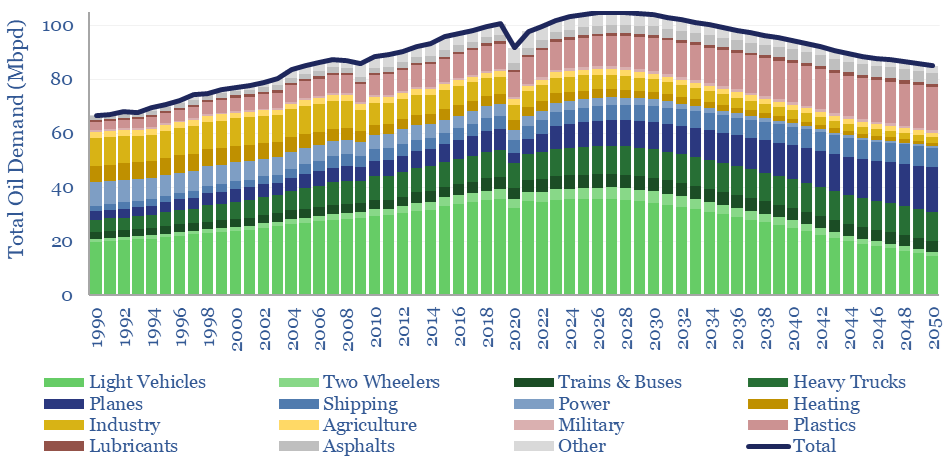

This model forecasts long-run oil demand to 2050, by end use, by year, and by region; across the US, the OECD and the non-OECD. We see demand gently rising through the 2020s, peaking at 105Mbpd in 2027-29, then gently falling to 85Mbpd by 2050 in the energy transition.

The model forecasts long-term global oil demand, based off of 25 input variables, such as GDP growth, electric vehicle penetration, energy efficiency initiatives, and substitution effects. You can flex these input assumptions, in order to assess long-term global oil demand out through 2050, and as part of the energy transition.

Our own scenario foresees oil demand gently increasing from c100Mbpd in 2022 towards a plateau of 105Mbpd in 2027-29. This peak for global oil demand is followed by a gradual decline to 85Mbpd in 2050. This can be consistent with decarbonization of the global energy system, in our roadmap to net zero.

The biggest shift for global oil demand is the disruption of c35Mbpd of oil demand for light vehicles, which is based on all of our vehicle research.

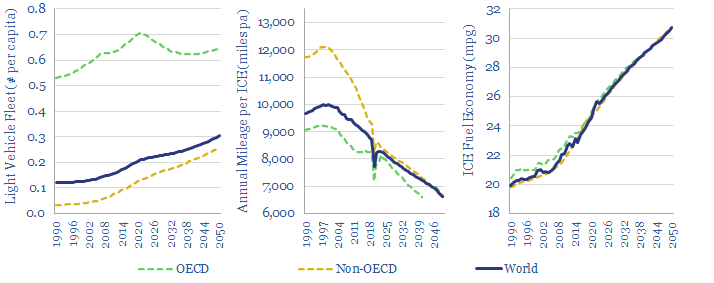

Our base case forecast captures a ramp up to producing over 65M electric vehicles in 2030, and almost 200M electric vehicles in 2050, while accelerating the retirement rates of today’s 1.7bn ICE fleet by several percentage points, to bludgeon down the total ICE fleet to around 1bn units by 2050. Underlying numbers are discussed in our recent research note on this topic and modelled here (see below).

Even these 1bn remaining ICE units must be driven 20% less than they are on average today (the average global vehicle is driven 8,000 miles per year, build-up in the data-file). While these vehicles also need to become 20% more fuel efficient on average (reaching an effective on-road fuel efficiency of over 30mpg, build-up also in the data-file).

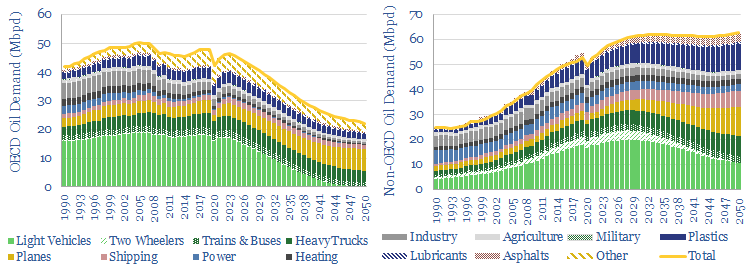

How will long-term oil demand vary by region? Another notable trend in the model is that it embeds very different trajectories for oil demand in the developed versus the emerging worlds (charts below).

