Sugar cane is an amazing energy crop, yielding 70 tons per hectare per year, of which 10-15% is sugar and 20-25% is bagasse. Crushing facilities create value from sugar, sugar-to-ethanol and cogenerated power. This 11-page note argues that more volatile electricity prices could halve ethanol costs or raise cash margins by 2-4x.

Global biofuels production stands at 3.7Mboed. Half of this comprises 28 bn gallons pa of ethanol, of which 60% is from corn and 40% from sugar crops (page 2).

The sugar-to-ethanol value chain is different from the corn-to-ethanol value chain because it generates net electricity and heat via its waste products. It is also more productive as quantified on page 3.

Our base case costs for generating a 10% IRR on a new sugar-to-ethanol production facility require ethanol prices of $1.5/gallon, which is c5% lower than for corn ethanol. Numbers are explained on 4-5.

The costs of sugar feedstocks are a crucial, themselves depending on the costs of harnessing sugar from sugar cane. The best feedstock is not sugar but molasses, for the reasons on pages 6-7.

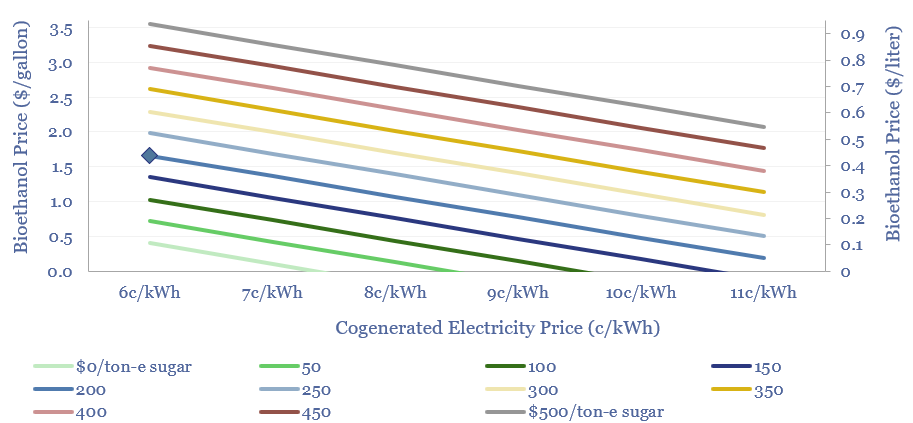

The angle that intrigues us for Brazilian biofuels is whether growing value in the bagasse for power generation could increase returns across the integrated value chain. Numbers and conclusions are on pages 8-10.

Dessert menu? We close by noting seven leading companies in sugar-based ethanol, including pure-plays in Brazil, India, broader global energy and food producers, such as AB Foods. Company notes are on page 11.