LFP batteries are fundamentally different from incumbent NMC cells: 2x more stable, 2x longer-lasting, $15/kWh cheaper reagents, $5/kWh cheaper manufacturing, and $25/kWh cheaper again when made in China. This 15-page report argues LFP will dominate future batteries, explores LFP battery costs, and draws implications for EVs and renewables.

2024 has offered up some exceptionally low battery prices. Most build-ups suggest lithium ion batteries should cost $110-130/kWh. Yet the pricing on Chinese LFP batteries has been reported at $50-80/kWh.

This has become a huge controversy that matters for the electric vehicle outlook, the costs of electric vehicles, the renewables+batteries outlook, and by extension the demand for other energy sources, such as gas peaker plants or long-term oil demand, and the equipment and materials suppliers in all of these value chains.

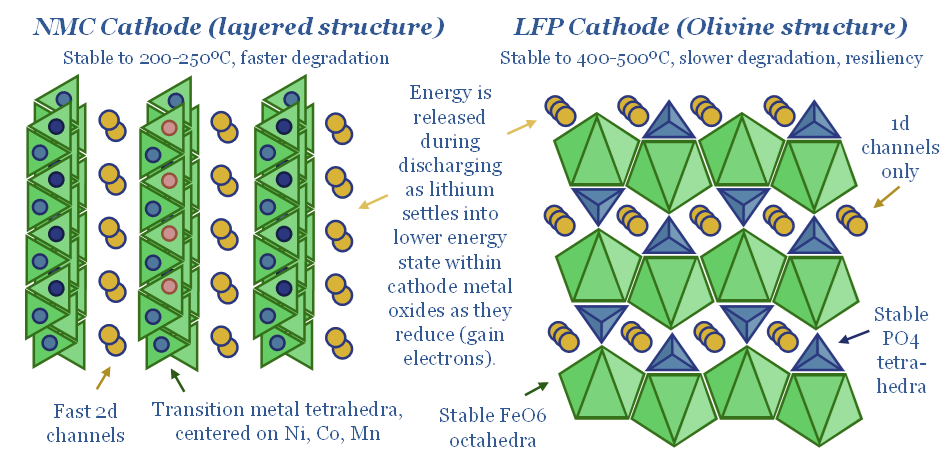

LFP cathode chemistry is fundamentally different from NMC, and can genuinely drive $20/kWh deflation across battery supply chains. This is a crucial point. Hence the chemical and performance differences of NMC vs LFP are outlined on pages 2-4.

LFP battery costs are lower, specifically because of these chemical and performance differences. Cost savings on the materials side are quantified on page 5, while cost savings on the cathode manufacturing side are quantified on page 6.

Chinese manufacturing of LFP batteries is the biggest reason for the downwards shift in the battery cost curve. Some of this simply reflects lower costs for heavy industrial activity in China and is structural. But we also show how the exceptionally low pricing of 2024 is likely to reflect temporary dislocations, on pages 7-11.

Our forward-looking cost estimates are informed by this analysis, covering global NMC cells, global LFP cells, Chinese LFP cells in 2024, and Chinese LFP cells in 2025+, all in $/kWh terms. These numbers are outlined and discussed on page 12.

How will cheap Chinese LFP impact the EV outlook? We re-evaluate the cost premium of EVs versus ICEs, on page 13.

How will cheap Chinese LFP impact the outlook for renewables and grid-scale batteries? We re-evaluate storage spreads on pages 14-15.