-

Carbon capture on ships: raising a sail?

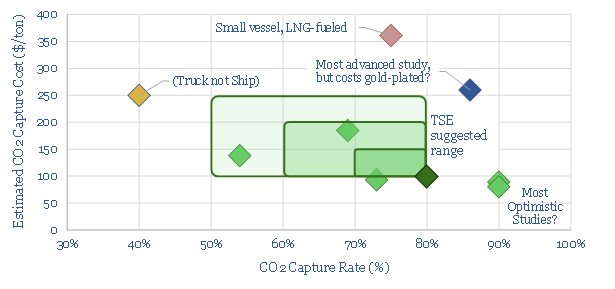

CCS is adapting to go to sea. 80% of some ships’ CO2 emissions could be captured for c$100/ton and an energy penalty of just 5%, albeit this is the best case within a broad range. This 15-page note explores the opportunity, challenges, progress and who might benefit.

-

Methanol: the next hydrogen?

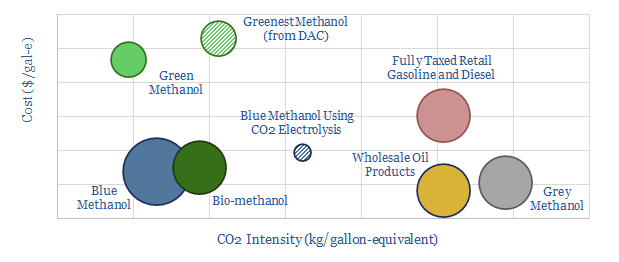

Methanol is becoming more exciting than hydrogen as a clean fuel to help decarbonize transport. Specifically, blue methanol and bio-methanol are 65-75% less CO2-intensive than oil products, while they already earn 10% IRRs at c$3/gallon prices. Unlike hydrogen, it is simple to transport and integrate methanol with pre-existing vehicles.

-

The Ascent of LNG?

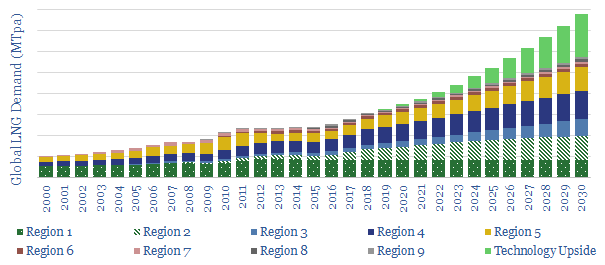

This note outlines 200MTpa of potential upside to consensus LNG demand, due to emerging technologies, in power and transportation. LNG use could thus compound at an 8% CAGR to 800MTpa by 2030, justifying greater investment in unsanctioned LNG projects.

-

Shell drives LNG in transport?

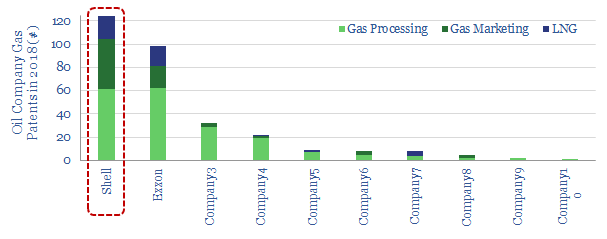

Shell is the most active Major in driving new LNG demand. In 2019, it patented a new sub-cooler to improve the ascent of LNG in transportation. Our note explains the challenges of boil-off and gas-weathering, how they are addressed by Shell’s new technology, and eight resulting advantages.

-

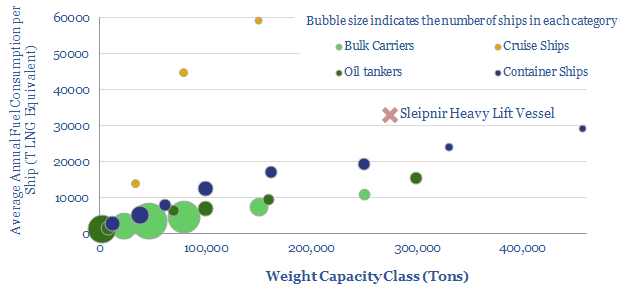

LNG Ships: a new record-setter?

Multiple records have just been broken for an LNG-powered ship, as construction completed at Heerema’s “Sleipnir” crane-lift vessel. It is a remarkable, LNG-powered machine, substantiating the 40-60MTpa upside we see for LNG demand, from fuel-intensive ships, after IMO 2020.

-

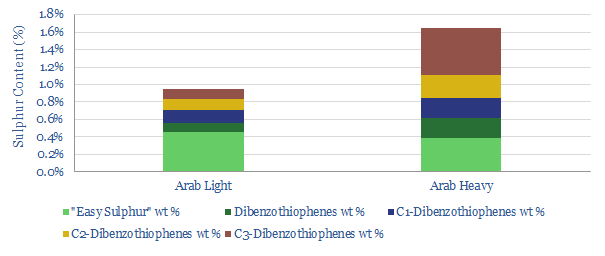

IMO 2020. Fast Resolution or Slow Resolution?

The downstream industry is debating whether IMO 2020 sulphur regulations will be resolved quickly or slowly. We think the market-distortions may be prolonged by under-appreciated technology challenges, which mandate large, increasingly hard-to-finance refinery overhauls.

-

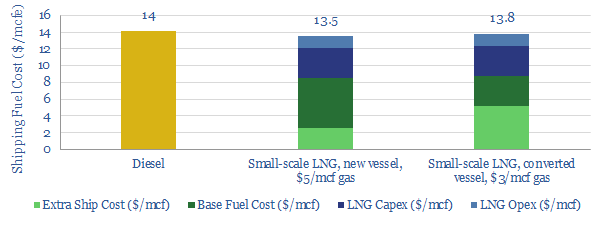

LNG in transport: scaling up by scaling down?

Next-generation technology in small-scale LNG has potential to reshape the global shipping-fuels industry. Especially after IMO 2020 sulphur regulations, LNG should compete with diesel. Opportunities in trucking and shale are less clear-cut.

-

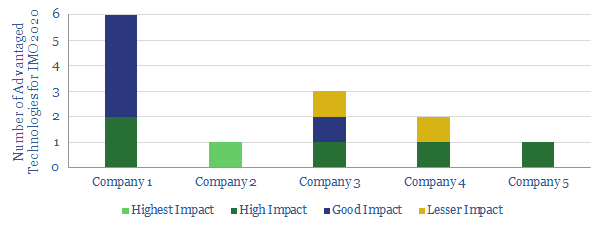

Our Top Technologies for IMO 2020

We review a dozen of the top, proprietary technologies that we have seen to capitalise on IMO 2020 sulfur regulation, across five of the world’s leading refiners.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (92)

- Data Models (822)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (200)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (275)

- LNG (48)

- Materials (81)

- Metals (74)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (23)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (124)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (347)