-

East to West: re-shoring the energy transition?

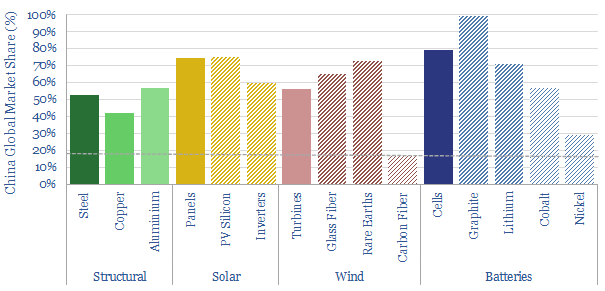

China is 18% of the world’s people and GDP. But it makes c50% of the world’s metals, 60% of its wind turbines, 70% of its solar panels and 80% of its lithium ion batteries. Re-shoring is likely to be a growing motivation after events of 2022. This 14-page note explores resultant opportunities.

-

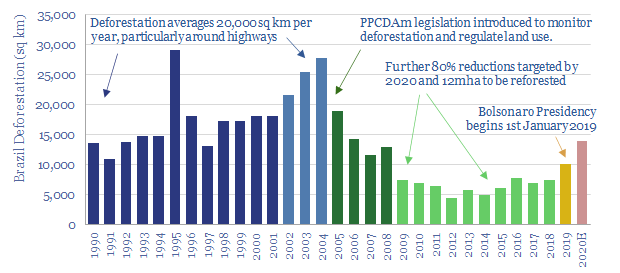

The Amazon tipping point theory?

Another 2-10% deforestation could make the Amazon rainforest too dry to sustain itself. 80GT of Carbon could thus be released, inflating atmospheric CO2 above 450ppm. This matters as Amazon deforestation rates have already doubled under Jair Bolsonaro’s presidency. We explore policy implications.

-

Biden presidency: our top ten research reports?

Joe Biden’s presidency will prioritize energy transition among its top four focus areas. Thus we present our top ten pieces of research that gain increasing importance as the new landscape unfolds. We are cautious on bubbles and supply shortages. But decision-makers will become more discerning around CO2.

-

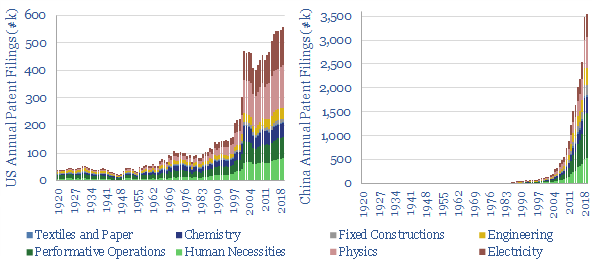

Rise of China: the battle is trade, the war is technology?

China’s pace of technology development is now 6x faster than the US, as measured across 40M patent filings, contrasted back to 1920 in this short, 7-page note. The implications are frightening. Questions are raised over the Western world’s long-term competitiveness, especially in manufacturing; and the consequences of decarbonization policies that hurt competitiveness.

-

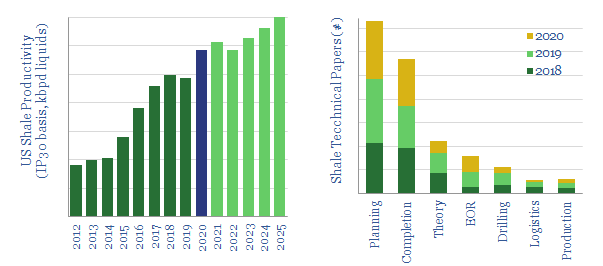

US Shale: the second coming?

US shale productivity can still rise at a 5% CAGR to 2025, based on evaluating 300 technical papers from 2020. The latest improvements are discussed in this 12-page note. Thus unconventionals could quench deeply under-supplied oil markets by 2025. Leading technologies are also becoming concentrated in the hands of fewer operators.

-

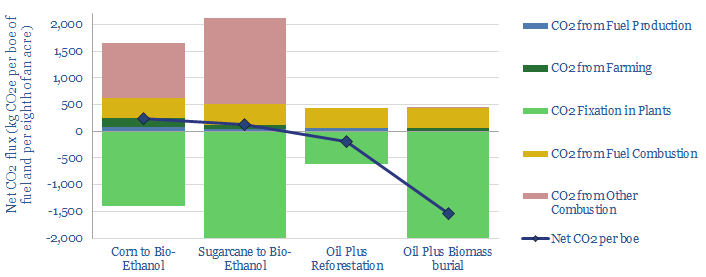

Biofuels: better to bury than burn?

The global bioethanol industry could be disrupted by a carbon price. Somewhere between $15-50/ton, it becomes more economical to bury the biofuel crop, rather than convert it into biofuels. This would remove 8x more CO2 per acre, at a lower total cost. Ethanol mills and blenders would be displaced.

