-

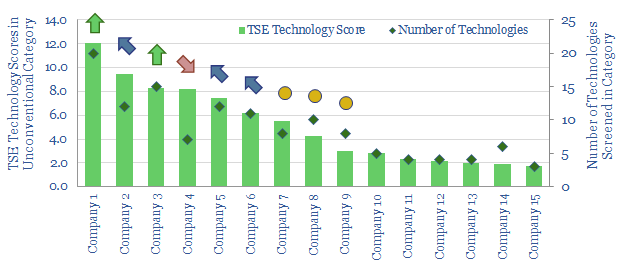

US shale: the quick and the dead?

It is no longer possible to compete in the US shale industry without leading digital technologies. This 10-page note outlines best practices, based on 500 patents and 650 technical papers. Chevron, Conoco and ExxonMobil lead our screens. Disconcertingly absent from the leader-board is EOG, whose edge may have been eclipsed.

-

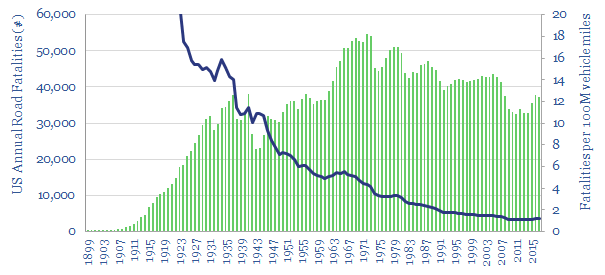

More dangerous than coronavirus? The safety case for digital and remote operations.

Remote working, digital de-manning, drones and robotics — all of these themes will structurally accelerate in the aftermath of the COVID crisis. This short note considers the safety consequences. They are as significant as COVID itself.

-

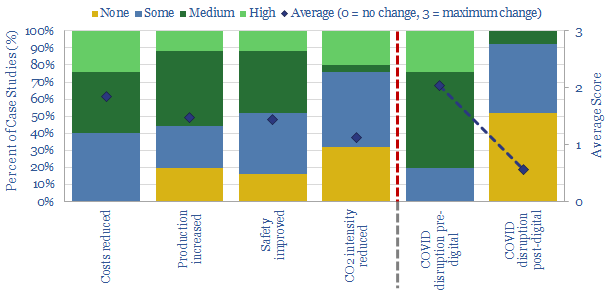

Digitization after the crisis: who benefits and how much?

Digitization improves economics and CO2 credentials. But now it will structurally accelerate due to higher resiliency: Just 8% of digitized industrial processes will be disrupted due to COVID-19, compared to 80% of non-digitized processes. This 22-page report outlines the theme and who will benefit.

-

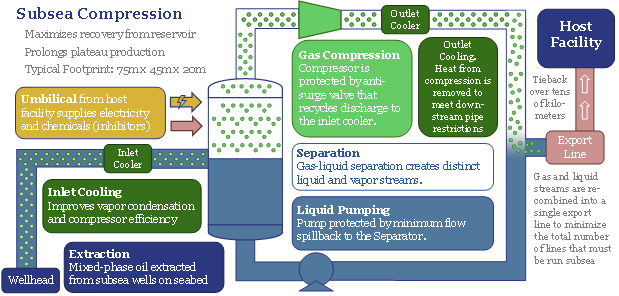

The future of offshore: fully subsea?

Offshore developments will change dramatically in the 2020s, eliminating production platforms in favour of fully subsea solutions. The opportunity increases a project’s NPV by 50% and effectively eliminates upstream CO2. We reviewed 1,850 patents to find the best-placed operators and services. Others will be disrupted. The theme supports the ascent of low-carbon natural gas.

-

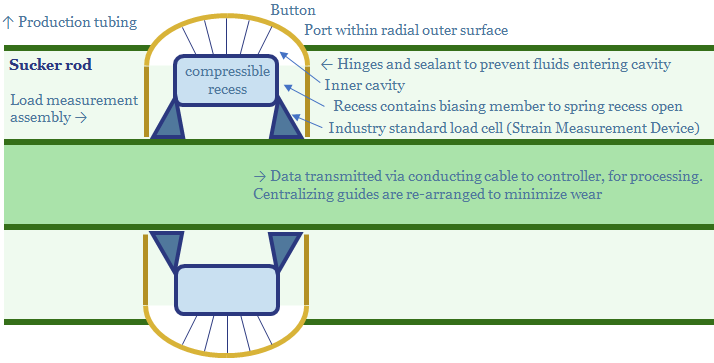

EOG’s Digitization: Pumped-Up?

