A fully decarbonized energy system may still require 85Mbpd of oil and 375TCF of gas. Hence a focus of our research is to find improved technologies that can improve the efficiency and lower the CO2 intensity of oil and gas production. This note profiles the exciting new prospect of ‘wet sand’ for hydraulic fracturing in shale plays. It can reduce breakeven costs up to $1/bbl and CO2 intensity up to 0.6kg/bbl.

Wet sand is defined as having a moisture content between 1% and 10% by weight. This is opposed to the 43MTpa of dry sand supplied in the Permian in 2018, where all the moisture has been burned away in a kiln, shortly after the washing process.

Wet sand has reached technical maturity. In a December-2020 technical paper, PropX described a patent pending process to “screen, transport, deliver and meter wet sand from local mines to the frac blender, bypassing the drying process altogether”.

A full trial of wet sand has also been undertaken at a 10-well pad in Oklahoma, implied to have been operated by Ovintiv. Over 4Mlbs of sand per day was delivered and pumped downhole. The system was reliable and consistently flowed wet sand with 4-8% moisture content.

The advantages: cost and CO2 savings?

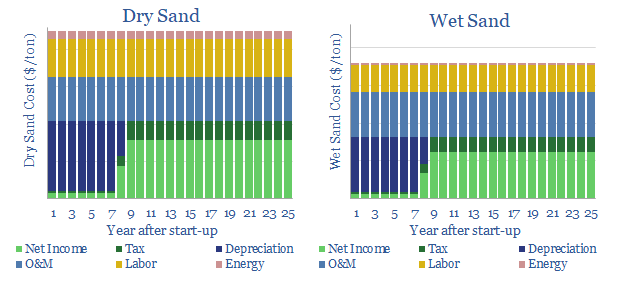

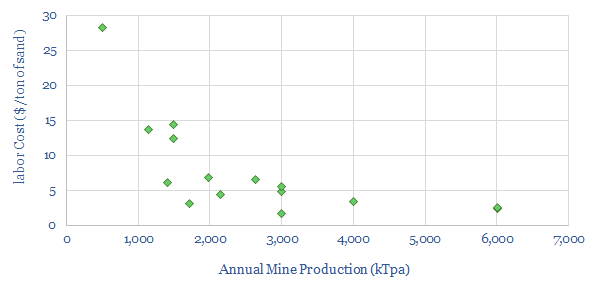

Cost savings from pumping wet sand are estimated at $2-10/ton. The largest capital component is in potential capex savings, as the kiln at a sand mine usually comprises $20-50M (including associated drying, storage and conveyance) out of a $180M total budget at a 2.5MTpa mine. A second saving is in opex, as labor costs average $5/ton across 15 surveyed sand mines (chart below), and the drying unit requires one-third of the labor force. Finally, there are fuel savings, likely around $1/ton.

After modelling the economics below, our base case estimate is that a greenfield sand mine can lower its total production costs by $5/ton, with a shift from dry to wet sand.

To test the economic impacts of a $5/ton reduction in sand costs, we turn to our economic model below. At a large, sand-intensive well, we estimate $0.1M of potential savings. This flows through to a $0.5/bbl reduction in the well’s NPV10 breakeven. However, the savings will be lower at industry average wells, which only consume 10-20M lbs of proppant.

CO2 savings are realized by cutting out fuel demand in the drying kilns at sand mines, typically at 0.3-0.4mmbtu per ton of dried sand, requiring 0.4mcf of gas, whose combustion would release 20kg of CO2. Again, we can run the savings through our models (below) and estimate CO2 could be reduced by up to 0.6kg/boe, which is not bad against a baseline of 26kg/boe of total upstream Scope 1 and Scope 2.

HSE advantages are also noted in the technical paper. Fugitive silica dust is materially reduced, as wet sand particles adhere to one-another. This helps meet OSHA’s 2016 silica exposure limits, below 50mg/m3 of air, averaged over an 8-hour shift.

The challenges: is wet sand more difficult to pump?

The challenge of wet sand is that wet san grains cohere to one-another, which impedes their smooth flow and can cause sand to “clump together”. In cold climates (but probably not Texas!) the water molecules can also freeze. Hence, PropX notes three areas where it has needed to innovate the sand supply chain.

Last-mile. It is recommended to use containers (rather than trailers) to transport sand to well-sites. These can be lifted from trucks onto the wellsite with “the fewest touch points and the least modification”. A typical container system carries 23,000-27,000lbs of sand, with a capacity of 28,500 lbs. These volumes have been emulated by PropX, by enlarging the container opening (from 20” diameter to 6’x6’, and covering it with a tarp, as is widely used in transportation of agricultural products.

Emptying containers is easy with dry sand as it flows naturally, emptying in c60-seconds. Wet sand containers need to be emptied into a blender hopper. This likely takes 120-seconds, via a 100bpm slurry rate carrying 2.7ppg of sand. PropX has undertaken successful trials placing the sand containers on a vibration table, with a sloped discharge cone, silicon-inserts to lower friction and a larger discharge exit gate.

Sand delivery to the well must occur at a rate of 16,800 lbs of sand per minute, for example, comprising 80-100bpm of slurry carrying 0.5-4.0ppg of sand. A unique belt has been designed which can carry up to 7.9ppg at up to 100bpm. It includes a metering system and screwless surge hopper, also on vibrating tables, to enable accurate, reliable and continuous pumping of wet sand without the risk of bridging.

Sand has undergone huge changes in the past, which suggests this supply chain is not ossified. For example, back in 2017, 90% of sand was shipped by rail to the Permian from Minnesota, Illinois and Wisconsin. Today there are 50 “local” sand mines in the Permian basin, with 107MTpa of capacity. This has reduced transload cost, and allowed sand pricing to run as low as $20/ton recently. Further deflation may lie ahead.

Why it matters: deflation and CO2 reduction?

A fully decarbonized energy system may still require 85Mbpd of oil and 375TCF of gas, as per the conclusion of our research to date. Hence a focus of our research is to find improved technologies that can improve the efficieny and lower the CO2 intensity of oil and gas production.

We still see great productivity enhancements ahead for the shale industry, after reviewing over 1,000 technical papers. A 5% CAGR is possible from 2019’s baseline.

There is also great potential for shale to lower its CO2 intensity, potentially towards zero (Scope 1 and 2 basis), as argued in our recent research (below). The potential is further enhanced by using waste water to cultivate nature based solutions (also below).

Shale thus sets the marginal cost in oil markets, as our numbers require of 2.5Mbpd of shale growth each year from 2022-2025 (models below).

But nearer-term we see risks, that sentiment will sour around shale capex, while productivity could temporarily disappoint during the COVID recovery.