-

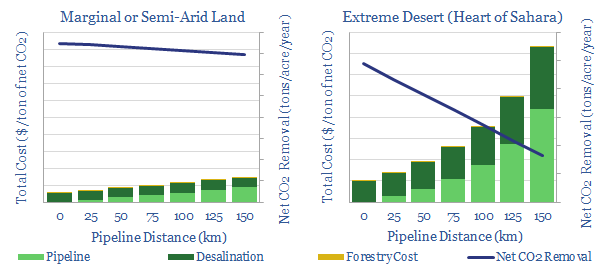

Green deserts: a final frontier for forest carbon?

Is there potential to afforest any of the world’s 11bn acres of arid and semi-arid lands, by desalinating and distributing seawater? Energy economics do not work in the most extreme deserts (e.g., the Sahara). Buy $60-120/ton CO2 prices may suffice in semi-arid climates. The best economics of all use waste water from oil and gas,…

-

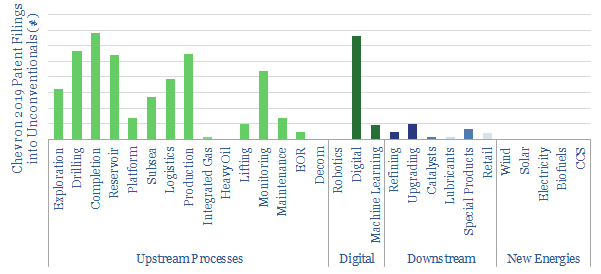

Chevron: SuperMajor Shale in 2020?

SuperMajors’ shale developments are assumed to differ from E&Ps’ mainly in their scale and access to capital. Superior technologies are rarely discussed. But new evidence is emerging. This 11-page note assesses 40 of Chevron’s shale patents from 2019, showing a vast array of data-driven technologies, to optimize every aspect of shale.

-

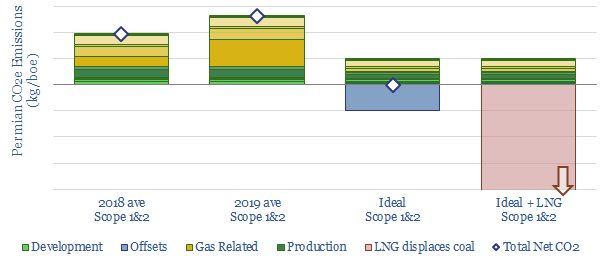

Shale growth: what if the Permian went CO2-neutral?

Shale growth has been slowing due to fears over the energy transition, as Permian upstream CO2 emissions reached a new high in 2019. We disaggregate the CO2 across 14 causes. It could be eliminated by improved technologies, making Permian production carbon neutral: uplifting NPVs by c$4-7/boe, re-attracting a vast wave of capital and growth. This…

-

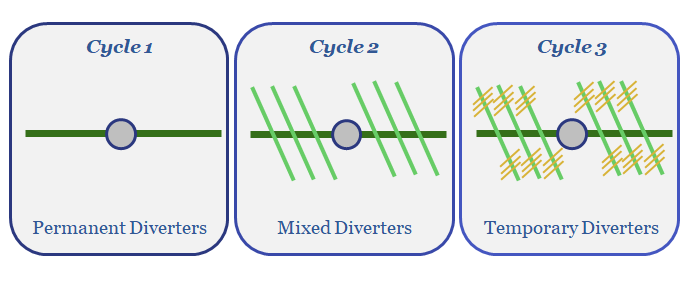

New Diverter Regimes for Dendritic Frac Geometries?

The key challenge for the US shale industry is to continue improving productivity per well. The process is increasingly being driven by Oil Majors and using data. This is illustrated by BP’s latest fracturing fluid patents, which optimise successive diverter compositions to create dendritic fracture geometries, to enhance stimulated rock volumes.

-

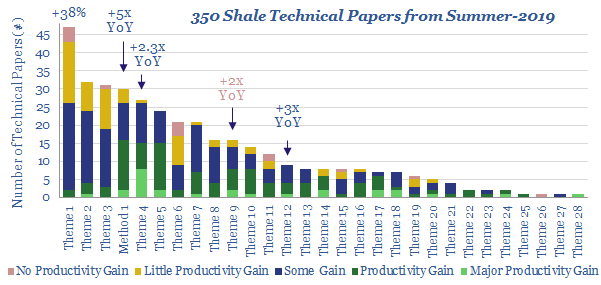

US Shale: No Country for Old Completion Designs

2019 has evoked resource fears in the shale industry. They are unfounded. Weak headline productivity is the benign result of changing completion designs. We review 350 technical papers from the shale industry in summer-2019 to rule out systemic issues. Underlying productivity continues improving at an exciting pace.