EOG patented a new digital technology in 2019: a load assembly which can be built into its rod pumps: to raise efficiency, lower costs and lower energy consumption. This 8-page note reviews the patent, illustrating how EOG is working to further digitize its processes, maximise productivity and minimise CO2 intensity.

-

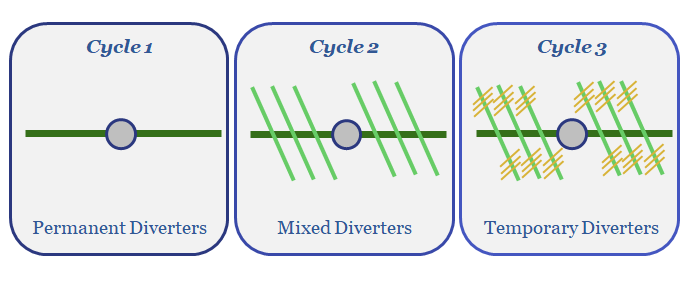

New Diverter Regimes for Dendritic Frac Geometries?

The key challenge for the US shale industry is to continue improving productivity per well. The process is increasingly being driven by Oil Majors and using data. This is illustrated by BP’s latest fracturing fluid patents, which optimise successive diverter compositions to create dendritic fracture geometries, to enhance stimulated rock volumes.

-

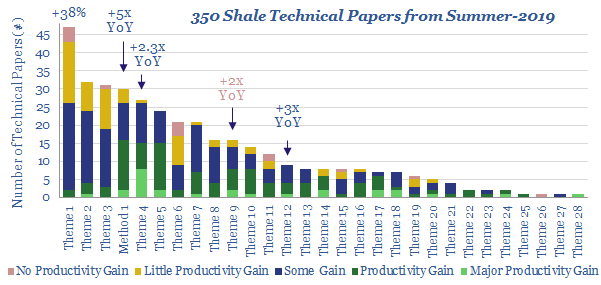

US Shale: No Country for Old Completion Designs

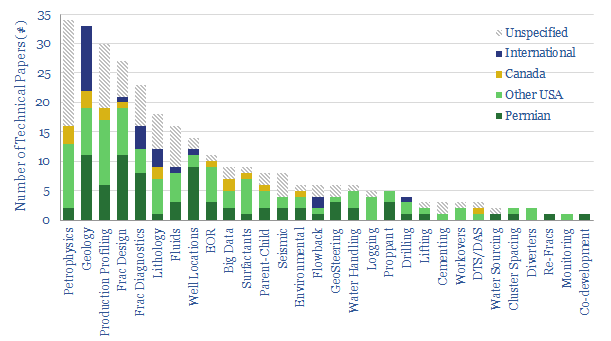

2019 has evoked resource fears in the shale industry. They are unfounded. Weak headline productivity is the benign result of changing completion designs. We review 350 technical papers from the shale industry in summer-2019 to rule out systemic issues. Underlying productivity continues improving at an exciting pace.

-

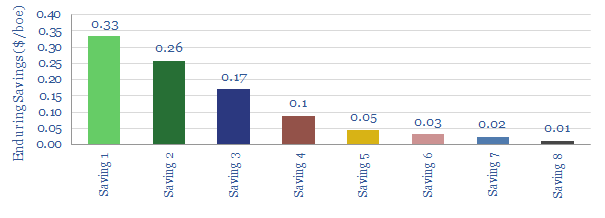

Digital Deflation: How Hard to Save $1/boe?

A typical operator can readily save $1/boe via continued, digital deflation. Our numbers are derived from a new case study from Cognite, which is among the leaders in oilfield digitization, collaborating with cutting-edge E&Ps. Digitization remains the most promising opportunity to improve offshore economics.

-

U.S. Shale: Winner Takes All?

Shale is a ‘tech’ industry. The technology keeps improving at an incredible pace. But Permian technology is improving fastest, extending its lead over other basins. There are our conclusions from assessing 300 technical papers across the shale industry in 2018.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (90)

- Data Models (816)

- Decarbonization (159)

- Demand (108)

- Digital (56)

- Downstream (44)

- Economic Model (197)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (273)

- LNG (48)

- Materials (79)

- Metals (71)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (22)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (123)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (345)