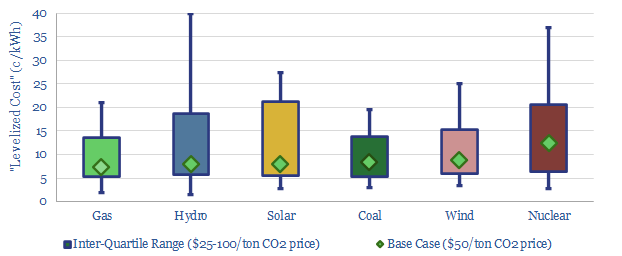

‘Levelized cost’ can be a useful concept. But it can also be mis-used, as though one ‘energy source to rule them all’ was on the cusp of pushing out all the other energy sources. Cost depends on context. Every power source usually ranges from 5-15c/kWh. A resilient, low-carbon grid is diversified. And there is hidden value in materials, power quality and electronics. Our 15-page note explores nuances and challenges for levelized cost analysis.

Finding value in the nuance is increasingly important to us, after 3.5 years focused on the energy transition. This note looks back through our various electricity market models, and wonders whether ‘levelized cost’ analysis might be overlooking some nuances? (page 2).

Vast variations are visible in our databases of capex, prevailing conditions (windiness, sunniness, wetness, geothermal gradients, fuel prices) and hurdle rates (pages 3-5).

The asset base. No doubt, a Volkswagen Golf costs about 75% less than a Tesla Model S. This does not mean that money has been ‘saved’ if you dismantle the Tesla Model S in your drive-way, and then go out and purchase a Golf. Nor is money saved if you decide you need to own a Tesla Model S and a Golf, rather than just one of the two. Building new and excess capacity can cost 2x more than simply running existing capacity (pages 6-7).

In one of the best jokes in quantum mechanics, an angry scientist protests “that’s not fair, you changed the outcome by measuring it”. It is not dissimilar with a new technology that appears to be at the bottom of the cost curve. Scale it up too quickly, too extensively, and you can change the costs of deployment by deploying it, including through materials shortages, and ever higher transmission costs (page 8).

Apples-to-apples. A good comparison should compare apples to apples, which in electricity markets, includes reliability, flexibility, inertia, reactive power, and other power quality components. Our view is that these values, or the costs of backstopping them, should be considered in an apples-to-apples calculation of levelized cost (page 9-13).

Value in nuance. The purpose of this report is not to troll other commentators, by raising challenges for levelized cost analysis. It is that there is value in the overlooked nuance (often, precisely because it is overlooked). We think this creates excess return opportunities in neglected energy sources, materials, transmission infrastructure and power electronics.