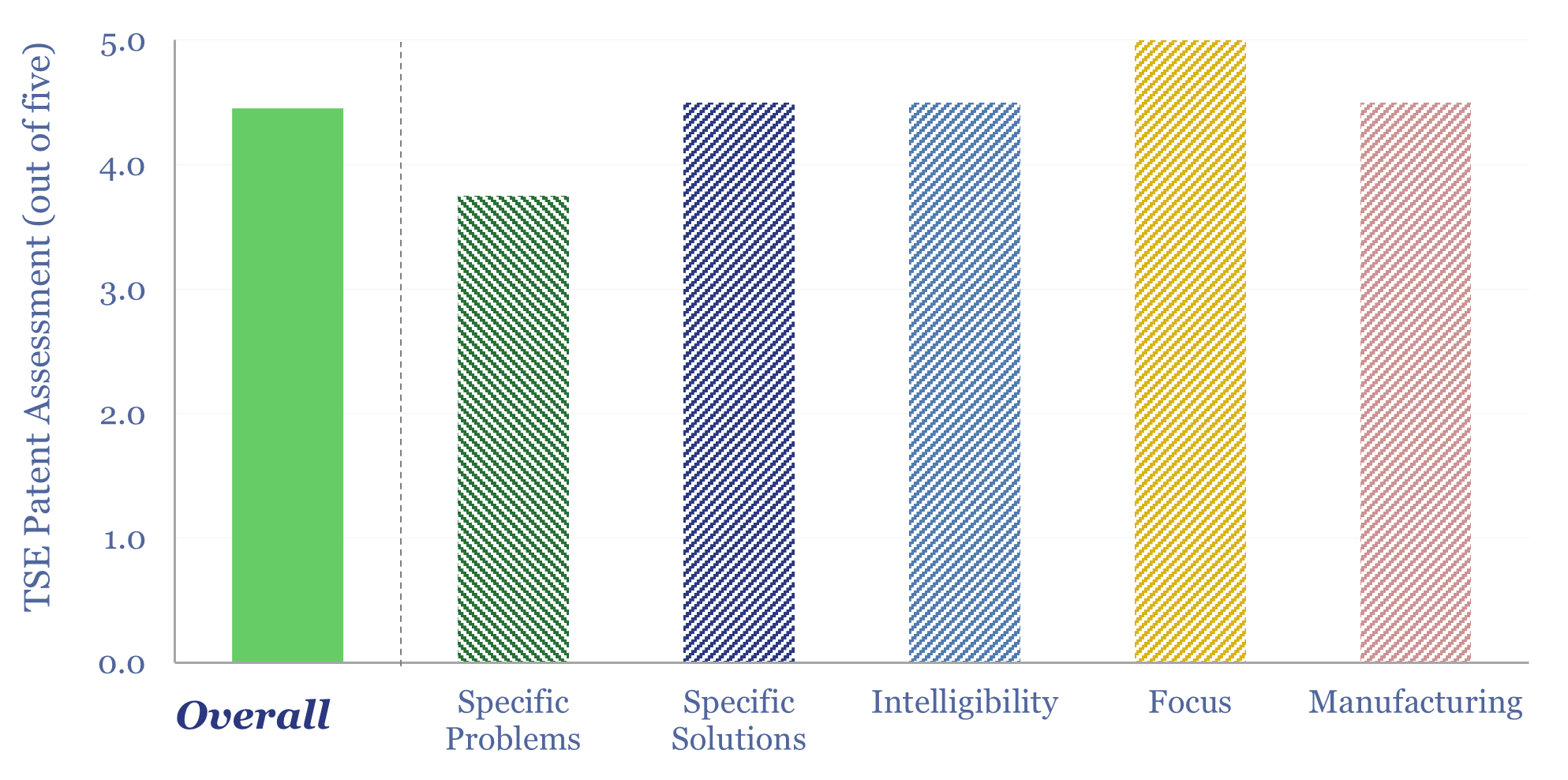

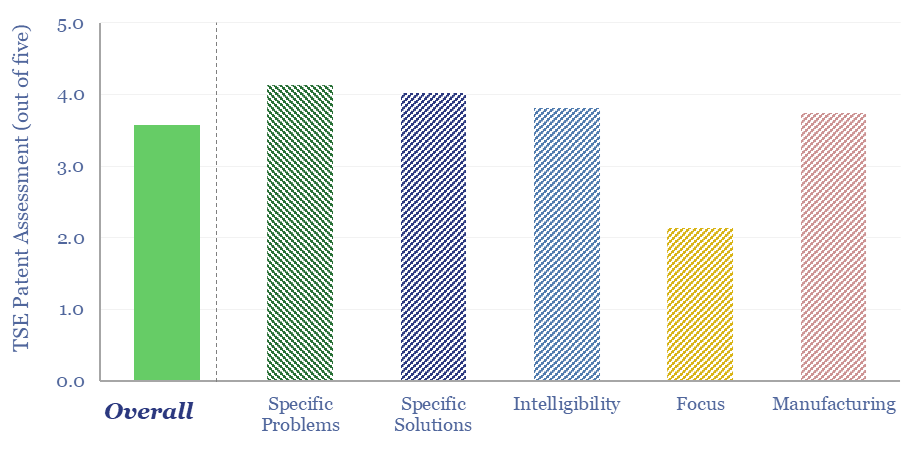

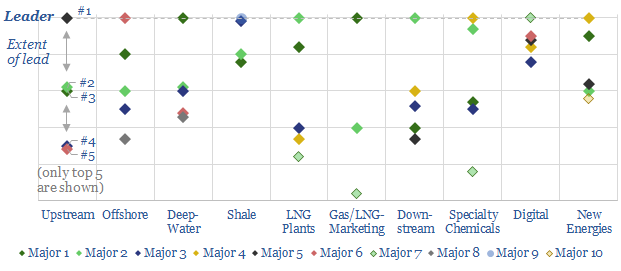

Patent Leaders in Energy

Technology leadership is crucial in energy. But it is difficult to discern. Hence, we reviewed 3,000 patents across the 25 largest companies. This note ranks the industry’s “Top 10 technology-leaders”: in upstream, offshore, deep-water, shale, LNG, gas-marketing, downstream, chemicals, digital and renewables. In each case, we profile the leading company, its edge and the proximity…

-

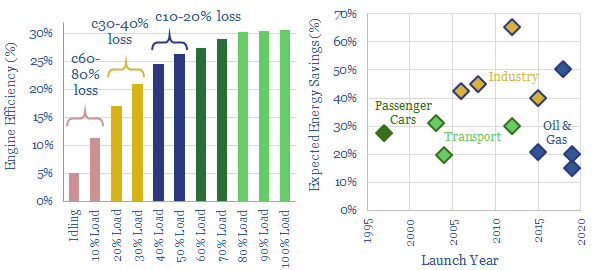

Hybrid horizons: industrial use of batteries?

Gas and diesel engines can be 30-80% less efficient when idling, or running at low loads. This is the rationale for hybridizing engines with backup batteries. Industrial applications are increasing, achieving 30-65% efficiency gains, across multiple industries. In 2018-19, the biggest new horizon has been in oil and gas, including hybrid rigs, supply vessels, construction…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)