-

Direct lithium extraction: ten grains of salt?

Direct Lithium Extraction from brines could help lithium scale 30x in the Energy Transition; with costs and CO2 intensities 30-70% below mined lithium; while avoiding the 1-2 year time-lags of evaporative salars. This 15-page note reviews the top ten challenges that decision-makers need to de-risk.

-

Lithium: reactive?

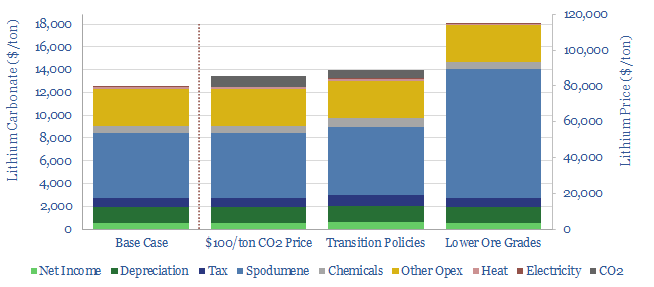

Lithium demand is likely to rise 30x in the energy transition. So this 15-page note reviews the mined lithium supply chain, finding prices will rise too, by 10-50%. The main reason is lower-grade ores. Second is energy intensity. Low-cost lithium brine producers may benefit from steeper cost curves.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (90)

- Data Models (816)

- Decarbonization (159)

- Demand (108)

- Digital (56)

- Downstream (44)

- Economic Model (197)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (273)

- LNG (48)

- Materials (79)

- Metals (71)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (22)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (123)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (345)