This 11-page note considers a new model of ‘carbon neutral’ investing. Look-through emissions of a portfolio are quantified (Scope 1 & 2 basis). Then accordingly, an allocation is made to high-quality, nature-based CO2 removals. This allows portfolio managers to maximize returns, investing across any sector, while also neutralizing the environmental impacts.

Is continued capital allocation needed, for energy-intensive sectors, even amidst the energy transition? We outline the arguments on pages 2-4, finding stark differences between other sectors where ‘divestment’ has been effective.

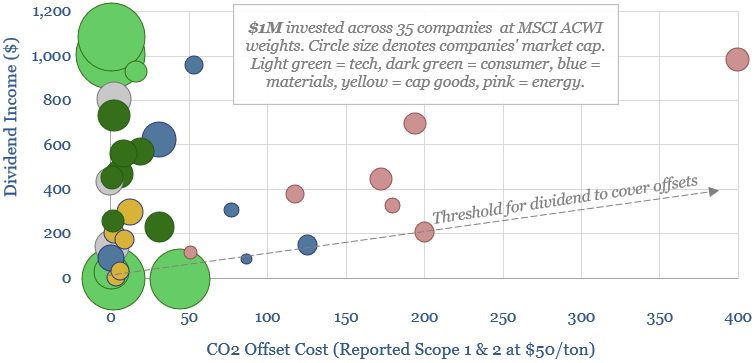

A new model is proposed on pages 5-6. The look-through CO2 intensity of a portfolio is calculated, then all emissions are offset using high-quality nature based allocations.

Advantages of the model are described on page 7, including the commercial opportunity for fund managers, cash coverage ratios and second order consequences.

More detailed challenges are then covered on pages 8-11, looking issue by issue, for implementing this model in practice, and where we hope we can help.