Oil demand by region. OECD oil demand has already peaked, at 50Mbpd in 2005, had softened to 48Mbpd in 2019 and is seen falling to 20Mbpd by 2050, effectively all for planes and freight, which are hard to decarbonize due to limits on the energy density of lithium ion batteries and myriad issues with hydrogen-based fuels.

Non-OECD oil demand has risen from 35Mbpd in 2005 to 52Mbpd in 2019 and is seen rising to 60Mbpd by 2050. This is even after two-thirds of future EM passenger cars are assumed to be electric, and some very stark assumptions about fuel economy.

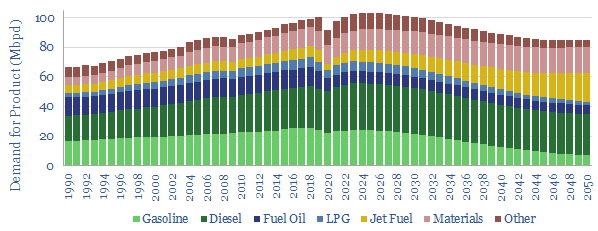

How will long-term oil demand vary by product? The balance of oil product demand through 2050 is also changing starkly in our model (chart below). Gasoline demand declines from 30% of the total oil market to <10%. Jet fuel rises from 8% to over 20%. Materials rise from 13% to over 20%. And a few pp of share continues shifting from fuel oil (<10%) to diesel (>30%). To calibrate our model, we also track global oil demand by product by region over time.

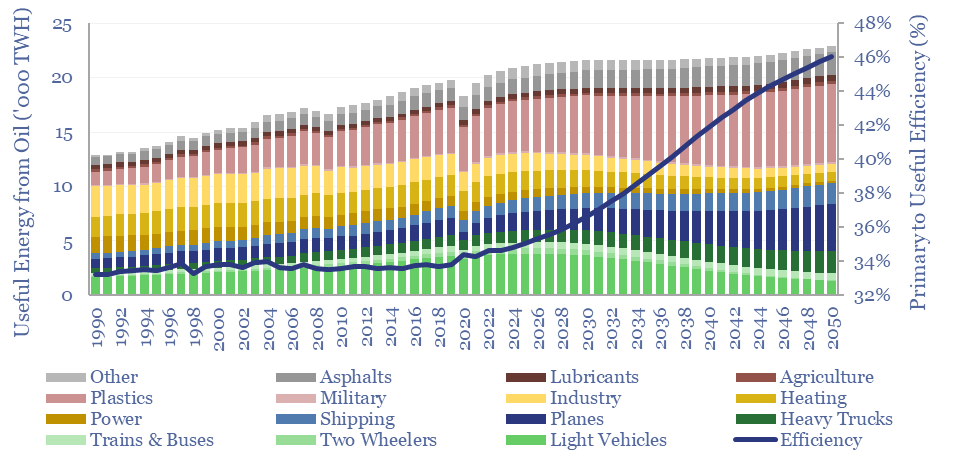

How will the primary-to-useful efficiency of global oil consumption change? A typical gallon of oil products contains 38kWh-th of primary energy. As a blended average, the combustion of oil products in 2023 is 35% efficient in converting primary to useful energy, albeit with sharp variations by category. Primary to useful efficiency of oil rises from 35% to 46% by 2050, of which two-thirds is due to mix-shifts in the oil market, and one-third is underlying efficiency gains of prime movers.

Without delivering the technology improvements in our energy transition research, total global oil demand would most likely keep growing to 130Mbpd by 2050, due to global population growth and greater economic development in the emerging world.

The model has been updated in May-2025, to reflect 2024 data, and our latest outlook into oil demand sensivity to GDP, changing vehicle fleets and long-term plastic demand. Underlying workings are shown in seven subsequent tabs, covering light vehicles, trucks, jet fuel, plastics, shipping, other products and demographics.

For more granular, month-by-month data, tabulating oil demand by region, we also have a tracker file based on JODI data, which is linked here.

Please download the data-file to stress test your own long-run oil demand forecasts, and evaluate oil demand by category, oil demand by region and oil demand by end use.