Dispersion in global gas prices has hit new highs in 2022. Hence this 17-page note evaluates two possible solutions. Building more LNG plants achieves 15-20% IRRs. But displacing industrial gas demand in Europe, then re-locating it in gas-rich countries can achieve 20-40% IRRs, lower net CO2 and lower risk? Both solutions should step up. What implications?

Global gas price dispersion is hitting new highs, with the best geographies remaining consistently below $2.5/mcf, but many others spiking to peak prices in 2022. Theories of gas price dispersion are laid out on pages 2-3, while we present data and conclusions on 20 different countries’ gas prices on pages 4-6.

Will it accelerate renewables? An interesting observation is that the countries with spiking gas prices are already deploying renewables ‘as fast as feasible’. Whereas it is often the countries with very low gas prices that have very low renewables deployment (page 7).

Will it accelerate LNG? In theory yes. Our expectations for future gas prices should unlock 15-20% IRRs at new LNG projects, and our growth forecasts are on page 8.

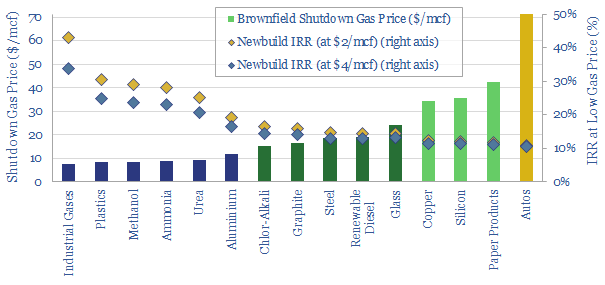

Will it accelerate industrial re-location, away from geographies with high-priced gas, and towards geographies with low-cost gas. This is the main focus of the note. And we think greenfield industrial facilities can earn 20-40% future IRRs if they are sited in geographies with low-priced gas. By contrast, we have constructed a ‘shutdown curve’ showing what gas prices are needed to free up 13bcfd of industrial gas demand in Europe. Our modelling framework is explained on pages 10-12.

There are further economic and ESG advantages to re-locating industry to gas-rich countries, compared with exporting their gas. They are quantified on pages 13-14.

Who benefits? We outline examples of leading companies in gas-rich countries on pages 15-16. This includes both emerging world producers, US E&Ps and US industrial companies that have featured in our research to-date.

Finally, for the renewables and LNG industries, we would highlight that this analysis is not an either-or. We will need all solutions to alleviate energy shortages. Yet displacing industrial gas demand in Europe may mute the kind of runaway cost-inflation that de-railed the LNG industry in the 2010s, and threatens the renewables industry in the 2020s (page 17).