-

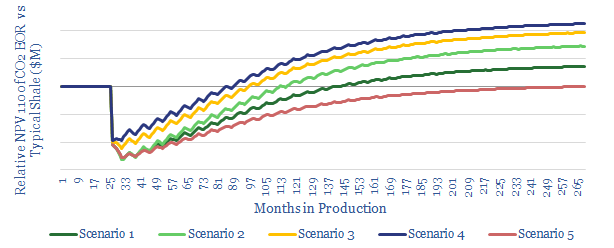

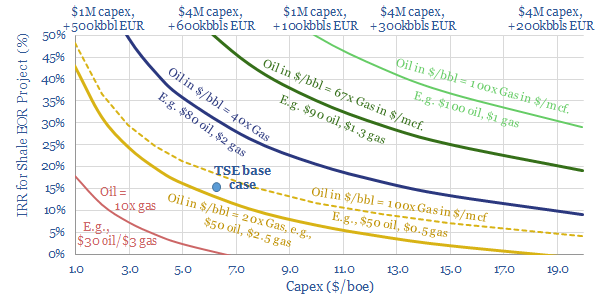

CO2-EOR in shale: the holy grail?

What if there were a technology to sequester CO2, double shale productivity, earn 15-30% IRRs and it was on the cusp of commercialization? Promising momentum is building, at the nexus of decarbonised gas-power and Permian CO2-EOR. This short note highlights the economic opportunity.

-

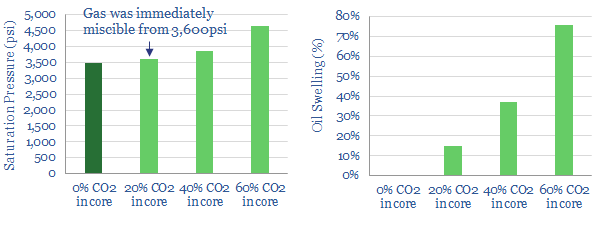

Permian CO2-EOR: pushing the boundary?

We see enormous opportunity in CO2-EOR in the Permian basin. Occidental Petroleum has now published laboratory analysis, informing its models and de-risking the technique. This short note profiles our “top five” conclusions from the paper.

-

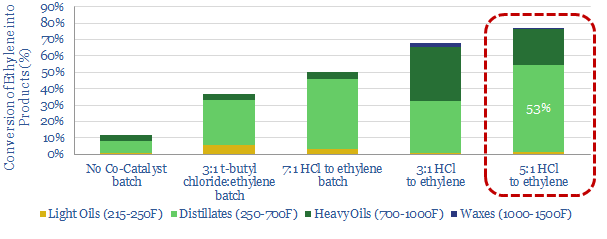

Shale: restoring downstream balance? New opportunities in ethylene and diesel.

Shale’s light mix is often criticised for distorting oil product markets. But distortions create opportunities for Integrateds. This note explores one opportunity, patented by Chevron, to convert ethylene into diesel.

-

Shale EOR: Container Class

Will Shale-EOR add another leg of unconventional upside? The topic jumped into the ‘Top 10’ most researched shale themes last year, hence we have reviewed the opportunity in depth. Stranded in-basin gas will improve the economics to c20% IRRs (at $50 oil). Production per well can rise by 1.5-2x. The theme could add 2.5Mbpd to…

-

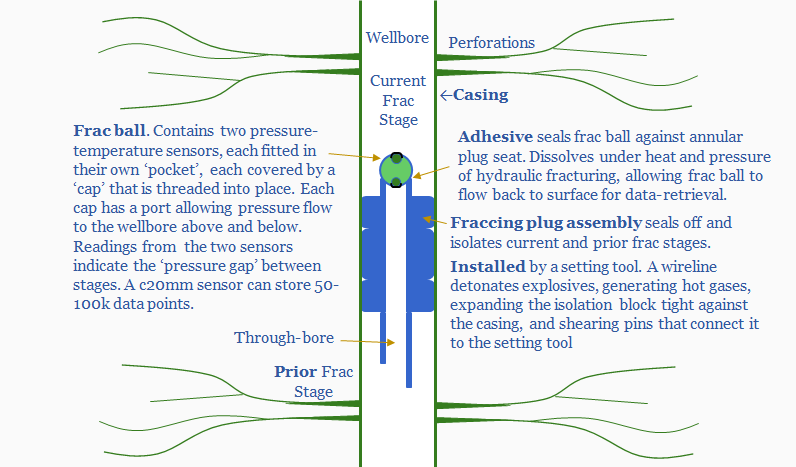

EOG’s Completions: Plugged-In?

EOG has patented a system to run pressure and temperature sensors in its frac plugs, which are then retrieved at the surface, providing low cost data on each frac stage. The data improve subsequent stages. We estimate the NPV uplifts at $1M/well.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (90)

- Data Models (816)

- Decarbonization (159)

- Demand (108)

- Digital (56)

- Downstream (44)

- Economic Model (197)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (273)

- LNG (48)

- Materials (79)

- Metals (71)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (22)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (123)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (345)