Search results for: “small scale LNG”

-

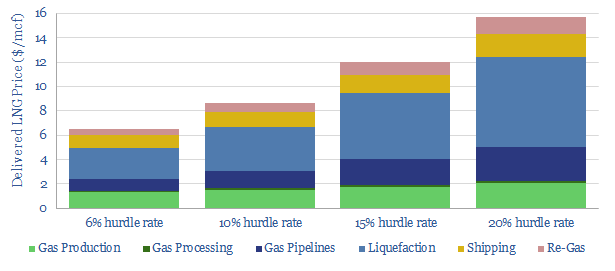

Global gas: catch methane if you can?

Scaling up natural gas is the largest decarbonisation opportunity on the planet. But this requires minimising methane leaks. Exciting new technologies are emerging. This note ranks producers, positions for new policies and advocates developing more LNG. To seize the opportunity, we also identify early-stage companies in methane measurement and mature public companies in the oilfield…

-

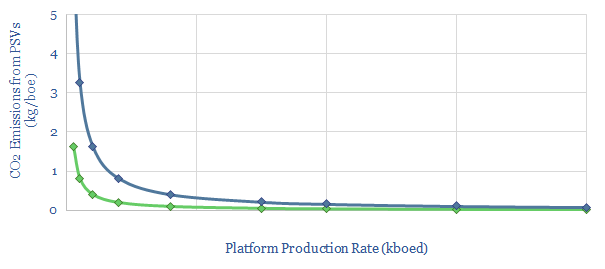

Platform supply vessels: what contribution to CO2?

This data-file calculates the contribution of Platform Supply Vessels (PSVs) to an oil and gas asset’s emissions. Our base case estimate is 0.1kg/boe for a productive asset in a well-developed basin. Numbers rise 4x in a remote basin, and by another c4x for smaller fields. 1kg/boe is possible. These emissions can be lowered by 10-20% through…

-

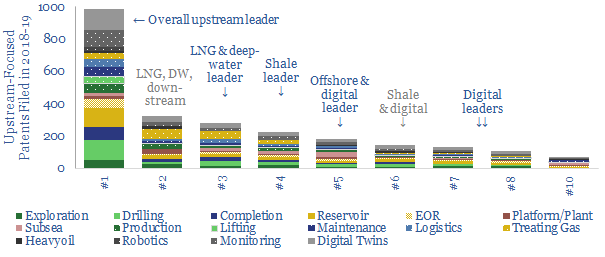

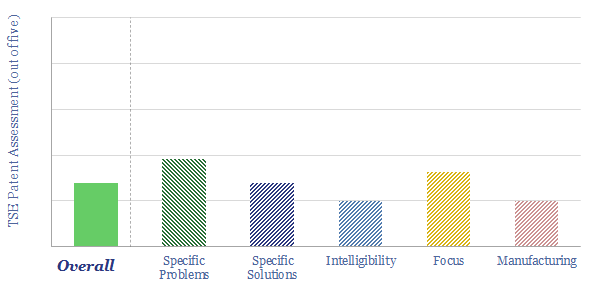

Upstream technology leaders: weathering the downturn?

Leading technologies correlate 50-80% with ROACEs and -88% with costs in the energy industry. Hence, we assessed 6,000 patents from 2018-19, to determine which Energy Majors are best-placed to weather the downturn, benefit from dislocation and thrive in the recovery. We find clear leaders in onshore, offshore, shale, LNG and digital.

-

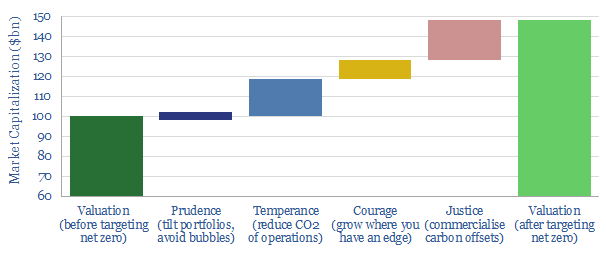

Net zero Oil Majors: four cardinal virtues?

Attaining ‘Net Zero’ can uplift an Energy Major’s valuation by c50%. This means emitting no net CO2, either from the company’s operations or from the use of its products. This 19-page report shows how a Major can best achieve ‘net zero’ by exhibiting four cardinal virtues. Decarbonization is not a threat but an opportunity.

-

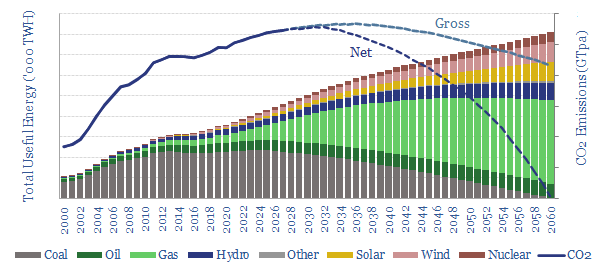

China: can the factory of the world decarbonize?

