Search results for: “small scale LNG”

-

Energy return on energy invested?

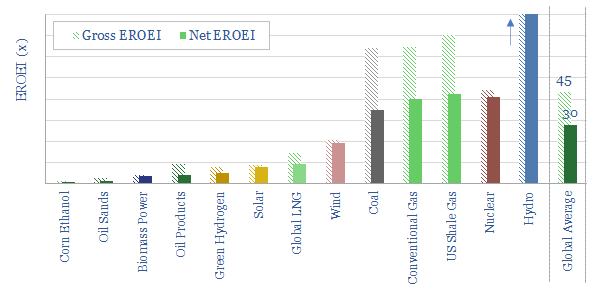

Global average EROEI is around 30x. Sources with EROEI above average are hydro, nuclear, natural gas and coal. Sources with middling EROEIs of 10-20x are solar, wind and LNG. Sources with weaker EROEIs are oil products, green hydrogen and some biofuels.

-

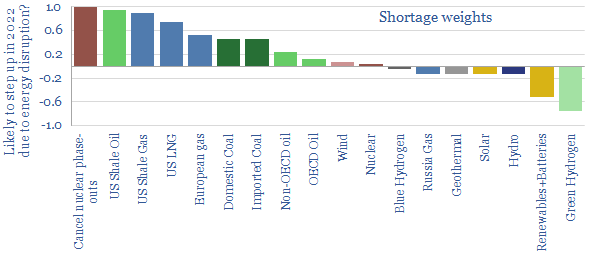

Russia conflict: pain and suffering?

This 13-page note presents 10 hypotheses on Russia’s horrific conflict. Energy supplies will very likely get disrupted, as Putin no longer needs to break the will of Ukraine, but also the West. Results include energy rationing and economic pain. Climate goals get shelved during the war-time scramble. Pragmatism, nuclear and LNG emerge from the ashes.

-

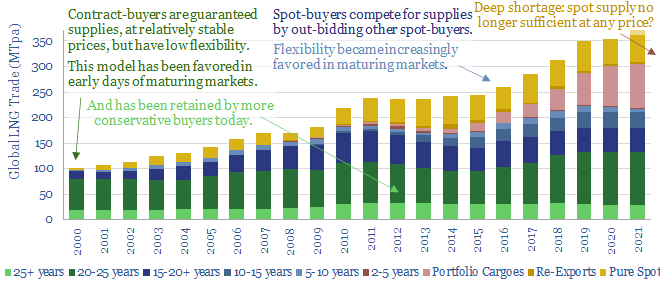

Energy security: the return of long-term contracts?

Spot markets have delivered more and more ‘commodities on demand’. But is this model fit for energy transition? Many markets are now short, causing explosive price rises. Sufficient volumes may still not be available at any price. This note considers a renaissance for long-term contracts.

-

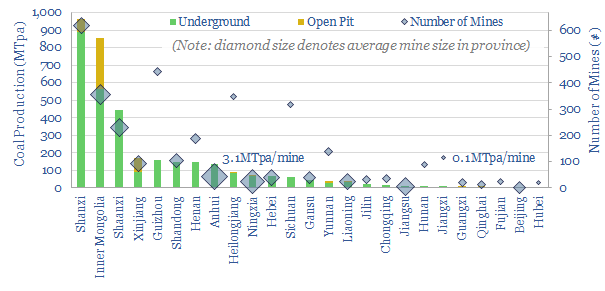

All the coal in China: our top ten charts?

Chinese coal provides 15% of the world’s energy, equivalent to 4 Saudi Arabia’s worth of oil. Global energy markets may become 10% under-supplied if this output plateaus per our ‘net zero’ scenario. Alternatively, might China ramp its coal, especially as Europe bids harder for renewables and LNG post-Russia? This note presents our ‘top ten’ charts.

-

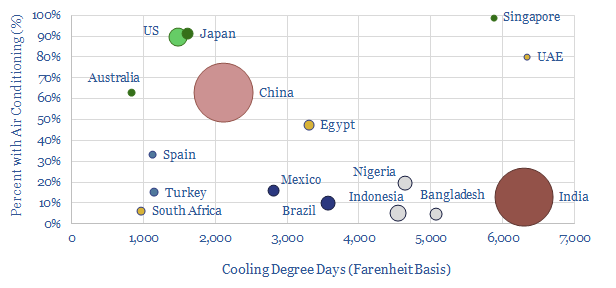

Air conditioning: energy demand sensitivity?

This data-file quantifies air conditioning energy demand. In the US each 100 variation in CDDs adds 26 TWH of electricity (0.6%) demand and 200bcf of gas (0.6%). Air conditioning already consumes 7% of all global electricity and could treble by 2050.

