-

Carbon negative construction: the case for mass timber?

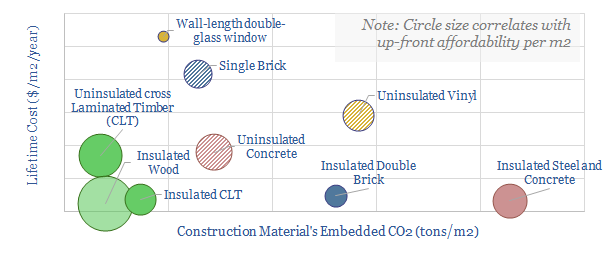

Construction accounts for 10% of global CO2, mainly due to cement and steel. But mass timber could become a dominant new material for the 21st century, lowering emissions 15-80% at no incremental cost. Debatably mass timber is carbon negative if combined with sustainable forestry. We outline the opportunity.

-

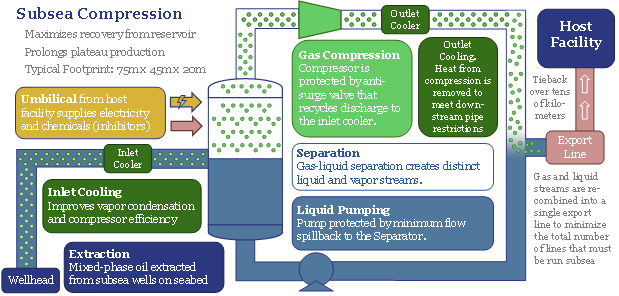

The future of offshore: fully subsea?

Offshore developments will change dramatically in the 2020s, eliminating production platforms in favour of fully subsea solutions. The opportunity increases a project’s NPV by 50% and effectively eliminates upstream CO2. We reviewed 1,850 patents to find the best-placed operators and services. Others will be disrupted. The theme supports the ascent of low-carbon natural gas.

Content by Category

- Batteries (87)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (92)

- Data Models (829)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (277)

- LNG (48)

- Materials (82)

- Metals (77)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (126)

- Renewables (149)

- Screen (114)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (350)