China now aspires to reach ‘net zero’ CO2 by 2060. But is this compatible with growing an industrial economy and attaining Western living standards? The best middle-ground sees China’s coal phased out and gas rising by a vast 10x to 300bcfd. The biggest challenges are geopolitics and sourcing enough LNG.

-

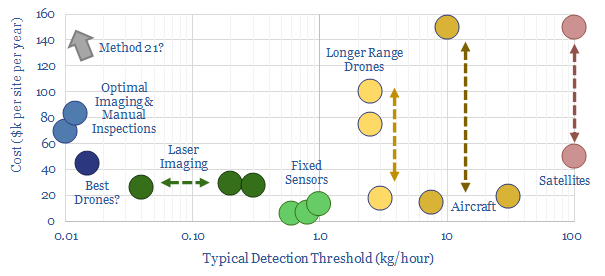

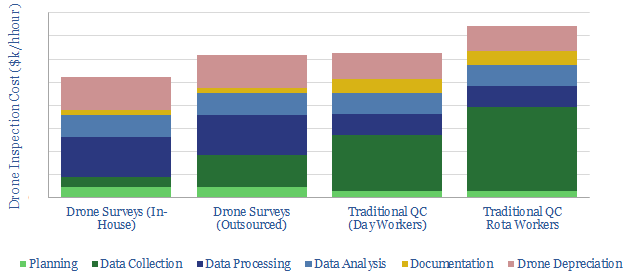

Inspection costs: drones versus traditional quality control?

This data-file estimates the costs of drone inspections, for the construction and resources industries, using bottom-up numbers from technical papers. Costs per hour can be 30% lower than for traditional quality control. A single drone, including software licenses likely costs c$30k.

-

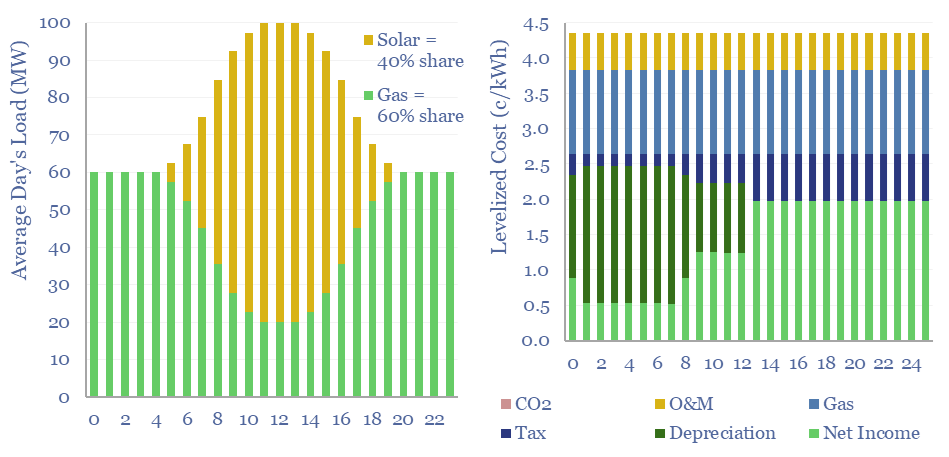

Renewables+gas LCOEs versus standalone gas turbines?

Levelized costs of electricity depend as much on the system being electrified as the energy sources used to electrify it. This data-file captures solar+gas LCOEs (in c/kWh), when meeting different load profiles, as a function of solar capex (in $/kW), gas prices (in $/mcf), and the relative utilization of solar vs gas.

-

End game: options to cure energy shortages?

This note considers five options to cure emerging gas and power shortages. Unfortunately, the options are mostly absurd. They point to inflation, industrial leakage and slipping global climate goals. But also opportunities in LNG, nuclear and efficiency technologies.

-

Aspen Aerogels: insulation breakthrough?

Aerogels have thermal conductivities that are 50-80% below conventional insulators. Target markets include preventing thermal runaway in electric vehicle batteries and cryogenic industrial processes (e.g., LNG). This data-file notes some challenges, using our usual patent review framework.

-

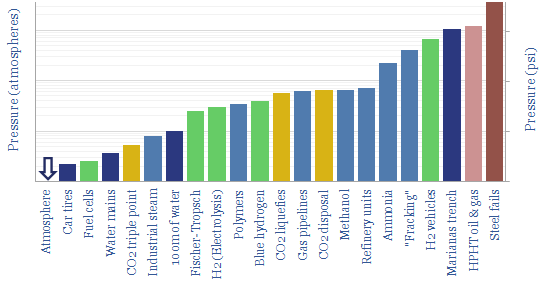

Pressure ratings: industrial and energy processes?

The purpose of this data-file is to chart the typical pressures of industrial processes and energy processes, as a useful reference. We are all used to 1 atmosphere of pressure, which is 1.0125 bar, 0.10125 MPa and 14.7 psi. But what pressures do industrial processes use?

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (839)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)