-

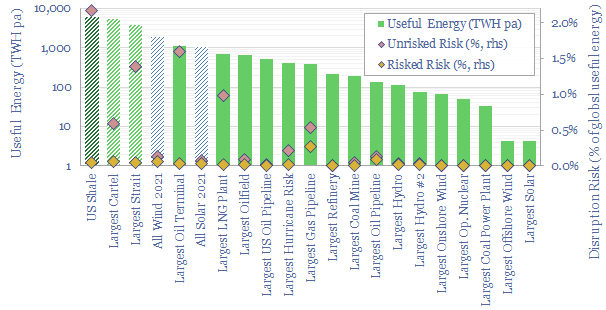

World’s largest energy assets: by category and risk?

The largest hydrocarbon mega-projects are still 10-25x larger than the world’s largest solar and offshore wind projects. Risks are different in each category. But on a risked basis, global energy supplies may come in c2% lower than base case forecasts

-

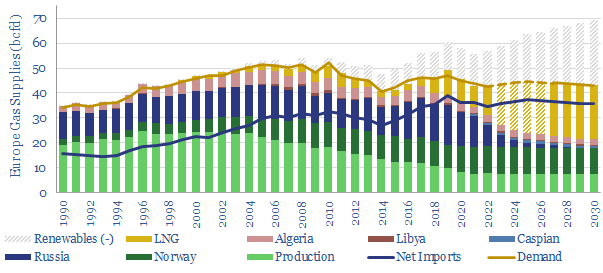

Global gas: five predictions through 2030?

Modelling Europe’s gas balances currently feels like grasping at straws. Yet this 10-page note makes five predictions through 2030. We have revised our views on how fast new energies ramp, which gas gets displaced first, which energy sources are no longer ‘in the firing line’, and gas pricing.

-

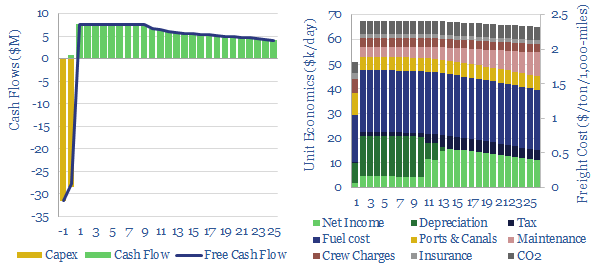

Bulk shipping: cost breakdown?

Bulk carriers move 5GTpa of commodities around the world, explaining half of all seaborne global trade. This model is a breakdown of bulk shipping cost. We estimate a cost of $2.5 per ton per 1,000-miles, and a CO2 intensity of 5kg per ton per 1,000-miles. Marine scrubbers increasingly earn their keep and uplift IRRs from…

-

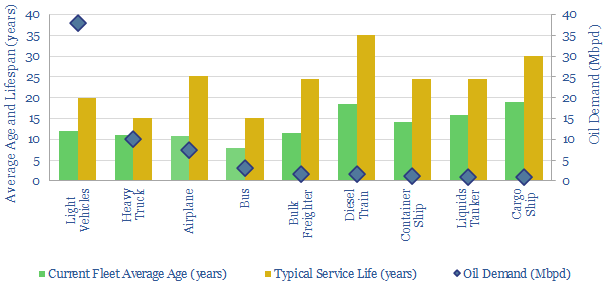

Vehicle fleets: service life and retirement age by vehicle type?

The weighted-average combustion vehicle in the world has a current age of 12-years and an expected service life of 20-years. In other words, a new combustion vehicle entering the global fleet in 2023 will most likely be running through 2043. Useful data and notes are compiled overleaf.

-

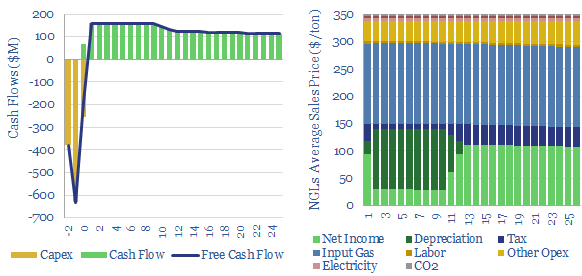

Gas fractionation: NGL economics?

Gas fractionation separates out methane from NGLs such as ethane, propane and butane. A full separation uses up almost 1% of the input gas energy and 4% of the NGL energy. The costs of gas fractionation require a gas processing spread of $0.7/mcf for a 10% IRR off $2/mcf input gas, or in turn, an…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)