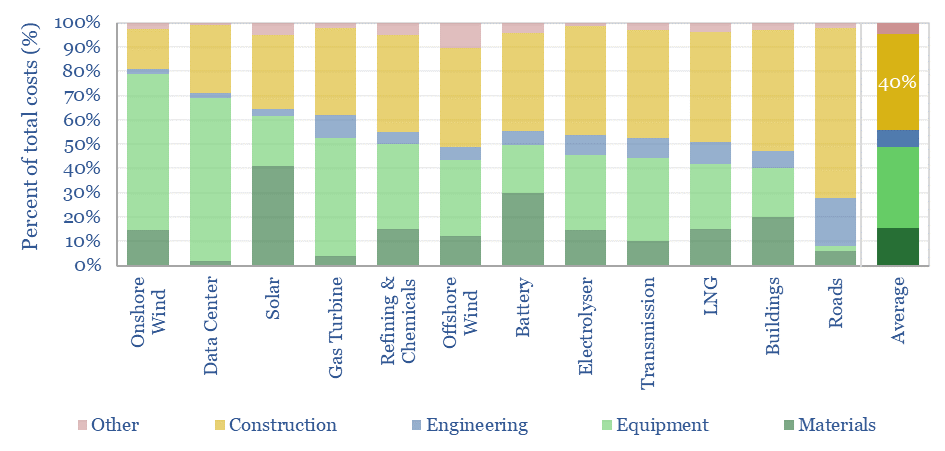

Energy transition is the largest construction project in history, with capex costs ultimately ramping up to $9trn per year. Overall, 40% of capex costs accrue to construction firms. Hence this 10-page note evaluates energy infrastructure construction companies, their EBIT margin drivers, and who benefits from expanding power grids?

The past five years of research have led us to conclude that achieving net zero by 2050 would effectively require the largest energy infrastructure construction project in the history of human civilization, absorbing $9 trn pa of capital expenditures.

Whether or not you believe the world will hit its decarbonization goals, a construction boom increasingly seems to be imminent, linked to power grid bottlenecks and the rise of AI. Our quantifications of these rising capex costs are on pages 2-3.

Overall, 40% of capex costs accrue to construction firms, across different project types captured in our economic models. Some of our favorite examples, and different projects, are discussed on pages 4-5.

In particular, building in boom times can result in projects costing 2-3x more than building in normal times, per a note from 1Q24 that is worth re-visiting alongside this work, highlighting the value of engaging high-quality construction firms, and re-capped on page 6.

Hence we have screened 25 of the largest construction companies in the world. Generally, across our screen, we found that the average company has 100 years of operating history, employs 35,000 people, and generates $13bn pa of revenues.

Across these energy infrastructure construction companies, we evaluated which factors have impacted EBIT margins, on pages 7-8.

Specific companies include those with the most extensive history of delivering mega-projects across different sectors, those with the most specialized skill-sets, and those with particular specialization into power grid infrastructure. These companies are profiled on pages 9-10.