Lithium demand is likely to rise 30x in the energy transition. So this 15-page note reviews the mined lithium supply chain, finding prices will rise too, by 10-50%. The main reason is moving into lower-grade ores. Second is energy intensity, as each ton of lithium emits 50 tons of CO2, c50% due to refining spodumene at 1,100◦C, mostly using coal in China. Low-cost lithium brine producers and battery recyclers may benefit from steepening cost curves.

Inflationary feedback loops increasingly matter in the energy transition. Decarbonization technologies themselves need to be decarbonized. But this tends to re-inflate their costs. Page 2 re-caps this issue and why it matters.

An overview of the lithium supply chain is spelled out on pages 3-7, across the three major categories of “brine”, “mine” and “refine”. In each case, we aim to highlight the key numbers and energy costs.

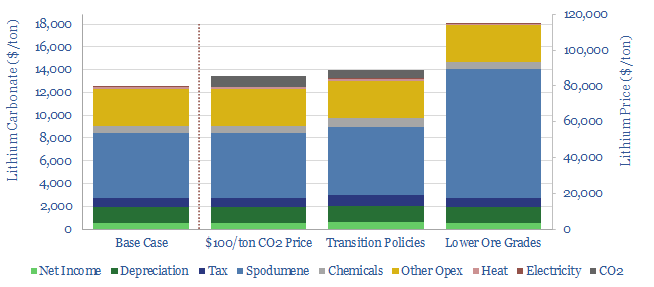

An economic model of mined lithium can thus be derived on page 8. We outline what price is needed for a 10% IRR across the value chain.

The first re-inflation risk is the direct cost of decarbonization, which is quantified on pages 9-10, including carbon prices, energy costs and materials costs.

The second and larger re-inflation risk is the need to move into lower ore grades, to meet a 30x increase in future lithium demand. This is quantified on pages 11-12.

The impacts on batteries and electric vehicles are then translated through on page 13. We conclude that OEMs may consider backwards-integrating, to secure supplies.

Who benefits? Steepening cost curves are best for those at the bottom of those cost curves. And possibly also for battery recycling. We have screened 20 companies and discuss our conclusions on pages 14-15.