-

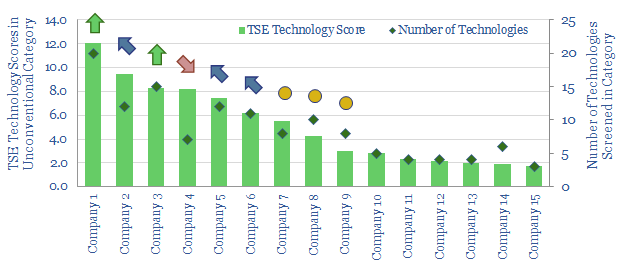

US shale: the quick and the dead?

It is no longer possible to compete in the US shale industry without leading digital technologies. This 10-page note outlines best practices, based on 500 patents and 650 technical papers. Chevron, Conoco and ExxonMobil lead our screens. Disconcertingly absent from the leader-board is EOG, whose edge may have been eclipsed.

-

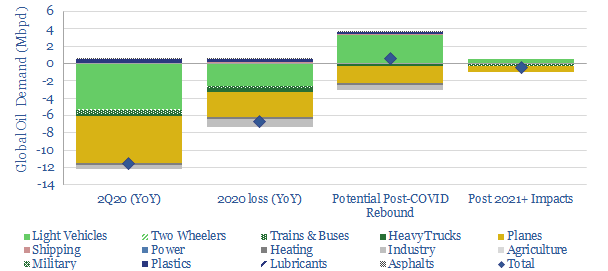

COVID-19: what have the oil markets missed?

This 15-page note outlines our top three conclusions about COVID-19, which the oil markets may have missed. Global oil demand could decline by -11.5Mbpd YoY in 2Q20. But gasoline demand could increase in the aftermath of the crisis. Finally, longer-term, structural changes will transform commuting, retail and travel.

-

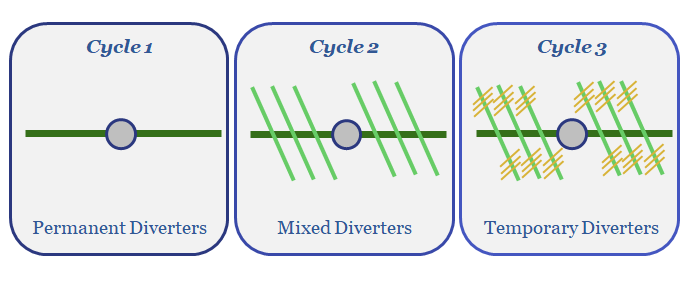

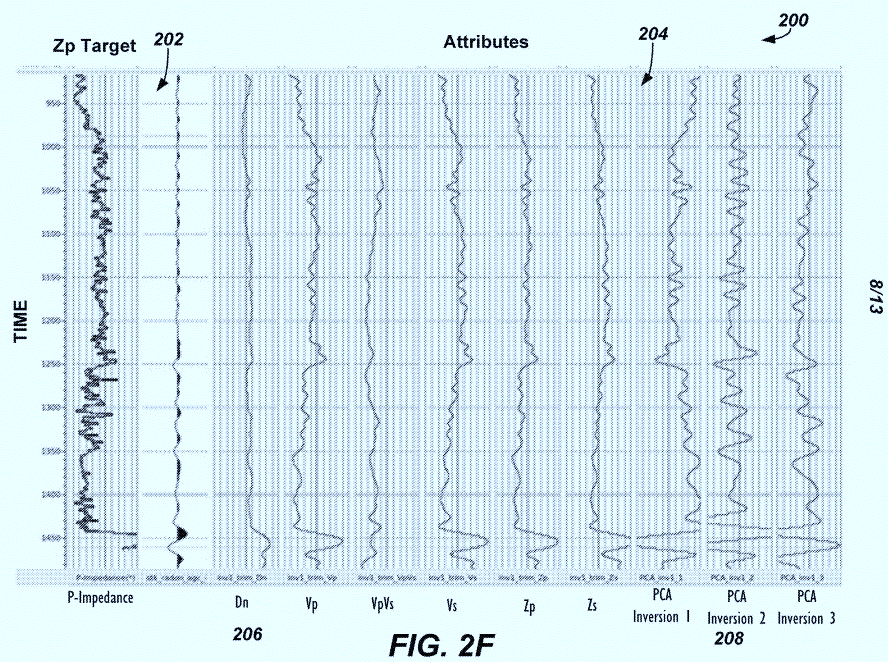

New Diverter Regimes for Dendritic Frac Geometries?

The key challenge for the US shale industry is to continue improving productivity per well. The process is increasingly being driven by Oil Majors and using data. This is illustrated by BP’s latest fracturing fluid patents, which optimise successive diverter compositions to create dendritic fracture geometries, to enhance stimulated rock volumes.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)