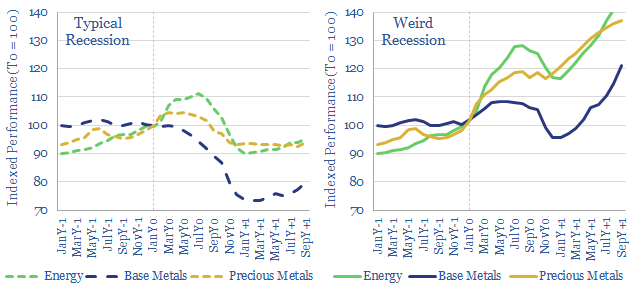

In a ‘weird recession’, GDP growth turns negative, yet commodity prices continue surprising to the upside. This 10-page note explores three reasons that 2022-24 may bring a ‘weird recession’. There is historical precedent, prices must remain high to attract new investment, and buyers may stockpile bottlenecked materials. So can commodities de-couple from GDP and how will this affect different industries?

This 10-page note condenses all of our research from 2021-22, into an updated ‘macro thesis’. We wonder whether 2022-24 could bring a ‘weird recession’, where traditionally cyclical commodities and industrials proved unexpectedly resilient.

The conventional wisdom is that commodities get crushed in a recession, declining by at least 30%. We re-cap this conventional wisdom on page 2, using data from historical recessions. However, could 2022-24 defy conventional wisdom?

(1) What is the right analogue? It is tempting to take 2007-09 as a case study for commodity price performance during recessions. It was recent. But we explore other analogues and case studies, which may be more appropriate on pages 3-4, focusing in particular upon the 1973-75 oil shock.

(2) Supply-side paradox? A major reason to fear recession in 2022-24 is persistently high commodity prices. New investment is ultimately needed to normalize commodity prices in the late 2020s. But a commodity crash would disrupt that investment. This argument is quantified on pages 5-7.

(3) Stockpiling? The average material needed in the energy transition sees its demand quintuple between now and 2050. Buyers are already worried about shortages for many key materials. Hence we speculate that buyers may enter bottlenecked markets and counteract price weakness (see pages 8-10).

The note ends with a list of materials that we think may offer the most resiliency in the ‘weird recession’ scenario described in this note. Can commodities de-couple from GDP? We think so. We are happy to discuss the work in more detail with TSE clients.